“Got the market going up… on a Wednesday” - Drake Jensen Huang

If there was ever a plot twist in the market, today was it. Wednesday was supposed to be all about the Fed minutes. We were supposed to sit there, hands folded, reading Jerome Powell's meeting notes like it was assigned homework. Instead the market took one look at "rates unchanged, Jerome's mood unclear” and said “YOLO” directly back into chips and memes.

(Source: Tenor)

Case in point: S&P 500 closed at 6,881.31 (+0.56%), the Nasdaq at 22,753.63 (+0.78%), and the Dow added 129 points to settle at 49,662.66. In other words, the Fed spoke. Nobody listened. We're so back.

How so? Because the real money flows were nestled inside Jensen’s leather jacket. In short, Nvidia climbed 1.6% after Meta announced it's going to hoover up millions of Nvidia chips for its AI data center buildout. Which, if you've been paying attention, is basically Meta saying "we are going to write Jensen Huang a check so large it needs its own zip code." Translation: If there’s one person whose down as f*k to blow money… It's Zuck.

(Source: Tenor)

Meanwhile, Amazon popped nearly 2% on news that Bill Ackman's Pershing Square grew its position by an eye-gouging 65% in Q4, making it the fund’s third-largest holding. Friendly reminder, this comes after stock experienced a New York Jets style losing streak. Meaning, say what you want about the guy… but Ackman clearly has a gift for showing up right when the bleeding stops.

Elsewhere, Micron had an even better day, ripping 5%+ after David Tepper's Appaloosa upped its stake. Two billionaire fund managers backing chip plays in the same week. You'd almost think there's a theme here. Spoiler: There is. It’s AI. It’s always AI.

On the commodity front, oil prices jumped on geopolitical pissing matches as JD Vanced said "failed to address U.S. red lines" in nuclear talks and that military action is still on the table. The kind of sentence that makes crude traders salivate and everyone else a little nauseous. On the other side of the globe, a planned U.S. arms sale to Taiwan is reportedly "in limbo" after Xi Jinping called Trump on Feb. 4. The Wall Street Journal says the administration is basically slow-walking an $11.1 billion weapons package to keep Beijing happy ahead of Trump's China trip in April.

In earnings land, a few names had monster days. Global Payments surged 16% after guiding for $13.80–$14 EPS by end of 2026, comfortably above the $13.58 consensus. Adjusted net revenue growth of ~5% vs. the Street's 4.7%. Not too sexy, but investors love it when companies play rough with their estimates.

(Source: Tenor)

Meanwhile Wingstop ripped 13% on… *checks notes*... flat to low-single digit same-store sales guidance (read: make it make sense). And Moody’s added 6% after a clean beat on both lines… $3.64 EPS vs. $3.43 expected, $1.89B revenue vs. $1.86B… plus full-year guidance of $16.40–$17 per share that brackets the consensus. Bigly.

So yeah… there you have it. In the end, the Fed minutes were supposed to be the headline today. Instead, the market yawned and went right back to doing what it's been doing for months… chasing AI capex, rewarding anyone who beats lowered bars, and treating geopolitical risk like background noise. Impressive, now do Bitcoin. Until next time, friends…

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

☕ Market Gossip

> Zuckerberg testimony: Some users lie about age when signing up for Instagram (CNBC): Something tells me Epstein said something similar…

> Fed Minutes Show Several Officials Point to Rate-Hike Scenario (Bloomberg): Aaaaand we’re cooked…

> Ford turns to F1 and bounties to build a $30,000 electric truck (TechCrunch): “Have you learned nothing?” - Diesel diehards and Ford investors alike…

> Palo Alto shares sink 7%, CEO defends cybersecurity’s position as AI hits software stocks (CNBC): What’s the Polymarket payout on an Anthropic/Palo Alto deal happening? Asking for a friend… (sup, Figma)

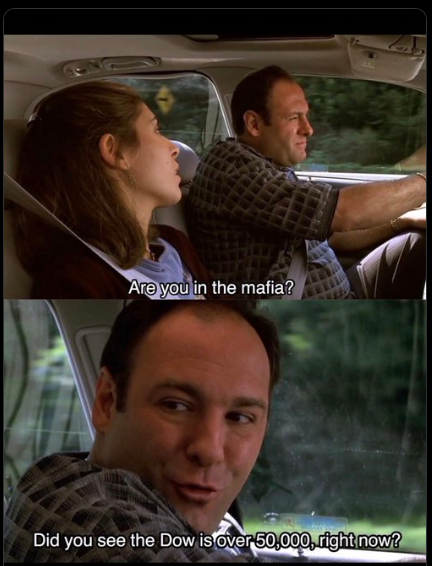

“WTF” Meme of the Day

At the time of publishing, Stocks.News holds positions in Meta, Amazon, and Ford as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer