The market just got its teeth kicked in. The Dow Jones dropped 816 points this fine Wednesday, closing at a whopping price of 41,860.44. The S&P 500 tanked 1.61%, and the Nasdaq limped out with a 1.41% loss. “Probably because of Tariffs?” No sir. This was a reaction to a Treasury market that’s turning into a friggin’ horror show.

(Source: Giphy)

In short, the 30-year Treasury spiked to 5.08%, its highest level since the cursed days of October 2023. The 10-year is now sitting at 4.59%, reminding everyone that the “soft landing” narrative was a bedtime story for portfolio managers who still believe in Santa Clause. Meaning, investors are finally waking up to the reality that the U.S. deficit isn’t just a number in a PDF… it’s a time bomb. And this new budget bill floating around? It’s pouring gasoline on it.

The bond market is screaming that the cost of money is about to get more expensive… again. Which has traders pricing in the fact that the U.S. is going to have to issue even more debt to keep the lights on, and buyers are demanding higher yields to even pretend to care. Meanwhile, stocks didn't just slide… they got ejected. UnitedHealth cratered nearly 6% after a downgrade from HSBC and a report accusing them of paying nursing homes to avoid sending sick residents to hospitals. Also, small detail: they're reportedly under a DOJ investigation for Medicare fraud. Sounds about right.

(Source: Giphy)

Target was also down 5.2% today. Why? Because they cut their full-year sales outlook and blamed it on tariffs and the political blowback from scaling back DEI initiatives. So now they’ve pissed off both sides of the aisle, and their margins are getting eaten alive by macro garbage they can’t control. Additionally, Nike was down more than 4% because they’re raising sneaker prices by $2 to $10. To be fair, they’re leaving kids’ and Jordan prices alone… because even Nike knows better than to mess with the only part of their product line that still has cultural relevance.

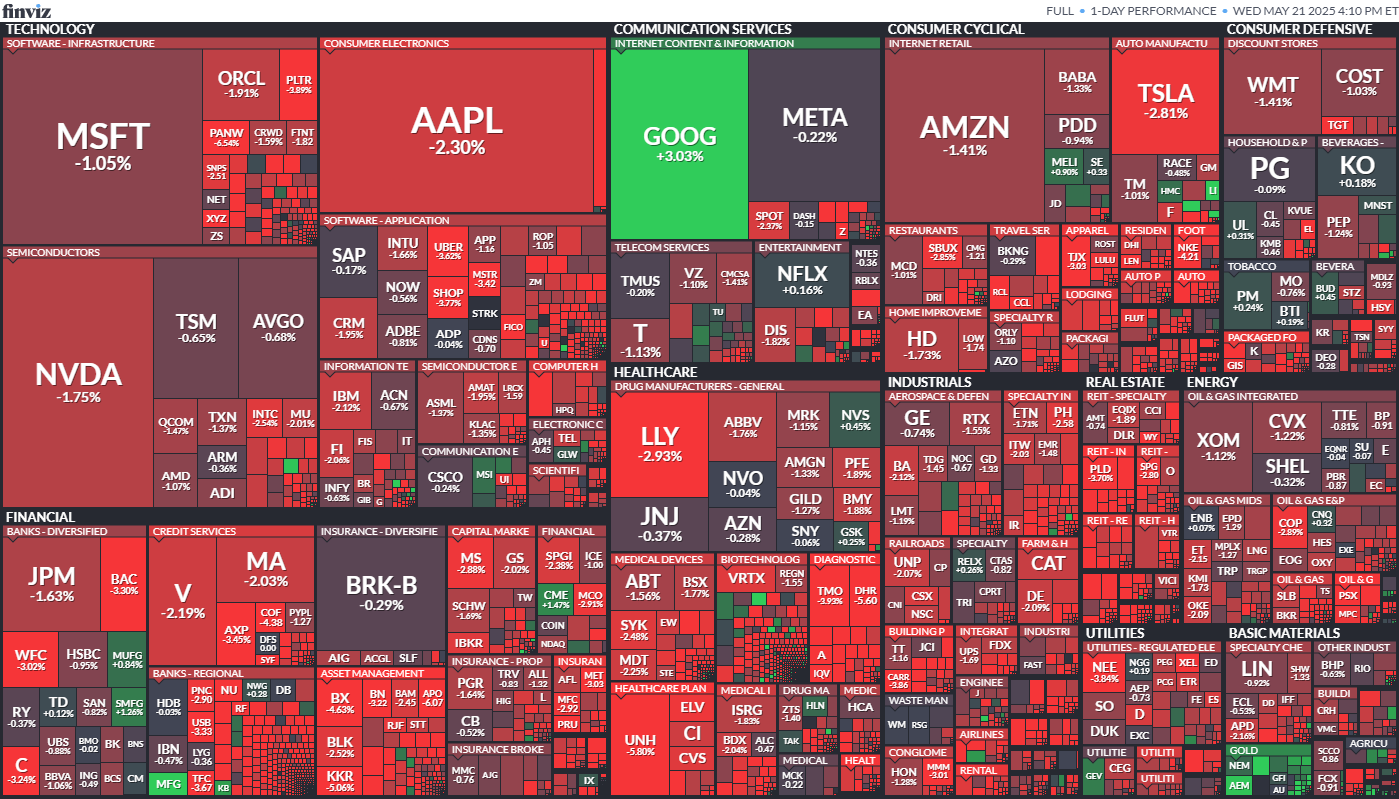

Oh, and tech didn’t get a pass either. Apple, Nvidia, and Tesla were all down 2%, with Microsoft, Amazon, Meta, and Broadcom red across the board. The only bright spot was Alphabet, up 3%, presumably because they’re taking a page out of Zuck’s AI glasses playbook. Spoiler: It’s Google Glass 2.0.

(Source: Giphy)

In the end, this was a horrific day to be in stocks. Treasury yields are screaming. The deficit is a joke. And consumer companies are flipping out. The worst part? Jerome Daddy Powell plainly stated he isn’t going to save us, and the government is officially broke. Greaaaat. Meaning, keep your eyes peeled for whatever chaos tomorrow brings us, and place your bets accordingly. Until next time…

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

Stocks.News holds positions in Meta, Apple, Amazon, Microsoft, Alphabet, and Tesla as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer