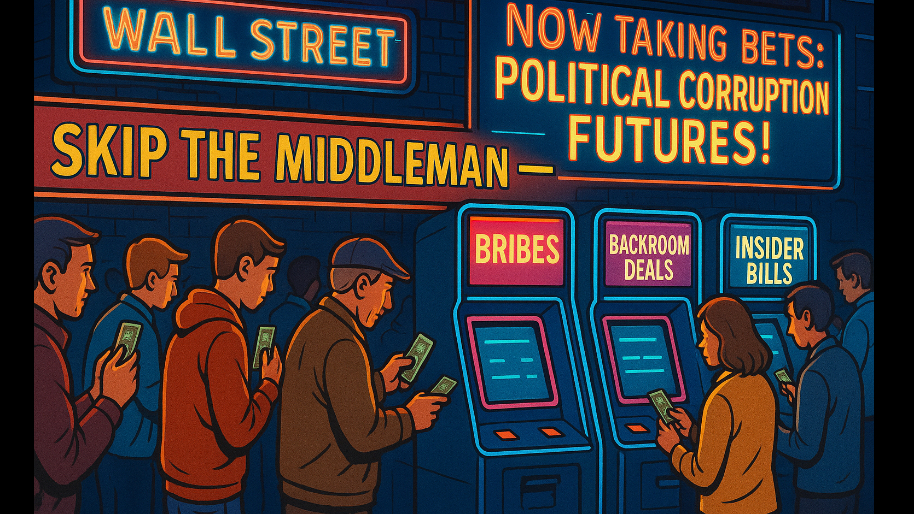

If you’re not a Stocks.News premium member, where let’s be honest, you’ve been tracking congressional grifters in real time while everyone else is still trading off TikTok rumors… congrats peasants, Wall Street just handed you the next best thing. And it didn’t even require a Super PAC donation. Why? Because the GRFT ETF (yes, that’s the actual ticker, and yes, America is cooked) is here to let you chase the same political insider trades as the lizard people in D.C…. bigly.

(Source: Giphy)

In short, Matthew Tuttle, the man who once created an ETF to bet against Jim Cramer’s entire existence, has finally snapped and filed for the most brazen product in ETF history: a fund that will straight-up track “companies with demonstrated ties to the politically connected.” The thesis is simple: Power = profit.

The GRFT ETF will actively buy stocks that pop up in congressional trading disclosures, companies where the CEO’s golf buddy is a cabinet member, and whatever random ticker gets name-dropped in a trade-talk memo before lunch. Meaning, if Trump, Pelosi, Hegseth, or AOC so much as farts in a company’s direction, expect GRFT to be there in size.

(Source: Bloomberg)

Of course, the fund’s not naming names. (No one wants to get subpoenaed before the opening bell.) But the prospectus says it’ll “translate political influence into investable insights,” which is a polite way of saying “we’re betting that the only thing more reliable than a lobbyist’s check is a politician’s greed.” It’ll even flip to cash if things get too spicy… which is the kind of monitoring that apparently justifies their 0.75% management fee on your money.

Now for those who are eye rolling this or thinks this is dumb, well… the jokes on you. NANC and GOP, a.k.a. The other congressional-tracking ETFs are outpacing the S&P this year, presumably because Nvidia is the main character and everyone’s too scared to short tech. But honestly, who cares if it’s working amrite? In a market where people buy ETFs called “YOLO” and “FOMO,” GRFT is just meeting America where it’s at: tired, salty, and ready to monetize its own disgust. If you can’t beat the swamp, at least you can try to squeeze a few basis points out of it. And that’s exactly what Matthew Tuttle is trying to get at here.

(Source: Giphy)

In the end, the GRFT ETF is the most honest thing Wall Street’s vomited up in years. And I for one, am here for it… especially for the entertainment. Meaning if you’re bold (or dead inside because you don’t want an actual screener that does this for you inside of Stocks.News premium) enough to buy it, best of luck. Retail investors are going to go nuts over this, and it’ll be interesting to see how lucrative “grift” actually is in the swamp we call our government.

For now though, keep your eyes on this story and place your bets accordingly. Until next time, friends.

At the time of publishing, Stocks.News does not hold positions in companies mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer