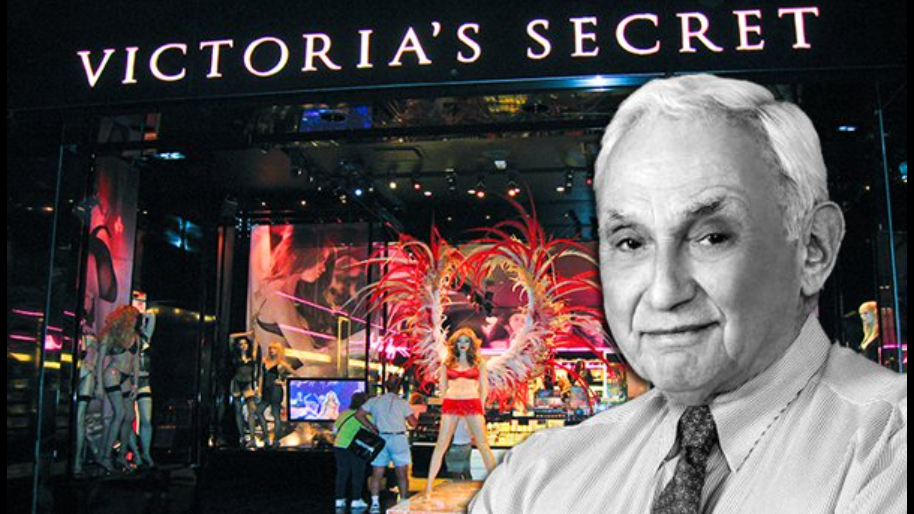

Les Wexner, the Ohio billionaire and former CEO of Victoria's Secret, just found himself sitting pretty comfortably on a new $800 million AI treasure. And no, he’s not rolling out AI-powered lingerie that adjusts itself. Believe it or not, it all started with a modest $1 million seed investment into a company that barely anyone had heard of at the time.

Back in 2019, Wexner’s family trust took a gamble on Atlantic Crypto, a struggling crypto miners operating out of a New Jersey garage. Pretty good stereotype right? Well, fast forward to today, that company is now Coreweave, a $19 billion AI empire, and Wexner’s stake has exploded to a whopping $720 million. I did the math, and that’s a 71,900% gain. Next time the powerball comes up, it might be a good idea to have the oldman buy you some tickets for good luck.

(Source: Business Insider)

As soon as the news hit, a wealth management firm swooped in like a distant relative who just found out you inherited a million bucks. So what’s the accusation? Florence Capital Advisors is demanding a $6.9 million fee, claiming their "brilliant" advice led Wexner to invest in Coreweave. Are they also taking credit for when their other clients invested and lost everything? I doubt it. Honestly, it would be hilarious if those clients who lost money from their recommendations joined Wexner and countersued.

Regardless of what you or I think, Florence Capital is adamant they’re owed a fee, bragging about an “almost unimaginable 30,986% return” from Wexner selling $71 million of Coreweave stock in November 2023. That sale, combined with his remaining stake, brings the total haul from this investment to nearly $800 million. That takes the “rich only get richer” phrase to a whole new level.

Coreweave, now a titan in the AI cloud industry with heavyweight partners like Nvidia and Microsoft, recently snagged $7.5 billion in debt from Blackstone and another $1.1 billion in equity to supercharge its data center network.

Wexner’s initial investment was through Greg Hersch of Florence Capital, who put in $1 million during Coreweave’s seed round. They doubled down with an additional $600,000 in stock from the Series A round, and then some more through a convertible note. Of course, like any old billionaire, all of this was tucked away in a trust for Wexner’s four children.

(Source: The Wexner Foundation)

After getting the boot from Victoria’s Secret in 2020 due to his suspiciously cozy ties with Jeffrey Epstein, Les Wexner quickly realized that swinging a tennis racket or a golf club just wasn’t his style. Instead, when he's not busy on Reddit or turning $1 million investments into $800 million, he's been wheeling and dealing land around his New Albany, Ohio home to tech giants like Google and Meta, raking in a cool $450 million.

And he’s far from done—his real estate company, the New Albany Company, still holds about $850 million worth of farmland, setting him up for even more lucrative deals down the road. In fact, a recent investigation revealed that Wexner played a key role in landing a $20 billion Intel chip factory in New Albany. He pocketed an estimated $35 million from that deal and is now busy developing nearby land to support Intel's suppliers, with more acquisitions to come.

Stock.News has positions in Microsoft, Google, Intel, and Meta.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer