Pick any DJ Khaled track you want… because TSMC just dropped “another one.” And this one wasn’t close. Net profit surged 61% year-over-year, while revenue climbed nearly 39%, blowing past estimates and extending a now-familiar trend. That’s four straight quarters of crushing expectations… something most chipmakers treat like a once-in-a-decade event. (No offense, Intel. Actually, full offense.)

It’s no mystery what’s driving the growth: AI demand is scaling fast, and TSMC happens to be the one company in the world capable of meeting it at volume with consistent yield.

For instance, 60% of TSMC’s Q2 revenue came from high-performance computing… the segment that includes chips for AI, data centers, and 5G. That’s up from 52% a year ago, and the trajectory makes sense. Nvidia’s H100s, AMD’s MI300s, Apple’s M-series (all of them) are built at TSMC. At this point, calling TSMC part of the AI boom feels like calling oxygen part of breathing. More importantly, 74% of wafer revenue came from nodes 7nm and smaller. These are the bleeding-edge chips required for AI workloads. There are only a few fabs in the world capable of building them at scale… and TSMC owns the lion’s share of that capacity.

Because of this, CEO C.C. Wei bumped 2025 revenue growth projections up to 30% (USD) from “mid-20s” in April. Considering the company just grew at a 39% clip this quarter, the guidance doesn’t feel like a stretch. If anything, it might still be conservative. (TSMC tends to sandbag a bit… probably to avoid getting trashed the one time they miss.)

That said, while TSMC’s core business is humming, the backdrop is still as shaky as it can get. Back in April, President Trump announced a 32% tariff on a wide basket of Taiwanese imports… semiconductors included. The order hasn’t kicked in yet (USTR is still hammering out the fine print), but Taiwan’s trade ministry says the clock could start as soon as this fall. In other words, the world’s biggest contract chipmaker is staring down a margin haircut that no number of AI orders can fully hide. Earlier this month, Trump turned up the heat again, floating “additional” levies aimed specifically at advanced chips. Meaning: the 32% might be the chips and salsa (before the real meal comes out). TSMC CFO Wendell Huang told analysts the company is “running scenarios,” but there’s not much you can do if this happens.

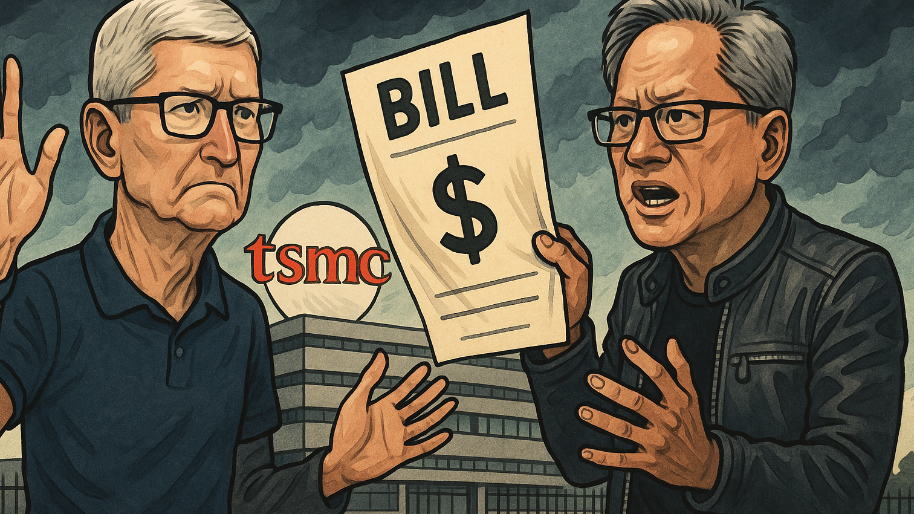

If the duties land as written, TSMC’s U.S. customers (Apple, Nvidia, AMD) either eat the cost or pass it along. Given smartphone ASPs are already testing consumer patience, guess who’s more likely to flinch (hint: it isn’t Tim Cook). C.C. Wei tried to keep the mood calm on the call: “We understand there are uncertainties and risk from the potential impact of tariff policies.” (Loosely translated: our yields are fine… it’s the yield curve in D.C. that’s killing us.)

And this is before factoring in the stop-and-go export rules on China. Nvidia and AMD just got a narrow green light to ship trimmed-down AI silicon to the mainland, but Commerce can yank that permission anytime they want. Every new restriction ricochets back to TSMC’s order book. And then there’s the currency problem. The Taiwan dollar has been gaining strength, which quietly chips away at reported revenue when converted into USD. Not exactly a headline-maker, but still a pain for anyone modeling earnings growth going forward.

To combat that, the company is pouring $100B+ into global expansion, building fabs in Arizona, Japan, Germany, and elsewhere. Obviously, this is less about demand, and more about risk insulation… TSMC knows that it can’t keep all its eggs in the Taiwan basket forever. With all that said, TSMC continues to prove it’s more than a chipmaker. It’s the cornerstone of modern computing infrastructure. The fundamentals are excellent, the capacity lead is unmatched, and the demand environment looks solid well into 2025.

However, you still need to keep an eye on what could mess this up. As we’ve seen lately, tariffs, export rules, and supply chain chaos can kill sentiment overnight and TSMC doesn’t control any of that. The business might be running like a Swiss watch, but all it takes is one policy shift or trade headline to throw it off rhythm.

At the time of publishing this article, Stocks.News holds positions in Intel and Apple as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer