You know that scene in The Big Short where Steve Carell’s character, Mark Baum, walks into the Vegas mortgage conference afterparty, and it’s a full-on circus… mortgage bros slamming shots, bragging about giving loans to strippers with five houses and zero income, convinced the housing market is bulletproof? And Baum just stands there, completely still, realizing he’s the only one with common sense in the room.

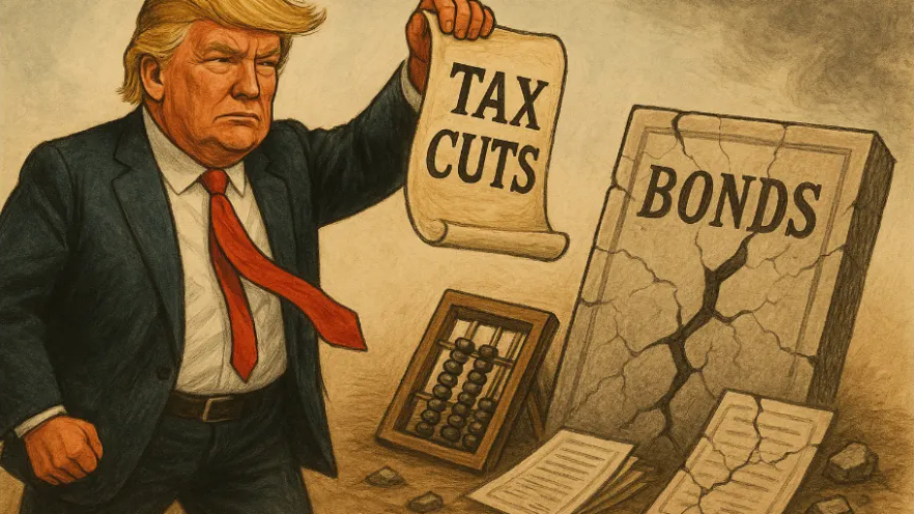

That’s what this feels like. Maybe not as apocalyptic (yet) but close.Trump’s $4 trillion tax-and-spend package narrowly passed the House with a 217–216 vote, and the market pretended they didn’t just watch fiscal responsibility get shoved into a wood chipper behind the Capitol.

The bill itself reads like a wishlist from two very different parties trapped in one man: sweeping tax cuts for individuals and corporations, a $1.2 trillion increase in defense spending, and no serious effort to pay for any of it. The Congressional Budget Office estimates the legislation will add nearly $4 trillion to the deficit over the next decade. And that’s assuming we don’t hit a recession or interest rates don’t spike further, two things that seem… increasingly likely.

The hilarious part for me? This is happening just as Trump’s new 10% universal tariff policy is lighting a fire under import costs. So we’re increasing spending, shrinking revenue, and choking off supply chains in one fell swoop. It’s a bit like trying to lose weight by eating more, exercising less, and locking the fridge.

Markets, somehow, ended the day in the green. The Dow climbed back 0.5% after a rough Wednesday, while the S&P 500 and Nasdaq nudged higher like nothing ever happened. But bond traders weren’t as chill… the 30-year yield spiked to 5.14%, a level not seen since the financial crisis, before retreating slightly. In other words, investors are preparing for the long-term consequences of funding tax cuts with internet money.

Speaking of internet money… just when you thought the week couldn’t get any weirder, Bitcoin ripped past $111,000. Why? Because 2025. Ethereum followed suit, rising on whispers of “institutional demand,” which at this point might just be code for “one hedge fund intern bought the dip.”

Adding even more to this crypto absurdity, Trump is hosting a private dinner tonight for the 220 biggest holders of his memecoin, $TRUMP. Yes, he made a coin. Yes, you can buy it. And yes, the top holders are now being rewarded with wagyu and networking at Mar-a-Lago Lite (aka. his Virginia golf course). Even some Republicans are criticizing the move, including Sen. Cynthia Lummis, who (while still a crypto fan) publicly said the whole thing gives her pause (interesting choice of words).

New data just dropped, and it’s official: short sellers have been getting destroyed. Since April 8, they’ve lost a collective $250 billion. Nvidia and Tesla alone were responsible for $19 billion of that damage, proving once again that betting against Musk is never a good idea (no matter how many times he postpones the Robotaxi). That’s because Nvidia is back in Wall Street’s favor, with the AI boom looking stronger than ever and expectations building ahead of its May 28 earnings. Tesla’s been climbing too, ever since Elon stopped cosplaying as a politician and started acting like he remembers he runs a car company.

Over in the lonely world of IPOs, Hinge Health made its debut at $32 and immediately popped to over $39. Investors clearly loved the pitch: “We’re a digital physical therapy app, but this time, we swear it’s different.” If you can’t tell, I'm not a huge fan.

If you work in solar sales, now might be a good time to start polishing that resume. Solar stocks just had one of their worst days on record after traders realized Trump’s new tax bill could rip out clean energy credits like a magician yanking the tablecloth off a fully set table… only this time, everything crashes to the floor. The Invesco Solar ETF dropped 8%, its steepest plunge in months. For anyone in renewables, the message is clear: start learning how to spell “ExxonMobil.”

Let’s end on a slightly less depressing note. Fed Governor Chris Waller offered a glimmer of hope, suggesting that rate cuts could still be in play later this year… assuming Trump’s 10% across-the-board tariff plan doesn’t derail the whole economy first. So that’s something to look forward to.

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer