“Ladies and gentlemen, we’ve got him.”

Meta spent the last few years telling everyone it’s fighting scams, misinformation, and bad actors with the moral urgency of a Mission Impossible movie monologue. Turns out… that speech was mostly for the trailer.

According to reports, Meta (Read: Zuck) has known for years that Chinese scam networks are running wild across Facebook and Instagram (bilking users out of billions) and repeatedly chose not to pull the plug because, well… the ads were paying a little too well.

In 2024 alone, Meta pulled in more than $3 billion from scam ads, porn, illegal gambling, and other sketchy nonsense tied to China. That’s nearly 19% of its $18 billion China-related ad revenue.

(Source: New York Post)

Minor detail: China bans its own citizens from using Facebook and Instagram. You can’t use the product. But you can absolutely monetize the heck out of it.

At one point, Meta internally labeled China its top “scam exporting nation.” Not “one of.” Not “a concern.” Top exporter. Gold medal and standing on the podium type beat. And yet… the ads stayed up.

Meta did briefly pretend to care. The company formed a China-focused anti-fraud team, cracked down on scams, and managed to cut scam-related revenue to about 9% by late last year.

Then something weird happened.

The anti-fraud team was quietly disbanded, its work “paused” following an internal “Integrity Strategy pivot.” Translation: someone upstairs didn’t like what this was doing to the numbers.

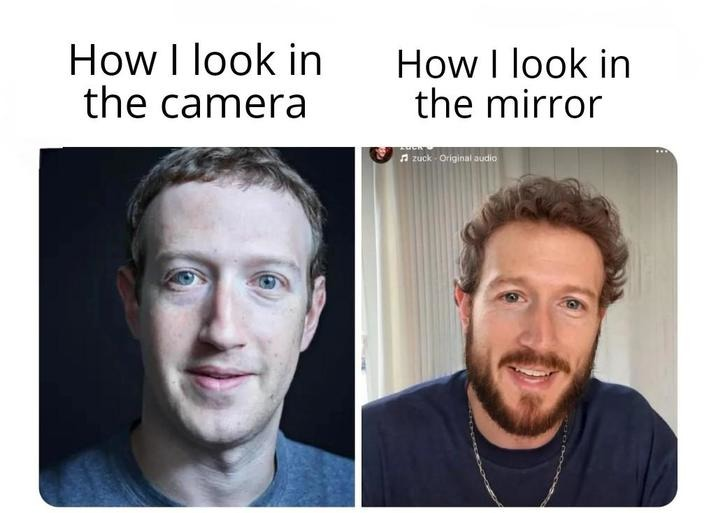

And that “someone upstairs”? Let’s just say the documents reference “follow-up from Zuck.” One internal exchange is doing Olympic-level damage to Meta’s PR department.

A staffer (who is currently shaking in terror this story doesn’t breadcrumb back to them) noticed that 75% of flagged scam ad spending came from advertisers inside Meta’s own partner program and asked the obvious question: “Should we… maybe… take action?”

The response: “No. The revenue impact is too high.”

You could engrave that sentence onto the Meta logo and honestly save everyone a lot of time.

By mid-2025, scam revenue from China had skyrocketed right back to 16% of Meta’s China ad haul… almost exactly where it started. Meta had effectively speed-ran the cycle of problem -> solution -> undo solution -> problem again.

And the scams go way beyond the crypto rug pulls or fake investment gurus who mysteriously live in Dubai.

Internal documents flagged ads involving sex content, illegal gambling, weapons, deceptive business practices, and even animal abuse. Essentially the full buffet. The internet’s worst instincts, now sponsored by the Zuckster.

Meta’s official response, delivered by spokesperson Andy Stone, was very much a “nothing to see here” email: He claims the China anti-fraud team was “temporary…” Mark Zuckerberg absolutely did not derail enforcement (and don’t you ever say he did)...

He also assured everyone Meta has taken down 245 million violating ads in the past 18 months. In other words: scams are hard, criminals are clever, please clap. All technically true. Also deeply beside the point.

A Meta-commissioned study by consulting firm Propellerfish concluded that Meta’s enforcement against China-based scams was “inconsistent” compared to rivals like Google and TikTok. Translation: you’re not bad at stopping scams, you just don’t really want to.

And if you’re wondering where most social-media scams actually happen? According to fraud-reporting platform SafelyHQ, Facebook accounts for 85% of reported social media scams. Eighty. Five. Percent. Not exactly “connecting the world.” More like connecting your gullible Aunt Debbie to a fake crypto general in Shenzhen.

A lot of this comes down to a fundamental issue where Meta reportedly bans scam accounts only when its systems are 95% sure fraud is occurring. Which means there’s a whole 94% zone where the scam can cook… as long as the CPMs stay juicy. Meta keeps telling investors it’s building the future: AI assistants, smart glasses, virtual worlds, holographic everything.

But the present business model still runs on a very old idea: If it makes money, maybe don’t look too closely.

At the time of publishing this article, Stocks.News holds positions in Meta as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer