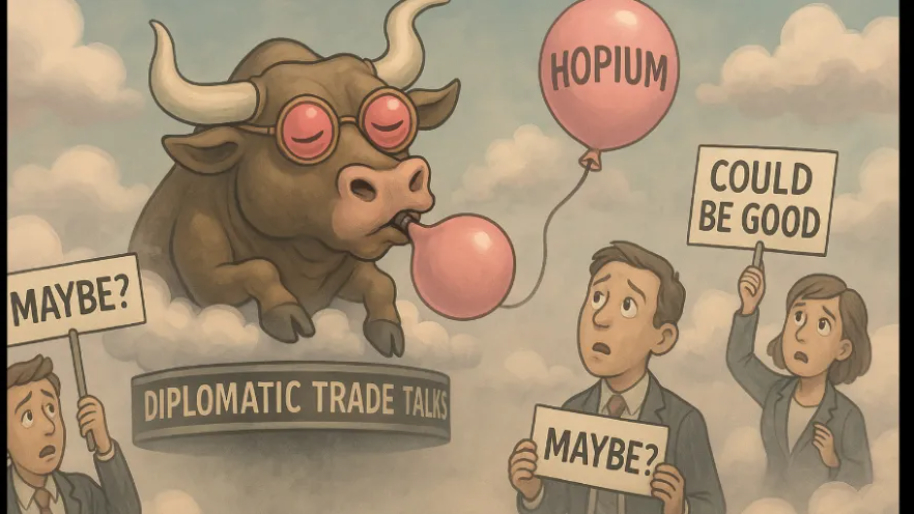

Apparently, all it takes for the S&P 500 to squeeze out three green candles in a row is a few bureaucrats in London promising to “work closely” on U.S.-China trade. Set aside your actual knowledge of geopolitics and just believe, d*mn it. Well the market sure does… because hope is a hell of a drug and nobody’s tested positive more often than Wall Street traders.

(Source: Giphy)

For starters, todays receipts are as follows: the S&P 500 closed at 6,038.81 (up 0.55%), the Dow dragged itself up 105 points for a modest 0.25% gain, while the Nasdaq got bricked up on a 0.63% gain, landing at 19,714.99. Translation: All this “progress” because U.S. Commerce Secretary Howard Lutnick flew to London, found a conference room with good lighting, and said things like, “Really, really well,”... which, presumably just means they haven’t started throwing staplers at each other yet.

This had traders, desperate for anything resembling good news, deciding this was all the excuse they needed to pile into chips. Intel went parabolic, soaring 8% on the day and becoming the S&P 500’s golden child for the session. ON Semiconductor and Micron both tagged along with 3% boosts, respectively.

Live look at Intel right now…

(Source: Giphy)

Additionally, oilfield services names like Halliburton and Schlumberger went full send (both popping 3.5% and 4%), along with APA Corp, and EOG Resources who also experienced 3% bangers. Oh, and housing stocks? Yeah, up and to the right. The iShares U.S. Home Construction ETF put in its fattest session since May (up 2%) with every single name in the basket closing green. For reference, Quanex Building and Dream Finders Homes led the charge with 6% gains, while Leggett & Platt shares looked downright perky for a company best known for making stuff you sit or sleep on.

Elsewhere in the circus, Tesla added 5.6% after its recent nightmare rally with Elon Musk vs. Special Guest Donald Trump last week. Topgolf Callaway, continued its delusional ascent after one board member took a loan out of his “F’ You Money” fund to drop $2 million on shares. Meanwhile, United Therapeutics was left sobbing in the corner, proving that biotech is still the most savage corner of Wall Street. Shares plummeted -15%.

(Source: Giphy)

For those of you who worship Michael Saylor and make internet money your entire personality, Bitcoin hovered at $109,900… just shy of its recent highs, while the 10-year Treasury yield ticked down to 4.47%. Which is good news, because at least my mortgage quote won’t look worse tomorrow.

Moral of the story here? The only thing the market hates more than bad news is no news, and right now, traders are happy to roll the dice on vague “progress” and diplomat photo ops. Also, keep in mind, the Nasdaq and S&P 500 are about 2.5% and 1.73% from their all time highs, so let’s just hope and pray somebody doesn’t say something batsh*t crazy to spoil it this week. Until next time, friends…

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

At the time of publishing, Stocks.News holds positions in Intel and Tesla as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer