Nvidia just pulled off the kind of comeback that makes Wall Street forget it ever panicked in the first place. After getting knocked down in January, the stock closed at a record-high $154.31 this week, catapulting the company’s market cap to $3.77 trillion… putting it back on top of the tech world, ahead of Microsoft, Apple, and whatever’s left of your AI startup portfolio. (Sorry, Tim Apple.)

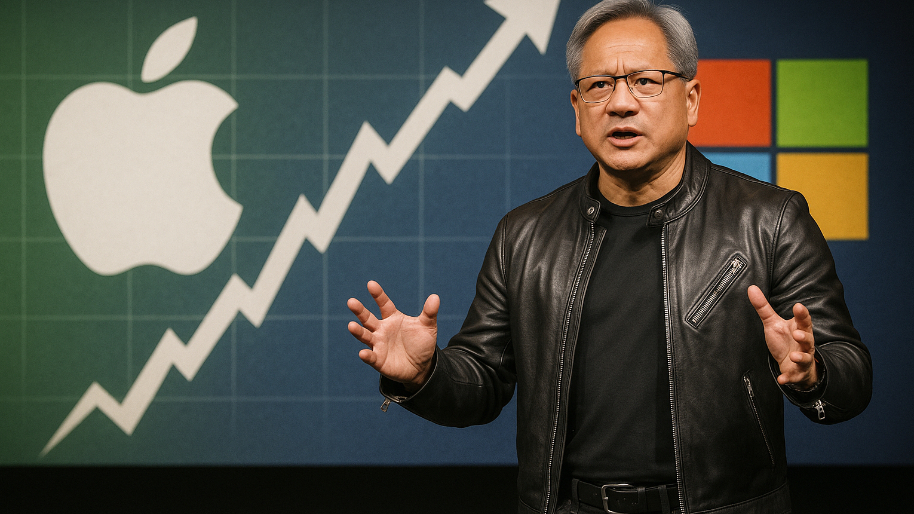

And despite what you may be thinking (yes I’m a mindreader), this wasn’t some dead-cat bounce or gamma-fueled rally. It was a hard re-rate… one that had everything to do with Jensen Huang’s shareholder meeting mic drop (and yes, he wore the leather jacket).

Let’s rewind to the “crisis” that sent the stock to $94. A Chinese startup called Deepseek claimed it trained a ChatGPT-level model on $300 worth of hardware. It’s still crazy to believe that Wall Street tanked Nvidia because someone ran a large language model on gear cheaper than an iPad.

Suddenly, Nvidia’s $40,000 H100s were being treated like overpriced collectibles. Everyone (from hedge funds to Robinhood traders) decided the AI arms race had been “democratized.” The stock tanked 37% in a week, as if Jensen had personally unplugged OpenAI. What got missed in all the noise was that Deepseek’s stunt didn’t scale. Sure, they trained a model. But building and running high-performance AI across cloud workloads, with uptime, latency, and compliance guarantees? That still requires industrial-grade compute. Not something you duct-taped together in a basement.

Which brings us to the rebound. At the shareholder meeting, Huang shifted from defending Nvidia’s AI dominance to laying out a much bigger vision… one that moves beyond data centers and into the real world. The AI story is evolving, and Nvidia wants to be the power source for all the machines that come next.

“We’re working toward a day where there will be billions of robots, hundreds of millions of autonomous vehicles, and hundreds of thousands of robotic factories powered by Nvidia.”

In other words: if it moves, thinks, or replaces your UPS driver, Nvidia’s trying to be inside it.

The automotive and robotics segment is still early… just $567 million in Q1 revenue, or 1% of total. But it's growing 72% year-over-year, and it's already racking up real partnerships: Mercedes-Benz, Toyota, Aurora, Continental… all using Nvidia’s DRIVE platform to build software-defined vehicles. Then there’s Cosmos, a humanoid robot in the works, and Isaac GR00T, a simulation engine that trains robots in virtual environments so they don’t cost you $50 million every time they fall over. (Yes, it’s named after Groot.)

It might sound like hype, but this is Nvidia applying the same full-stack strategy that made it dominant in AI (hardware, software, developer tools) and extending it into the physical world. The chips are already shipping, the partners are already building, and (most importantly) Wall Street is paying attention.

Meanwhile, the core AI business is still an absolute monster. Data center revenue rose 73% YoY, helping push total revenue up 69% last quarter. Analysts expect Nvidia to do $200 billion in revenue this year, up from $130 billion in 2024 and just $27 billion in 2023. But what about CHI-NA? Yes, the U.S. government decided to block sales of Nvidia’s H20 chips… ironically, the ones specifically designed to comply with the last round of export restrictions. The move forced Nvidia to write down $4.5 billion in inventory and put a giant “nope” sticker on $8 billion of expected revenue. Huang called the policy a “failure” (who wouldn’t with that much money on the line).

But unlike other tech companies, Nvidia isn’t freaking out over the China thing. They’ve already shifted focus to U.S. and European markets, along with growth areas like robotics and autonomy. China may be frozen for now, but it’s not killing the plan for world domination.

Yes, Huang sold $14.4 million in stock this month, with plans to dump up to $865 million by year-end. But let’s not kid ourselves… this isn’t a crisis of confidence. When your company’s worth $3.7 trillion and your net worth could cover a small war, taking a little off the table isn’t bearish… it’s just what happens when you start thinking in yachts instead of dollars.

As for the Deepseek freakout, it was exactly what it looked like: a brief market-wide anxiety attack triggered by a flashy headline and a $300 GPU stunt. People saw “ChatGPT-level model” and forgot to read the fine print… like the part where it only works if you don’t care about latency, uptime, or deploying at scale. Nvidia’s moat isn’t about being the only game in town… it’s about being the only one that can actually scale across infrastructure, software, and support without blowing up the lab.

Now that same playbook is being deployed into robotics. Not hypotheticals… real tech, real chips, real partnerships. Mercedes, Toyota, Aurora… they’re already building on Nvidia’s platform. And the game plan is aggressive in all the right ways. So yeah, the valuation’s rich. But this is what happens when you build the ecosystem everyone else is forced to rent.

At the time of publishing this article, Stocks.News holds positions in Microsoft, Apple, and Robinhood as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer