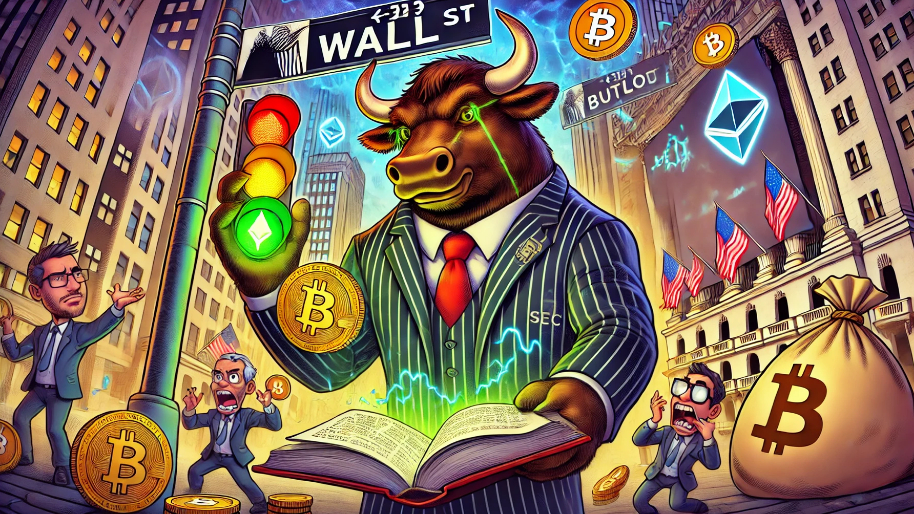

The crypto chokehold has officially been loosened, friends. The SEC just rescinded SAB 121, the accounting rule that’s been keeping Wall Street banks from diving headfirst into Bitcoin and its merry band of decentralized misfits. For those of you who don’t spend your evenings reading SEC guidance, this rule forced banks to treat any crypto they held on behalf of customers as a liability on their balance sheets. Translation: It made holding crypto comically expensive, like trying to buy a Manhattan penthouse with Monopoly money.

(Source: Giphy)

Introduced in 2022 under former SEC Chair Gary Gensler (aka the ultimate crypto cockblock skeptic), SAB 121 was basically a “you can look, but you can’t touch” law for big banks. Sure, they could dabble in derivatives or ETFs, but full-on custody services? Forget it. The capital requirements were so strict that most banks decided it wasn’t worth the headache—or the hit to their bottom line.

But times have changed. And that change is a new administration that has the SEC pulling the plug on SAB 121 this week. The reaction? Full-on praise. Wall Street’s been itching to expand its digital asset portfolios, and this rule was the last major hurdle keeping them from rolling out the red carpet for Bitcoin. SEC Commissioner Hester Peirce, affectionately dubbed “Crypto Mom” by the industry, summed it up best in a post on X: “Bye, bye SAB 121! It’s not been fun.” Love to see it.

(Source: CNBC)

However, with that said, let’s not think for once second this ONLY about good policy. This is politics, plain and simple. The Trump administration’s pro-crypto tone is already reshaping the regulatory landscape, and Wall Street is wasting no time adjusting its game plan. Goldman Sachs CEO David Solomon even told CNBC this week that the bank couldn’t own Bitcoin “from a regulatory perspective” but would “revisit the issue if the rules changed.” Well, David, the Trump era is back baby, and you just got an invite to print money.

And it’s not just Goldman. Morgan Stanley, Bank of America, and every other big name in finance are eyeing this as their golden ticket to get serious about crypto. Remember, these banks aren’t just interested in offering custody services—they’re looking to build entire ecosystems around digital assets. Think trading platforms, lending services, and maybe even a few NFTs for the boomers who still think Bitcoin is “that internet money.”

(Source: Axios)

Obviously, the crypto community as a whole is loving this. The same people who’ve spent years calling for “institutional adoption” are now John Bendering into the sunset with fist pumps—as Wall Street jumps on board. Meaning, Wall Street is about to get more weirder than it already is.

With SAB 121 but of the way, banks will finally have the regulatory clarity they need to dive into crypto. Expect a flurry of announcements in the coming months as everyone scrambles to stake their claim in the digital gold rush. And while this is great news for crypto degenerates, it’s also a stark reminder that when Wall Street enters a market, it plays to win. Whether that’s good or bad for crypto’s decentralized ethos is a debate for another day.

(Source: Giphy)

For now, enjoy the chaos. After all, there’s nothing more entertaining than watching banks try to act cool about Bitcoin while secretly panicking about how little they actually understand it. Regardless though, we’ve officially entered a new era—and we’re all about to see Wall Streets insatiable levels of greed skyrocket.

In the meantime, place your bets accordingly friends—and if you’re a crypto bull, don’t be dumb. Do your due diligence and don’t let the FOMO bite you in the a$$. As always, stay safe and stay frosty! Until next time…

P.S. The markets are making new highs, and greed is sweeping the markets left, right, and twice on Sunday! The best part? Our recent $DWTX alert skyrocketed 876% in less than ONE-DAY! Click here to join Stocks.News to make sure you take advantage of our next alert…

Stocks.News does not hold positions in companies mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer