“Can you take me higher?”

(The stock market said: barely, but we’ll take it.)

Stocks crept higher (once again) as two completely contradictory forces somehow managed to push the market in the same direction… up. On one hand, Donald Trump struck a fresh trade deal with Vietnam (complete with some new tariffs friendly to Uncle Sam), while on the other, the U.S. labor market just flashed its weakest signal in over two years.

The Nasdaq led the way with a 0.7% gain, lifted by a couple of familiar faces. Apple popped 2.3% after Jefferies issued an AI-sparked upgrade, and Tesla rose 2.9% thanks to a Q2 production beat… even though sales actually dropped 4.8% (but hey, who’s counting?). The S&P 500 edged up 0.3%, tiptoeing toward all-time highs again, while the Dow lagged with a sleepy 0.1% gain.

But the real market mover wasn’t tech, AI, or Elon promising robotaxi’s will replace every Toyota Camry in America. It was the ADP jobs report… and boy, it was ugly. Private employers shed 33,000 jobs in June, versus an expected gain of 98,000 (yikes). This was the first negative print since March 2023, and most of the job losses came from small businesses (in other words: the mom and pop economy is taking hits while Big Tech keeps buying back stock). The report breathed new life into the “rate cuts are coming” fantasy, traders are now pricing in a 23% chance of a July cut (up from 21% yesterday… steady progress, folks) and almost a sure thing by September. Two bad reports in a row and the Fed might finally say “screw it.” It’s starting to feel like when you root for your favorite team to lose just to land the #1 draft pick.

Back to Trump’s Vietnam move. The agreement includes a 20% tariff on imports and a 40% hit on anything rerouted through Vietnam (which is often code for “made in China but with a disguise”). The immediate winners were footwear stocks. Nike spiked nearly 4% before cooling off at +1.7%, while ONON and Deckers caught some of the retail hopium as investors hoped the move might finally clear up supply chain fog.

Robinhood rose past the $100 mark for the first time ever, jumping 7% on the day and now up 160% this year. The rally's being driven by a crypto bull run (I mean Bitcoin, altcoins are down bad) and its expansion into Europe, where it’s launching tokenized stock and ETF trading.

But let’s not pretend it was all up and to the right. Microsoft slipped after confirming it's laying off up to 9,000 employees (about 4% of its workforce) as it trims middle management to go full AI mode. (“We taught ChatGPT how to send emails and show up to work late, please grab your things.”)

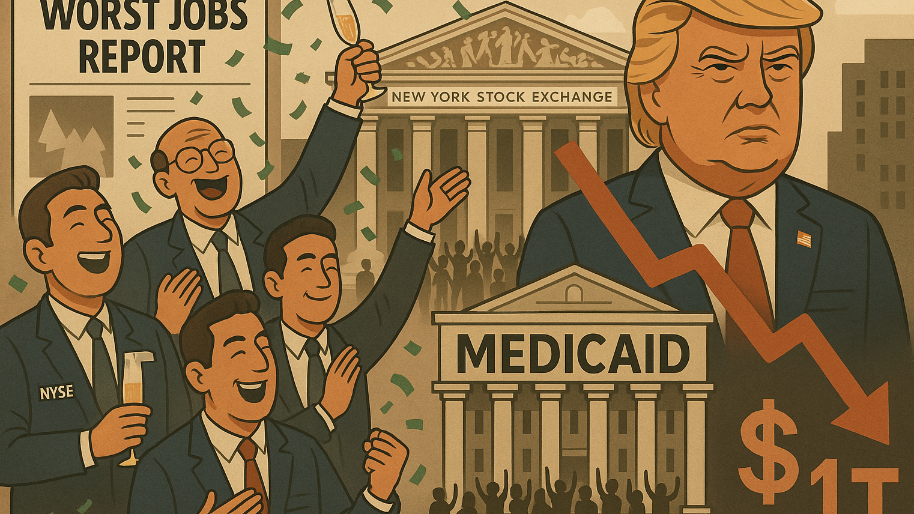

The biggest meltdown of the day belonged to Centene, which collapsed 39% after the company unexpectedly pulled its 2025 earnings guidance during its investor day presentation. Execs offered little explanation beyond “ongoing operational challenges,” which scared investors already nervous about rising healthcare costs and policy shifts. The stock is now down 43% year-to-date and pacing for its worst annual performance since going public in 2001 (not a great day for the largest Medicaid company in the country).

You might as well toss the entire insurance sector into a blender at this point, because things got messier after Trump’s “Big Beautiful Bill” made it through the Senate. The legislation aims to erase roughly $1 trillion from Medicaid and ACA funding… which, in plain English, means up to 12 million Americans could lose coverage by 2034. Elevance got wrecked 8.9%, UnitedHealth tumbled 2.9%, and CVS slipped 2.3% as everyone realized insurance companies are now cooked thanks to the Don.

Intel wasn’t far behind in the pain parade, falling 3.7% on reports that CEO Lip-Bu Tan may ditch the company’s highly-hyped 18A chip tech… a move that casts even more doubt on whether Intel can keep up with the likes of TSMC. (Or, frankly, anyone.)

Now all eyes are on tomorrow’s official jobs report. If it’s anywhere near as weak as the ADP numbers, it could give the Fed just enough political cover to finally pull the trigger on rate cuts. Because in this upside-down market, weak data is still treated like a green light. (At least until things get too ugly… then it’s every portfolio for itself.)

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

At the time of publishing this article, Stocks.News holds positions in Apple, Tesla, Robinhood, Microsoft, and Intel as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer