“Ok, grandpa, let’s get you to bed.” - Every Wall Street bull to Jay Goldberg, the only analyst on Earth who dares to say “sell” on Nvidia.

While 79 other analysts are pretty much holding hands and singing hymns to Jensen Huang’s GPUs, Jay’s the lone voice reminding everyone, “Yeah… Cisco got this kind of love once too.”

Goldberg, a 54-year-old Seaport Global analyst who works from his cluttered Victorian home in San Francisco (because of course he does), has a sell rating on Nvidia… and he’s not budging. He even keeps a collection of ancient gadgets in his office: flip phones, camcorders, and what looks like a prototype server that probably ran Netscape. No joke, the man’s office is basically a museum of bubbles past.

(Source: BNN Bloomberg)

“There’s a lot more that can go wrong with Nvidia than can go right,” he says. Which, fair. The company’s worth $4.5 trillion, up 3,000% since 2020… and yet everyone acts like the GPUs will keep printing money forever.

Out of 80 analysts, 73 say “buy,” six say “hold,” and then there’s Jay… waving a little “sell” flag like it’s his Alamo. He’s got buy ratings on Apple, Broadcom, and Arm Holdings, all part of the same AI club, but when it comes to Nvidia? He’d rather go to the dentist than buy the stock.

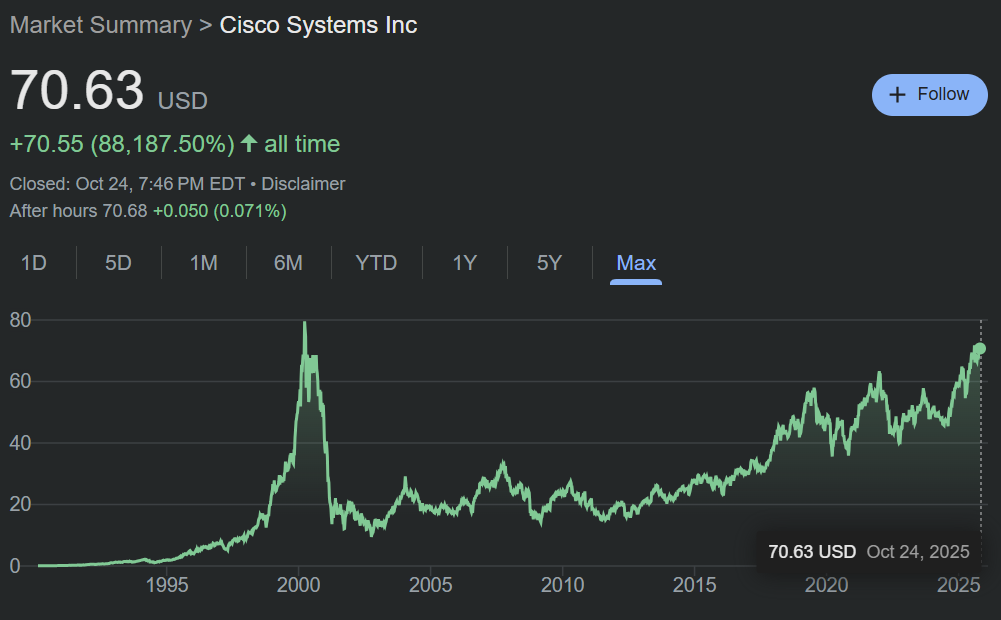

And the thing is, he’s seen this movie before. “This is not my first bubble,” he says. He was around for the dot-com boom when everyone thought Cisco would rule the world forever. Spoiler: Cisco’s stock still hasn’t recovered from the 2000 crash.

Jay thinks Nvidia’s story rhymes with that… massive buildouts, psychological FOMO, and questionable returns. “We’re going to build up all this AI stuff for what are largely psychological reasons,” he said. “At some point the spending will stop, and the whole thing will tumble down, and we’ll reset.”

Meanwhile, the bulls are out here channeling their inner Russell Wilson (Broncos tire-fire version) yelling, “Let’s ride.” Nvidia’s biggest fan, HSBC’s Frank Lee, just upped his price target to $320, arguing the AI chip market is only getting started. Others say we’re in the “early innings”... which is what people also said in 1999, right before Pets.com bought its Super Bowl ad.

Goldberg’s price target? $100 (current price is $186, so he’s calling for a 40% level crash). It’s by far the lowest on Wall Street.

But even he’ll admit Jensen Huang runs a tight ship. His sell rating isn’t a call to short Nvidia… it’s just saying the party might end earlier than the bulls think. “There aren’t many swing factors on the upside,” he said.

Which brings us to one of Jay’s biggest concerns… electricity. The new wave of AI data centers is eating up megawatts like we’ve never seen before. Case in point, power demand from AI and crypto could hit 10% of ALL U.S. electricity use by the end of the decade, and nobody’s entirely sure where that juice is coming from. Jay warns that one small failure (a local provider, a substation, a delayed project) could cascade across the entire GPU food chain.

“Once you trace down where all these GPUs are going,” Jay said, “you get into the weeds of the neoclouds and all these electricity and property deals that are taking place. It’s easy to see how some obscure company fails and that cascades down the rest of the supply chain.” The man’s got a point. Nvidia’s chips might be running the future, but if someone forgets to pay the power bill, it could all go dark real quick.

Even Sam Altman and Jeff Bezos have admitted AI is in a bubble. Goldman Sachs CEO (and part time DJ) David Solomon went a step further… compared the mania to the dot-com era. Yet, investors keep piling in, convinced this time really is different.

As for Jay? Nvidia could hit $1,000 and he’ll still be the guy writing articles saying “sure you’ve made 1,000,000% returns on Nvidia… but it’s set to crash 50% any day now.” I wouldn’t be surprised if he also stands in the corner at weddings, reminding everyone that love statistically ends in divorce.

At the time of publishing this article, Stocks.News holds positions in Apple as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer