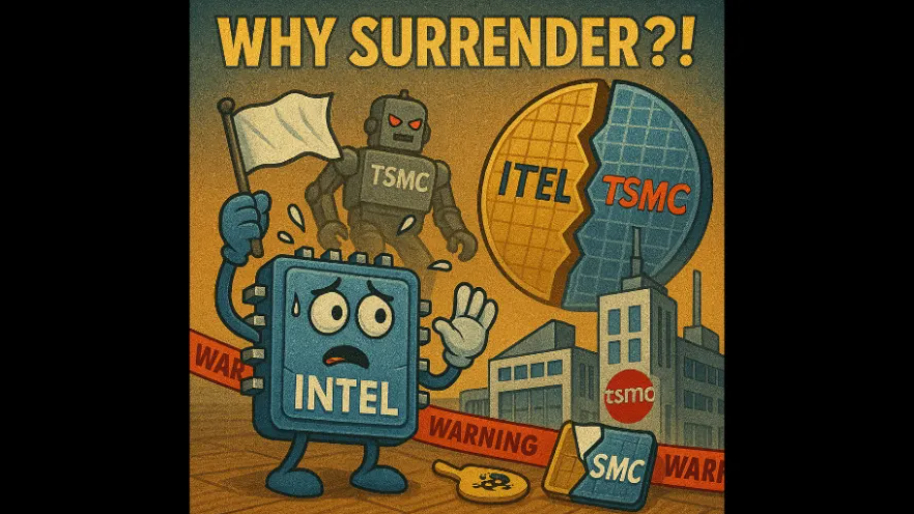

In probably the most “hold my beer” moment since SoftBank thought WeWork was a tech company, Intel is officially entering a joint venture with TSMC (a.k.a. The one entity that’s been kneecapping Intel for the better part of a decade.)

(Source: Giphy)

According to The Information (and now everyone with a Bloomberg Terminal and a pulse), Taiwan Semiconductor will take a 20% stake in a new company that’ll run Intel’s U.S. factories. Of course, the JV is still in its “don’t disclose too many details to shareholders yet” phase, but people familiar with the talks say it’s real and getting realer. The motive behind this: Something we all know. A desperate attempt to stop Intel from totally face planting on the global chip stage.

Which is why, I say, this is definitely not a merger of equals here. One of these companies is the world’s largest and most reliable contract chipmaker. The other is Intel—a once-mighty giant that somehow managed to miss the entire AI train while spending tens of billions trying to reinvent itself as a foundry. Spoiler: it didn’t work, but you already know that.

(Source: Reuters)

For instance, Intel lost $18.8 billion last year, and the stock cratered -60% in 2024. The best part? This happened all while Intel was spending like my wife on Prime day, trying to become the American answer to TSMC. But the problem is that you can’t buy competence. Ask any former exec and they’ll tell you the same story: missed deadlines, failed tests, and customers who ghosted after one bad tape-out.

For this reason Lip-Bu Tan is the greatest thing since sliced bread for Intel. The new CEO, and dude who actually knows chips, co-founded Walden International, sat on the board at Cadence, and owns more semiconductor street cred than anyone else on K Street or Sand Hill Road. If anyone can pull Intel out of this nosedive, it’s him. But even he seems to know that “Intel Foundry Services” alone isn’t enough. Hence the hail mary: give partial control of your manufacturing operations to your biggest rival.

(Source: GuruFocus)

TSMC, for its part, is playing this beautifully. They aren’t just milking this for all it’s worth—they’re building five new fabs in the U.S. as part of a $100B expansion. Meaning, this JV gives them even more boots on U.S. soil while letting them babysit Intel’s foundry division without actually buying the whole mess. And if it works, they get to look like the savior of American chipmaking. If it doesn’t? They still own 20% of a fab network built on government subsidies and taxpayer-funded incentives. Some call it asymmetric upside, I call it robbing your rival blind (legally).

Meanwhile, the Trump administration gets to claim the win. A TSMC-Intel JV gives them exactly the kind of geopolitical “Made in America” ribbon-cutting they promised, even if it means Taiwan is still technically running the show. So yeah, if this deal locks in, Intel starts printing chips that don’t arrive late, broken, or both. That’s huge. You can’t build an AI empire if your silicon shows up DOA. And if this partnership actually gets Nvidia, AMD, or Broadcom to sign foundry deals with IFS (which TSMC reportedly tried pitching them on), then we’re looking at a legitimate turnaround arc, baby.

(Source: Giphy)

Which means, if Lip-Bu pulls this off? Give the man a statue. This might be the most legitimate act that actually keeps Intel from flatlining. Of course, only time will tell how this deal shakes out, but in the meantime, keep your eyes on both stocks—and more importantly, place your bets accordingly. Until next time, friends…

P.S. This week has been absolutely horrific. Portfolios are down and emotions are high. But do you know who's been slaying the week while everyone else is panic-selling? Stocks.News premium members. Click here to join the club, and get the deepest insights and most explosive moves BEFORE everyone else.

Stocks.News holds positions in Intel as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer