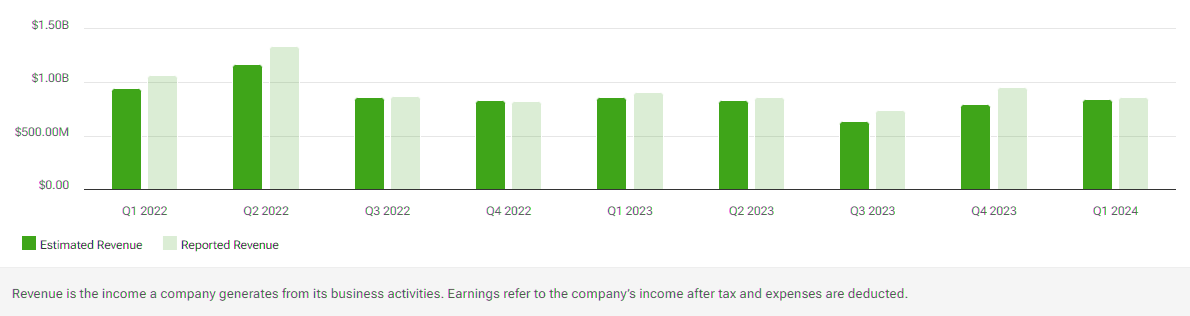

Carlyle Secured Lending, Inc. 8.20% Notes due 2028 Earnings History by Quarter

| Date | Quarter | Consensus Estimate | Reported EPS | Beat/Miss | Revenue Estimate | Actual Revenue |

|---|---|---|---|---|---|---|

| 06/28/2024 | Q2 2024 | $0.37 | $62.46 M | |||

| 03/29/2024 | Q1 2024 | $0.56 | $42.82 M | |||

| 12/29/2023 | Q4 2023 | $0.57 | $62.90 M | |||

| 09/28/2023 | Q3 2023 | $0.57 | $60.36 M | |||

| 06/28/2023 | Q2 2023 | $0.08 | $52.07 M | |||

| 03/29/2023 | Q1 2023 | $0.53 | $45.06 M | |||

| 12/29/2022 | Q4 2022 | $0.23 | $55.62 M | |||

| 09/28/2022 | Q3 2022 | $0.71 | $54.64 M | |||

| 06/28/2022 | Q2 2022 | $0.09 | $44.62 M | |||

| 03/29/2022 | Q1 2022 | $0.58 | $53.35 M | |||

| 12/29/2021 | Q4 2021 | $0.64 | $51.83 M | |||

| 09/28/2021 | Q3 2021 | $0.88 | $51.33 M | |||

| 06/28/2021 | Q2 2021 | $0.79 | $44.60 M | |||

| 03/29/2021 | Q1 2021 | $0.65 | $42.52 M |

Carlyle Secured Lending, Inc. 8.20% Notes due 2028 Earnings: Frequently Asked Questions

-

How can I listen to Carlyle Secured Lending, Inc. 8.20% Notes due 2028's earnings conference call?

The conference call for Carlyle Secured Lending, Inc. 8.20% Notes due 2028's latest earnings report can be listened to online.

-

How can I read Carlyle Secured Lending, Inc. 8.20% Notes due 2028's conference call transcript?

The conference call transcript for Carlyle Secured Lending, Inc. 8.20% Notes due 2028's latest earnings report can be read online.

-

How much revenue does Carlyle Secured Lending, Inc. 8.20% Notes due 2028 generate each year?

Carlyle Secured Lending, Inc. 8.20% Notes due 2028 (:CGBDL) has a recorded annual revenue of $220.39 M.

-

How much profit does Carlyle Secured Lending, Inc. 8.20% Notes due 2028 generate each year?

Carlyle Secured Lending, Inc. 8.20% Notes due 2028 (:CGBDL) has a recorded net income of $220.39 M. Carlyle Secured Lending, Inc. 8.20% Notes due 2028 has generated $1.82 earnings per share over the last four quarters.

-

What is Carlyle Secured Lending, Inc. 8.20% Notes due 2028's price-to-earnings ratio?

Carlyle Secured Lending, Inc. 8.20% Notes due 2028 (:CGBDL) has a price-to-earnings ratio of 12.04 and price/earnings-to-growth ratio is 0.79.