“I’m never going to financially recover from this…” - UNH investors or UNH Board… either one…

UnitedHealth just reported Q2 earnings, and if you were hoping for a miracle cure… tough luck. The nation’s largest insurer just confessed to blowing the pricing model on its Medicare Advantage plans… and the market scalpel came out fast. Shares dropped over 5% Tuesday, dragging the entire healthcare complex with them.

(Source: Giphy)

For starters, revenue came in at $111.6 billion… technically a beat. But EPS? It was an ugly miss at $4.08 compared to the $4.59 analysts wanted. But the real bloodbath isn’t in the headline numbers. It’s in the margins, where UnitedHealth’s profitability just got stretchered out of the building.

(Source: Yahoo Finance)

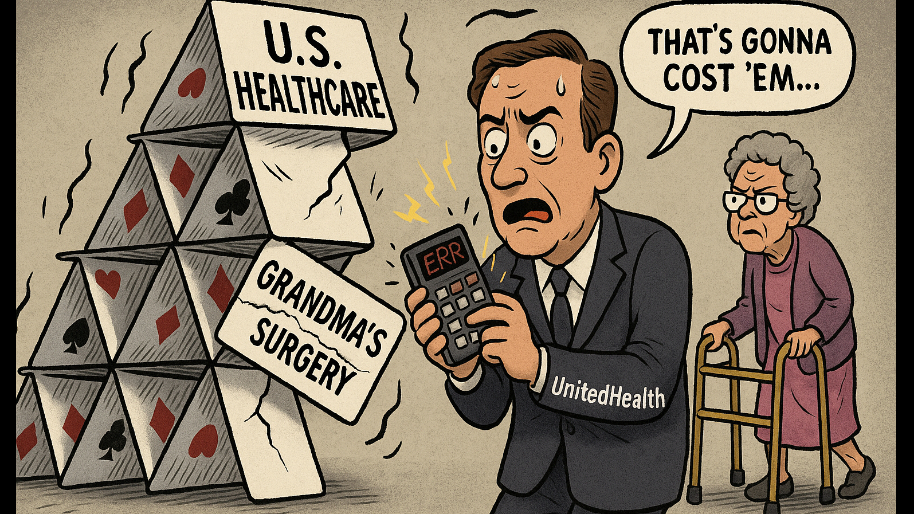

In short, UnitedHealth admitted it completely misread the medical cost trend when it built out its 2025 Medicare Advantage plans. Translation: They set the premiums assuming grandma was going to keep postponing her hip replacement. She didn’t. Neither did half the country. The result? A medical care ratio of 89.4%... which basically means for every dollar they collected, they spent 89 cents covering increasingly expensive procedures. That’s up from 85.1% last year. And yes, every tenth of a percent matters when you’re insuring millions of aging boomers with titanium knees.

(Source: CNBC)

Meanwhile, the “guidance” they re-issued (after yanking it last quarter) calls for at least $16 per share in 2025 adjusted earnings. Wall Street was expecting $20.91. That’s a nearly $5 per-share hole. No surprise: the stock puked on arrival. But, but, but… don’t worry, they have a plan. CEO Tim Noel, now the guy holding this medical-grade dumpster fire, said they’re walking back $1 billion in “previously planned portfolio actions.” Corporate translation: “We’re deleting the slide deck and praying nobody asks questions.”

Oh, and speaking of pressure points… Optum isn’t exactly putting on a clinic either. The supposed high-margin jewel of UnitedHealth’s vertical integration empire saw its Optum Health revenue fall 7% year-over-year. Which is kind of awkward when your entire business model is built on choking efficiency out of the American healthcare meat grinder. Sure, pharmacy revenue was up 19%... but selling pills is the easy part. Running a functional healthcare network? Not so much.

(Source: Giphy)

Also, hanging over this report is the Department of Justice. UnitedHealth admitted it’s being probed for Medicare billing practices and is now scrambling to convince regulators and investors it’s not upcoding grandpa’s physical therapy as thoracic surgery. They’ve even brought in outside consultants like FTI and Analysis Group to perform a public audit of their processes. That report’s due by the end of Q3. No pressure.

In the end, the TL;DR is this: revenues are up, but that’s where the good news ends. EPS missed. Margins are shrinking. Costs are surging. DOJ is circling. And their supposedly unstoppable Optum unit is wobbling. Naturally, investors were hoping for signs of stabilization. What they got was a reminder that you can be vertically integrated, financially diversified, and clinically optimized… and still get blindsided when every 72-year-old in America books surgery the moment their deductible resets.

(Source: Giphy)

So yeah, this is a masterclass of what it means when a company with vertical dominance loses horizontal control. And with shares already down over 46% YTD, it’s going to take more than a few AI-powered billing audits to restore confidence. For now, investors are left clutching their statements and whispering, “Do no harm” like it’s a prayer. Unfortunately, UnitedHealth's chart says the opposite. Translation: Place your bets accordingly, friends. Until next time…

At the time of publishing, Stocks.News does not hold positions in companies mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer