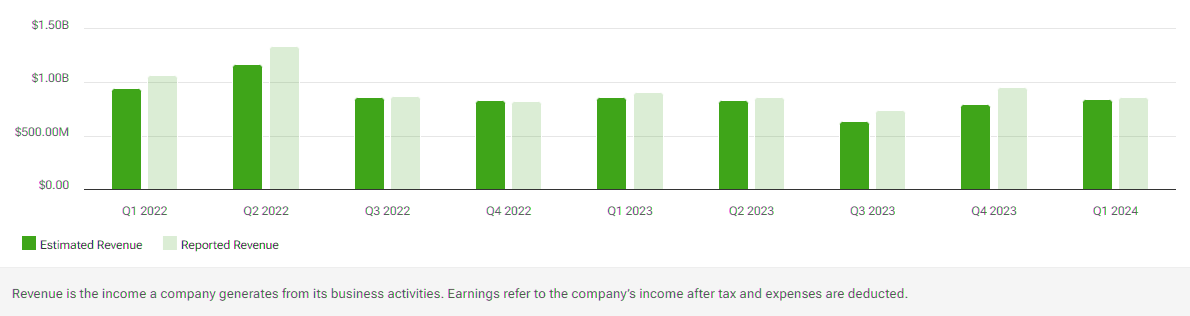

Great Elm Capital Corp. 6.75% Notes Due 2025 Earnings History by Quarter

| Date | Quarter | Consensus Estimate | Reported EPS | Beat/Miss | Revenue Estimate | Actual Revenue |

|---|---|---|---|---|---|---|

| 08/01/2024 | Q4 2024 | -$0.14 | $9.08 M | |||

| 05/02/2024 | Q3 2024 | -$0.05 | $11.27 M | |||

| 02/29/2024 | Q2 2024 | $0.55 | $3.89 M | |||

| 11/02/2023 | Q1 2024 | $1.02 | $7.45 M | |||

| 08/03/2023 | Q4 2023 | $0.68 | $9.52 M | |||

| 05/04/2023 | Q3 2023 | $1.07 | $10.26 M | |||

| 03/02/2023 | Q2 2023 | -$0.96 | $9.79 M | |||

| 11/03/2022 | Q1 2023 | $0.18 | $7.20 M | |||

| 08/04/2022 | Q4 2022 | -$0.87 | $-104,238,000 | |||

| 05/11/2022 | Q3 2022 | -$1.12 | $-14,375,000 | |||

| 03/04/2022 | Q2 2022 | -$4.94 | $698,000 | |||

| 11/05/2021 | Q1 2022 | -$0.78 | $9.03 M | |||

| 08/03/2021 | Q4 2021 | $0.63 | $3.86 M | |||

| 05/07/2021 | Q3 2021 | $3.21 | $2.02 M | |||

| 03/16/2021 | Q2 2021 | -$2.60 | $5.75 M | |||

| 11/09/2020 | Q1 2021 | $4.34 | $5.95 M | |||

| 08/07/2020 | Q4 2020 | $2.07 | $4.77 M | |||

| 05/11/2020 | Q3 2020 | -$20.00 | $6.43 M | |||

| 03/19/2020 | Q2 2020 | -$0.95 | $7.01 M | |||

| 11/14/2019 | Q1 2020 | -$5.75 | $7.00 M |

Great Elm Capital Corp. 6.75% Notes Due 2025 Earnings: Frequently Asked Questions

-

When is Great Elm Capital Corp. 6.75% Notes Due 2025's earnings date?

Great Elm Capital Corp. 6.75% Notes Due 2025 has not confirmed its next earnings publication date, but the company's estimated earnings date is Thursday, March 30th, 2023 based off last year's report dates.

-

How can I listen to Great Elm Capital Corp. 6.75% Notes Due 2025's earnings conference call?

The conference call for Great Elm Capital Corp. 6.75% Notes Due 2025's latest earnings report can be listened to online.

-

How can I read Great Elm Capital Corp. 6.75% Notes Due 2025's conference call transcript?

The conference call transcript for Great Elm Capital Corp. 6.75% Notes Due 2025's latest earnings report can be read online.

-

How much revenue does Great Elm Capital Corp. 6.75% Notes Due 2025 generate each year?

Great Elm Capital Corp. 6.75% Notes Due 2025 (:GECCM) has a recorded annual revenue of $31.12 M.

-

How much profit does Great Elm Capital Corp. 6.75% Notes Due 2025 generate each year?

Great Elm Capital Corp. 6.75% Notes Due 2025 (:GECCM) has a recorded net income of $31.12 M. Great Elm Capital Corp. 6.75% Notes Due 2025 has generated $3.33 earnings per share over the last four quarters.

-

What is Great Elm Capital Corp. 6.75% Notes Due 2025's price-to-earnings ratio?

Great Elm Capital Corp. 6.75% Notes Due 2025 (:GECCM) has a price-to-earnings ratio of 23.43 and price/earnings-to-growth ratio is 0.1.