Well, sometimes we just can’t have nice things. And nowhere does that feel more true than in Trump’s second term (at least so far).

This morning started like a 2020-level market comeback. The Dow jumped 1,312 points (up nearly 3.9%), the S&P 500 climbed 2.1%, and the Nasdaq surged 4.2%.

Bulls were back in business, and retail traders were licking their fingers, ready for some fresh chicken tendies. The narrative was that Trump and China might hop on a call, hug it out, and hammer out a trade deal that didn’t burn the global economy to the ground.

Treasury Secretary Scott Bessent pretty much ignited this expectation, saying about 70 countries had approached the U.S. for tariff negotiations. Then Trump posted on Truth Social that he had a “great call” with South Korea and that China “wants to make a deal badly.” Spoiler: They in fact, did not make a deal.

By the afternoon, White House Press Secretary Karoline Leavitt made it worse, announcing the U.S. would tack on an additional 50% tariff on Chinese goods. That’s on top of the existing 10% base rate and 34% reciprocal tariffs… bringing the total to a completely unhinged 104%.

Leavitt added, “Americans do not need other countries as much as other countries need us… President Trump has a spine of steel and he will not break.” (And neither will the economy, apparently. It'll just bend until it cries.)

Markets flipped like a pancake at iHOP. The S&P 500 closed down 1.1%, the Nasdaq dropped 1.7%, and the Dow erased its entire 1,300-point gain, closing down 1.21%... a 1,500-point reversal in a single session.

And just to make sure there was no hope left, Trump confirmed the 104% tariff rate goes live at 12:01am Wednesday (because nothing good ever happens after midnight… except maybe if you’re shorting Apple).

Speaking of, Apple dropped another 4.5% and is now down 21% in just four days… its worst losing streak since 2008. That’s $711 billion in market cap gone. Just like that. Nvidia was up 7% at one point before reality walked in and reminded everyone that tariffs affect semis too. It closed up just 1%, which on a normal day would be fine… but this was not a normal day.

Oil, which had been up earlier, flipped and dropped 2.5%, with WTI crude settling at $59.58, its lowest close in nearly three years.

The only real winners were health insurers and coal companies… which feels like the most on-brand sentence of the year.

Humana soared 11%, CVS gained 8%, and UnitedHealth popped 7% after the Trump administration increased Medicare Advantage reimbursement rates by 5.06%, more than double the original January proposal.

And on the fossil fuel side, Trump’s push to classify coal as a “critical mineral” gave Peabody Energy a 10% lift and sent Ramaco up 17%.

Oh and China? They responded by calling the move “blackmail” and vowing to “fight to the end.” Which… yeah, doesn’t exactly sound like “deal-making mode.” At this point, if you think last week’s crash was bad… prepare yourself for tomorrow's market open.

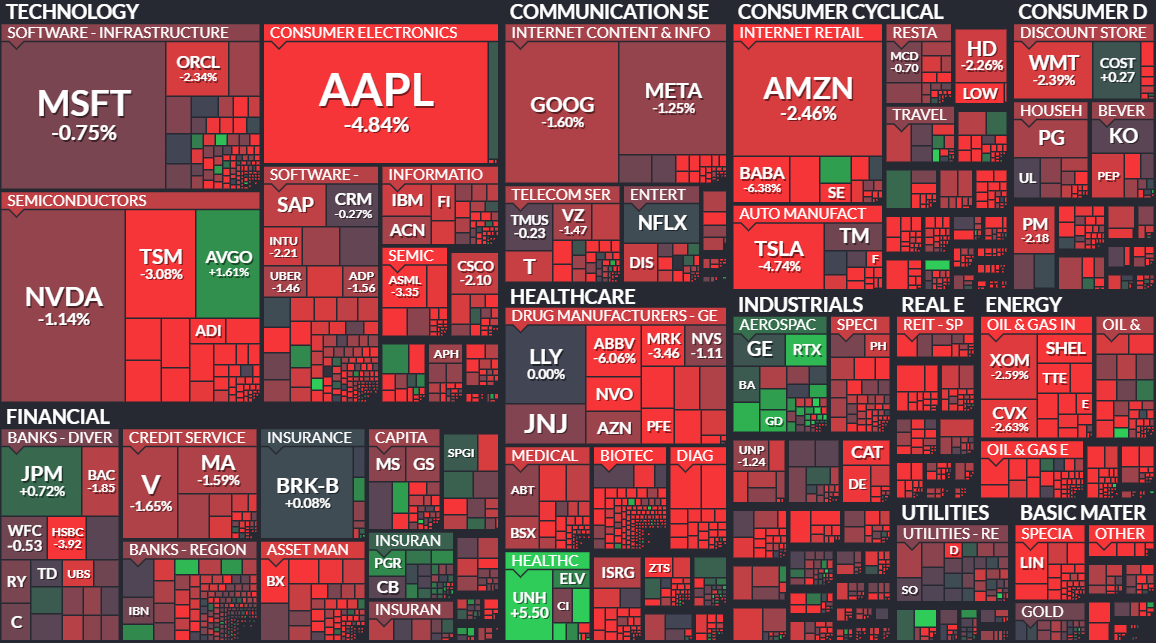

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer