Well, well, well… look who decided to rally. Despite a geopolitical hurricane “to the likes of which we’ve never seen,” Trump’s neverending obsession with tariffs, and Moody’s devastating (or so we all thought at the time) downgrade, the Treasury market just wrapped up its best month since February… and its strongest first half in five years. Not exactly what you'd expect with the world wobbling on three different axes of chaos, but hey, bond traders aren't picky when it comes to green candles.

Case in point: the 10-year Treasury yield has fallen from over 4.6% in early June to about 4.28% now. That may not sound huge, but in bond land, a 30+ basis point drop in a few weeks is a green light for traders to start repositioning aggressively. That means they’re betting the Fed will cut rates… and possibly sooner than expected. And they’re not making this up. Fed funds futures are now pricing in roughly a 65% chance of a rate cut by September, and even a nearly 20% shot for July. For context, earlier this month, July was barely on the radar. Now? Traders are dusting off their “cut watch” spreadsheets again.

According to George Catrambone at DWS Americas, it’s a mix of good old fashioned FOMO and rate-cut hope. Basically, traders are loading up on Treasuries because if Powell even flinches in the direction of a dovish pivot, those bond prices go up and everyone gets to pretend they’re a genius for a week. Vanguard’s John Madziyire is even more specific. He’s going long on 5 and 10-year Treasuries, the part of the curve most sensitive to rate expectations and economic outlook. His rationale is that the economy is cooling (but not crashing) so the risk of holding duration is now “worth the squeeze.” That means investors think inflation has peaked, the labor market is softening, and the Fed is running out of reasons to stay hawkish.

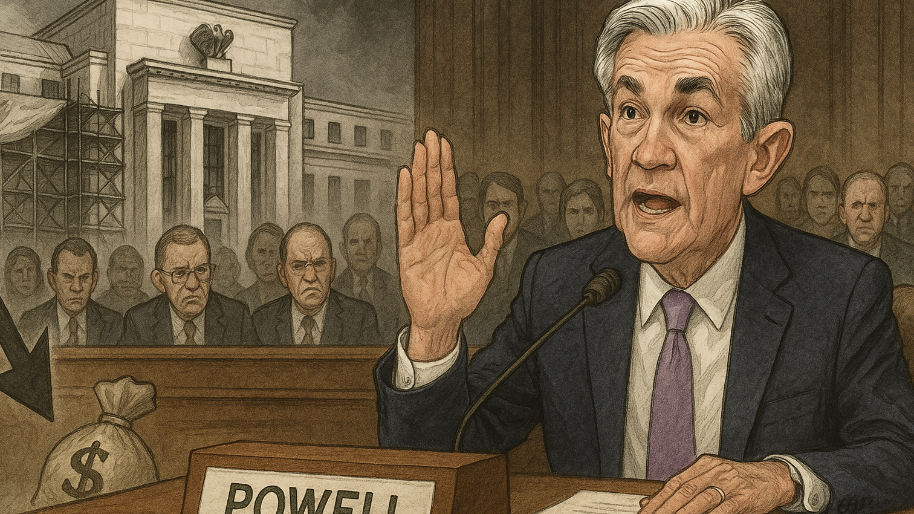

And just as traders start dreaming of a two-cut summer, we cut to Jerome Powell… who’s facing heat not for rate decisions, but for allegedly fibbing under oath about a $2.5 billion facelift to the Federal Reserve’s D.C. headquarters (this is real). Powell told Congress with a straight face that there were “no VIP dining rooms, no new marble, no rooftop terraces.” But planning documents from 2021 say otherwise. They include “vegetated roof terraces” (for “urban wildlife and pollinators”), upgraded water features, and even a private elevator that drops Fed governors directly into their exclusive dining suite. So… basically the Four Seasons but with more word salads.

As you’d expect, this didn’t exactly go unnoticed. Senator Tim Scott called the whole thing “the Palace of Versailles.” Elon Musk, who now moonlights as a government watchdog on X, labeled it “an eyebrow raiser.” And Andrew Levin (a former Fed economist) flat-out said Powell’s testimony might warrant censure for making false statements to Congress. So yes, we’re officially in the part of the cycle where lying about marble could trigger a Senate showdown. I’m not saying Trump engineered this whole marble scandal to get Powell thrown in jail… but if Jerome ends up behind bars and rates drop to 1%, don’t act surprised.

Speaking of, Trump is back on Powell’s case. Not exactly breaking news… their grudge match goes back to 2018. But now Trump’s turning up the heat. This time, he’s complaining about rates being “artificially high”… and demanding Powell cut them to somewhere between 1% and 2%. (Just a light 225 basis point drop from the current 4.25% to 4.5% range, no pressure.)

And if Powell doesn’t play ball, Trump’s now threatening to replace him early, even though Powell’s term runs through May 2026. On top of that, Trump floated the idea of appointing a “shadow Fed chair”... basically, an economic doppelganger who would make public rate calls from the sidelines. (What better way to calm markets than having two Fed chairs shouting over each other like the Biden/Trump presidential debate?)

All of this chaos is building just in time for Thursday’s July jobs report… a potential make-or-break moment for Powell. Economists are expecting signs of a slowdown, with payrolls forecast to increase by just 113,000, down from 139,000 in June. The unemployment rate is expected to tick up to 4.3%, which would be the highest since 2021.

If the report comes in soft, it could give the Fed exactly what it needs to justify a rate cut in July. But if the labor market shows more heat than expected, Powell might buy himself a few more weeks… pushing the decision to September while quietly sipping wine on his rooftop terrace, surrounded by those taxpayer-funded butterfly gardens. So yeah, Thursday’s numbers could tip the scales. Keep an eye on that payroll figure, and plan your trades accordingly.

At the time of publishing this article, Stocks.News doesn’t hold positions in companies mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer