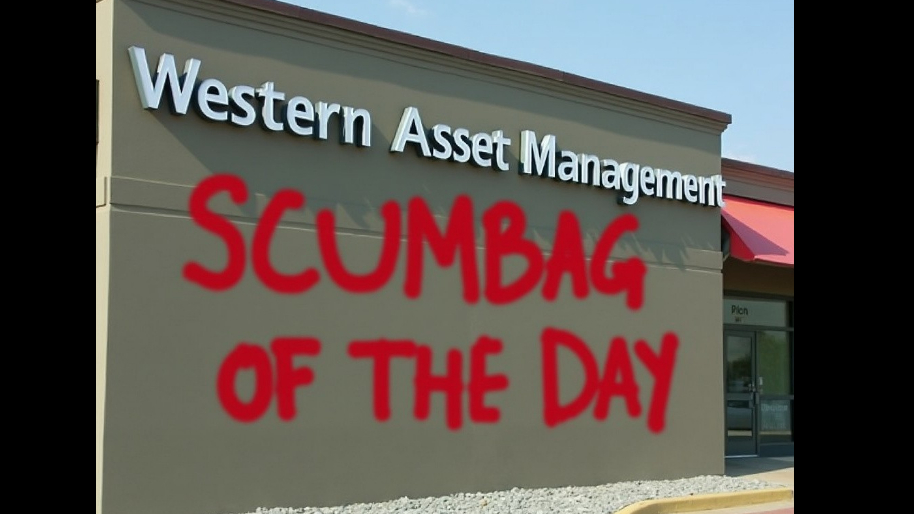

Welp, it’s another day, another dumpster fire in the financial world folks. This time, it’s the shady crooks over at Western Asset Management who are holding our beloved award of Scumbag of The Day - August 22nd Edition.

In short, Western Asset Management has been playing fast and loose with their trading practices, and now they’re staring down the barrel of a criminal investigation. Duh… duh… duhhhh...

(Source: Bloomberg)

No shocker there, considering this is basically the cost of business to raking in billions on Wall Street. However, this latest scandal centers around the slimy practice of “cherry-picking”. Now for those of you who have skipped Ethics 101, or have yet had the chance to become a victim of a high flying “100% Accurate” stock picking expert on youtube, this practice is when a firm (like WAM) gives the VIP treatment to their elite clientele, handing them lucrative trade opportunities while the rest of us peasants get leftovers that are about as appealing as 7-11’s donuts.

(Source: Reddit)

Meaning, this isn’t just bad manners or favoritism here - it’s actually illegal. Which is why the U.S. The Attorney's Office in Manhattan is all over this like white on rice, with the SEC running its own investigation on the side. With that said, no charges have been filed yet, but given the firm holds over $381.1 billion of assets under management, they may end up getting the Carl Icahn treatment here.

(Source: Giphy)

But alas, despite my personal think so’s on the matter, the “tell me you’re guilty without telling me you’re guilty” move came when Ken Leech, the firm’s co-chief investment officer, received a Wells notice. Translation: Ken got the good ole “You’re about to be in deep sh*t” memo.

(Source: Bloomberg)

As a result, Ken didn’t stick around to chat as he’s officially taken a leave of absence while Western Asset tries to play the good guy, saying they’re “cooperating” with the investigation. But let’s be real, that’s about as promising as Biden getting through a full press conference without speaking some version of utter nonsense.

Which is why, regardless of the “cooperation” on Western Asset Management’s part, they’ve just pulled the plug on its $2 billion Macro Opportunities strategy, handing the reins over to Michael Buchanan as the solo chief investment officer.

(Source: Morningstar)

Meanwhile, Franklin Resources Inc., aka Western Asset’s sugar daddy, is feeling the heat too— as its shares have tanked 13%, adding to a brutal 34% slide this year.

(Source: Market Watch)

So clearly a lot of air punching and dipping out is being felt on the investor part. Plus, to add insult to injury, the “legal” investment game for WAM is getting hammered due to rising rates leading to major outflows from their flagship funds. For example, their Core Plus fund is training behind 97% of its competition, as investors are now flocking to rivals like Pimco and Blackrock. Ooof…

(Source: Bloomberg)

So with all of that said, what’s the takeaway here?

Well this is yet another example of my favorite saying of all time: “When you play stupid games you win stupid prizes”. Because while regulators sit on their hands trying to figure out what stupid prize to give Western Asset Management, the reputation of the firm is now tarnished to some extent.

(Source: Giphy)

Plus, this is just another example to all the other Wall Street firms that it might not be a good idea to play favorites with other people's money - I know, crazy idea, amirite? But in the end, with that said, as we all get another reminder that “Greed” is definitely the motto on Wall Street, be careful who you trust in the game - especially if you are retail.

In the meantime, stay safe and say frosty, friends! Until next time…

Stocks.News does not hold any positions in companies mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer