Back in high school, I played on a scrappy basketball team that shocked the favorites in a fall tournament. We weren’t supposed to win. But when that buzzer went off, we piled on each other like we’d just won the NBA Finals. Then, in the locker room (once the screaming stopped and the Gatorade dried) I looked at the team and said something that’s burned into my brain: “Don’t get cocky. The championship’s next. I want the damn trophy, not a one-hit wonder.”

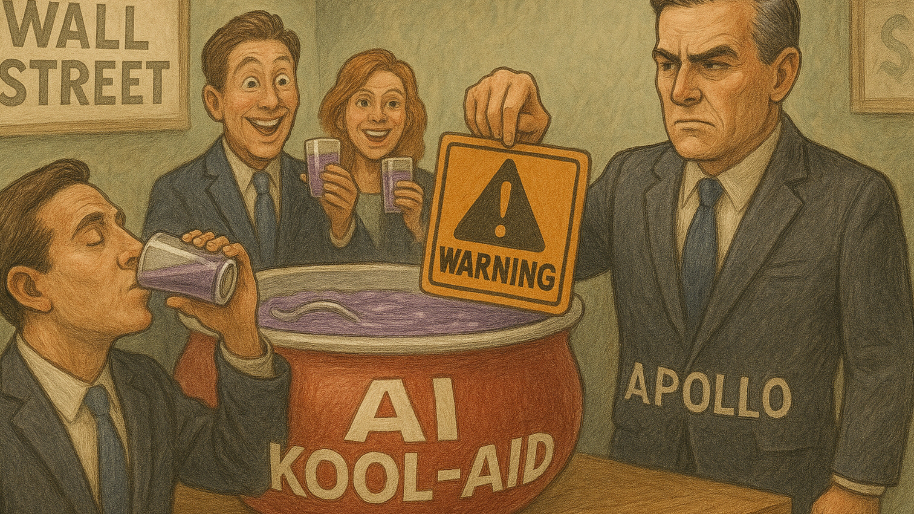

Now, don’t worry, I’m not out here pretending I made it to the NBA. I’m well aware my basketball career peaked in a sweaty high school gym. The only reason I bring this up (besides humble-bragging about the glory days) is because Apollo Management is basically doing the same thing right now. Only instead of teenage hoop dreams, it’s the U.S. stock market on the court… specifically the all-star team of AI stocks that just dragged the S&P to fresh all-time highs. But while I was telling my teammates to stay sharp for the next game, Apollo’s saying something a bit scarier: “This whole thing might blow up in our face.”

Torsten Sløk, Apollo’s chief economist (read: the guy paid to be the adult in the room), just dropped a market note that might as well have been titled “We’re All Gonna Die (Financially).”

Here’s the gist: “The difference between the IT bubble in the 1990s and the AI bubble today is that the top 10 companies in the S&P 500 today are more overvalued than they were in the 1990s.” He’s not talking about fringe meme stocks or tiny AI startups either. He’s talking about Nvidia, Microsoft, Apple, Meta, Alphabet… the big dogs. The “I bought the S&P 500 so I’m diversified” crowd doesn’t realize nearly 40% of their money is riding on just 10 names… almost all AI hype machines. You think you’re holding a basket of 500 companies? Nah. You’re betting on Jensen Huang and a bunch of GPU hopes and dreams.

Here’s an argument I’ve heard too many times to count: “But they’re profitable! Doesn’t that make it different?” Well, yes and no. The Magnificent 7 are pulling in insane revenue… Nvidia’s market cap jumped $277 billion in one day after its latest earnings call (the biggest one-day gain in U.S. history, by the way). But that doesn’t mean their valuations make sense.

Sløk’s point isn’t “AI is bad.” It’s: “Y’all are paying dumb money.” Back in 2000, the dot-com bubble burst even though the internet was obviously going to change the world. The problem wasn’t the tech. It was the price. Same story now. The top 10 AI-heavy stocks are now trading at forward P/E ratios even higher than the tech darlings of 1999. Yeah… higher than peak dot-com mania. That’s like paying more for a Tesla today than people paid for Pets.com back when it was busy delivering dog food and lighting investor cash on fire. (And we all know how that ended.)

And generative AI revenue? Don’t even get me started. Let’s just look at the numbers. Back in 2000, internet-related revenue (adjusted for inflation) was around $1.5 trillion. Generative AI in 2024? Less than $10 billion. Yet somehow, OpenAI is valued at $157 billion… while losing billions. To quote Apollo Management, “the payoff just isn’t there yet.”

People keep pointing to how many users ChatGPT or Gemini have like it’s some kind of economic miracle. But let’s be real… popularity doesn’t equal profit. Social media is free too, and unless you’re counting 12 hours of TikTok scroll-time as productive GDP, we both know user numbers don’t tell the whole story. What actually matters is whether this stuff makes money. And right now? It doesn’t. These models cost upwards of $100 million just to train, and then you’ve got to keep feeding them expensive chips, power, water, and elite engineering talent who expect fatter checks for their trouble. The costs are massive, and the revenue… just isn’t keeping up. Even a barely functioning AI could tell you that math doesn’t work.

Now do I agree with the AI conspiracy theorists who think this is all one giant scam that even Joe Rogan couldn’t dream up after a three-hour DMT trip? No. AI’s real. The tech is impressive. It’s already changing workflows, shaking up entire industries, and more productive than half your coworkers. But does that mean it deserves trillion-dollar price tags and “change the world” expectations baked into stock prices right now? That’s where things get messy.

The truth is, markets can stay irrational longer than we like to admit. Just because something feels revolutionary doesn’t mean it’s paying like one yet. And that’s the heart of Apollo’s warning: this AI rally isn’t being driven by hard results… it’s being driven by momentum, storylines, and FOMO. Investors are treating these AI giants like every rosy prediction is already locked in. OpenAI’s $100 billion revenue forecast for 2029? People are pricing it like it’s inevitable… not the corporate equivalent of me saying I’m going to be a billionaire by the end of the decade. (For the record, OpenAI’s pulling in $3.7 billion right now… and still losing money like it’s a competitive sport.)

And just to be clear (Nvidia, Microsoft, Apple, Meta, Alphabet) these aren’t Pets.com with a sock puppet mascot and no business model. These are real, profitable monsters with massive reach and actual earnings. No one’s questioning whether they’re legit. But when the entire market starts piling in behind them like they’re invincible, like nothing bad could ever happen, and the numbers don’t matter anymore? That’s usually when the air gets thin.

Ask anyone who bought Yahoo at the peak in December 1999. They’ll tell you how fast “can’t miss” turns into “where did all my money go?” So no, maybe this isn’t a full-scale 2000 moment… not yet. But it’s humming a familiar tune. And if you’ve been in this game long enough, you know how quickly the music can stop… especially when no one’s watching the fundamentals. Of course, the tricky part is figuring out what to do about it. Are we all supposed to yank our money out of the market and move it into something more stable? Like… Bitcoin? Yeah, good luck with that.

At the time of publishing this article, Stocks.News holds positions in Microsoft, Apple, Meta, and Alphabet as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer