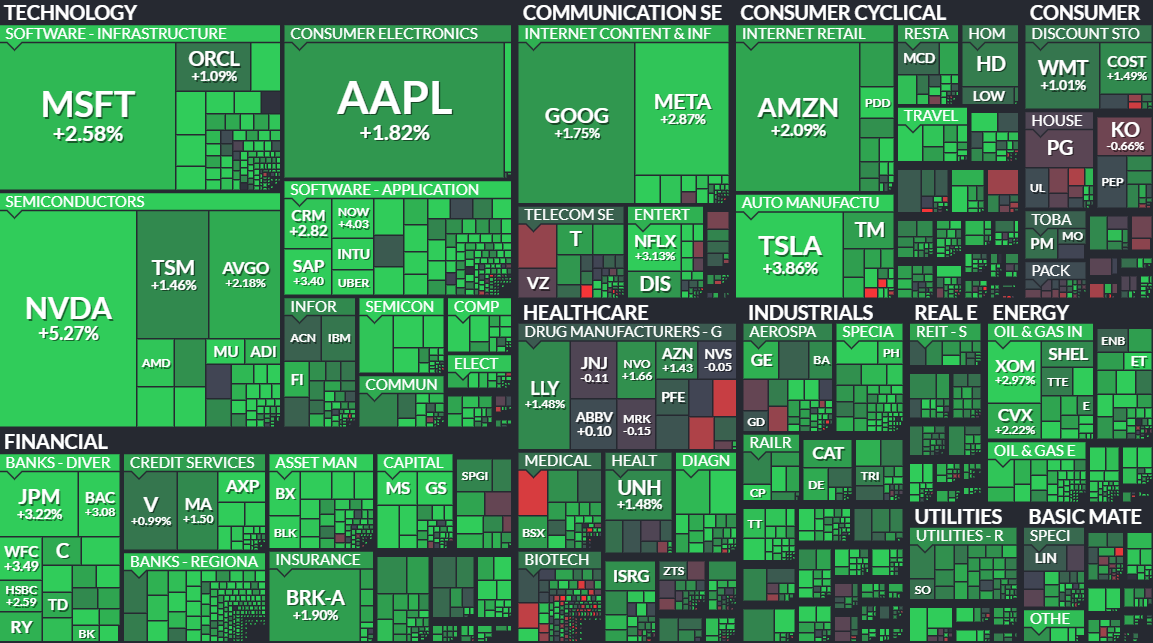

The whole world stopped googling “how to buy T-bills” today, as stocks bounced back from a week that felt like watching whole life burn down in 5 minutes. The Dow shot up 579 points (+1.4%), the S&P 500 climbed 2.05%, and the Nasdaq was the winner with a 2.42% gain, all thanks to Big Tech finally remembering it’s supposed to go up.

Nvidia popped over 4%, while Tesla, Meta, Amazon, Netflix, and Apple all clawed back some dignity. Investors took a break from panic-selling as Trump took a rare breather from tariff threats (probably because he was too busy beefing with late-night hosts).

But let’s not act like everything is sunshine and tendies. The S&P 500 just got bodied into correction territory, plunging 10% in 16 days… which officially makes this the fifth-fastest correction since 1950. The Nasdaq was already limping, and the small-cap Russell 2000 is about one bad headline away from a full-blown bear market, now 19% off its peak. The Dow just notched its second straight losing week, its worst streak since March 2023, while the S&P 500 and Nasdaq are now on their fourth straight week of pain (truly inspiring stuff).

Tesla’s 4% rally today was cute, but it’s like slapping a Band-Aid on a compound fracture. The EV giant is still down 28% in 2025, and unless Elon pulls a miracle out of his dark MAGA hat (meaning turn back the click), Tesla has officially had its eighth straight losing week, a record nobody wants. Monday’s 15% implosion (Tesla’s worst since 2020) happened right after Musk admitted that running his empire is proving to be a “great difficulty”.

Even Trump saying he’d buy a Tesla wasn’t enough to stop the slide (though let’s be real, he probably meant the stock, not the car). Moving over to Jensen Huang's world, Nvidia had a solid day, but earlier in the week, it tanked 5% as AI investors panicked over recession fears. The VanEck Semiconductor ETF has now cratered 9% in 2025 and 13% over the past month.

While Big Tech tried to get back on its feet, some other stocks made bigger splashes. Rubrik exploded 25% after crushing Q4 earnings, while DocuSign skyrocketed 18% on better-than-expected revenue. Crown Castle spiked 10.4% after offloading its fiber assets for $8.5 billion in a deal with EQT and Zayo.

But not everyone got to join the party. Several major S&P 500 names hit new 52-week lows, including Interpublic Group of Companies (October 2022), Ross Stores (November 2023), Target (October 2023), T. Rowe Price Group (November 2023), and JB Hunt (February 2021)... which means things haven’t been this bad for them since people were still debating whether or not to watch House of the Dragon.

As for the economy… it’s throwing up red flags like an NFL ref with personal beef. The University of Michigan’s consumer sentiment index collapsed to 57.9, way below the expected 63.2, which is Wall Street’s way of saying "people are broke and not thrilled about it." Inflation expectations are creeping higher, and the 10-year Treasury yield is rising, which is similar to your Uber driver taking “the scenic route” to rack up the fare.

Now, all eyes are on next week’s Federal Reserve meeting, where markets have all but guaranteed a 97% chance of no rate hike. Investors are watching with the intensity of Morgan Wallen fans trying to decode his next album. “What we would like to see is rates not go up, because that would be an indication that the Fed is losing control,” said Thomas Martin at Globalt Investments. “If the Fed says they’re cutting and rates still go up, that’s a lack of confidence.” (No sh*t, Thomas).

Every S&P 500 sector was up on Friday, led by energy and tech, but only energy and utilities finished the week positive (because apparently, the best way to make money these days is to either drill for oil or charge people absurd rates for electricity). So, is this rally legit, or is it just a dead cat bouncing? With the Fed meeting coming up on Wednesday and Trump typing up a tariff threat on Truth Social this very second… I think we already have our answer.

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer