The markets rallied on Tuesday because apparently, nothing keeps Wall Street happy like pretending uncertainty doesn’t exist. The S&P 500 clawed back 0.72%, the Nasdaq jumped a hefty 1.35%, and even the Dow managed to stumble its way into a 0.3% gain. Meaning, while today felt good—it almost feels more like a collective shrug from traders who’ve given up trying to make sense of whatever Trump’s tariff roulette wheel is spinning this week.

(Source: Giphy)

Outside of China slapping 15% of tariffs on coal, LNG, crude oil, farm equipment, and cars—and Trump's 2-minute “Who’s Your Daddy” fiasco with Mexico and Canada, the real star of the day was Palantir. Share’s catapulted 24% after posting fourth-quarter results that made analysts look like blindfolded dart throwers. Revenue surged 36% to $828 million, obliterating expectations, with U.S. sales jumping 52%.

Palantir CEO Alex Karp led hard into the AI narrative, dropping phrases like “center of AI revolution” as Nvidia piggybacked on the 1.7% frenzy for being in the same AI ecosystem. Meanwhile Tesla edged up 2.2% after getting absolutely rekt on Monday. Why? Because Trump decided to delay tariffs on Mexico for a month, and about 15% of the parts in a Model Y sold in the U.S. come from south of the border. That’s right—Elon’s empire dodged a bullet, at least for now. But the bigger issue is that since Tesla’s stock has been on a losing streak (down -4.58% MTD), investors are starting to realize that “full self-driving” is still a glorified beta test, not a magic money printer.

(Source: Giphy)

On the other hand, PayPal got smacked—down 13.17% after total payment volume rose 7%, but actual transactions fell 3%. In other words, people are still spending money, but they’re consolidating purchases instead of using PayPal for every little thing. Not exactly the growth story you want to see in a fintech stock that’s been struggling to compete with TikTok shop.

And finally, Spotify surged 13% because it added more premium subscribers than expected. Turns out, people will still pay to avoid ads, even in a world where every corporation is trying to nickel-and-dime them to death. The company topped revenue estimates, proving that even in a crowded streaming landscape, Spotify’s got enough of a grip on the market to keep growing.

In the end, AI stocks are still running the show, tariffs are being treated like background noise, and earnings season is exposing which companies can actually deliver versus those just coasting on vibes. But with that said, don’t get too comfortable after today’s rally—because if you haven’t learned yet, the second you think you have the market figured out—it punches you square in the face.

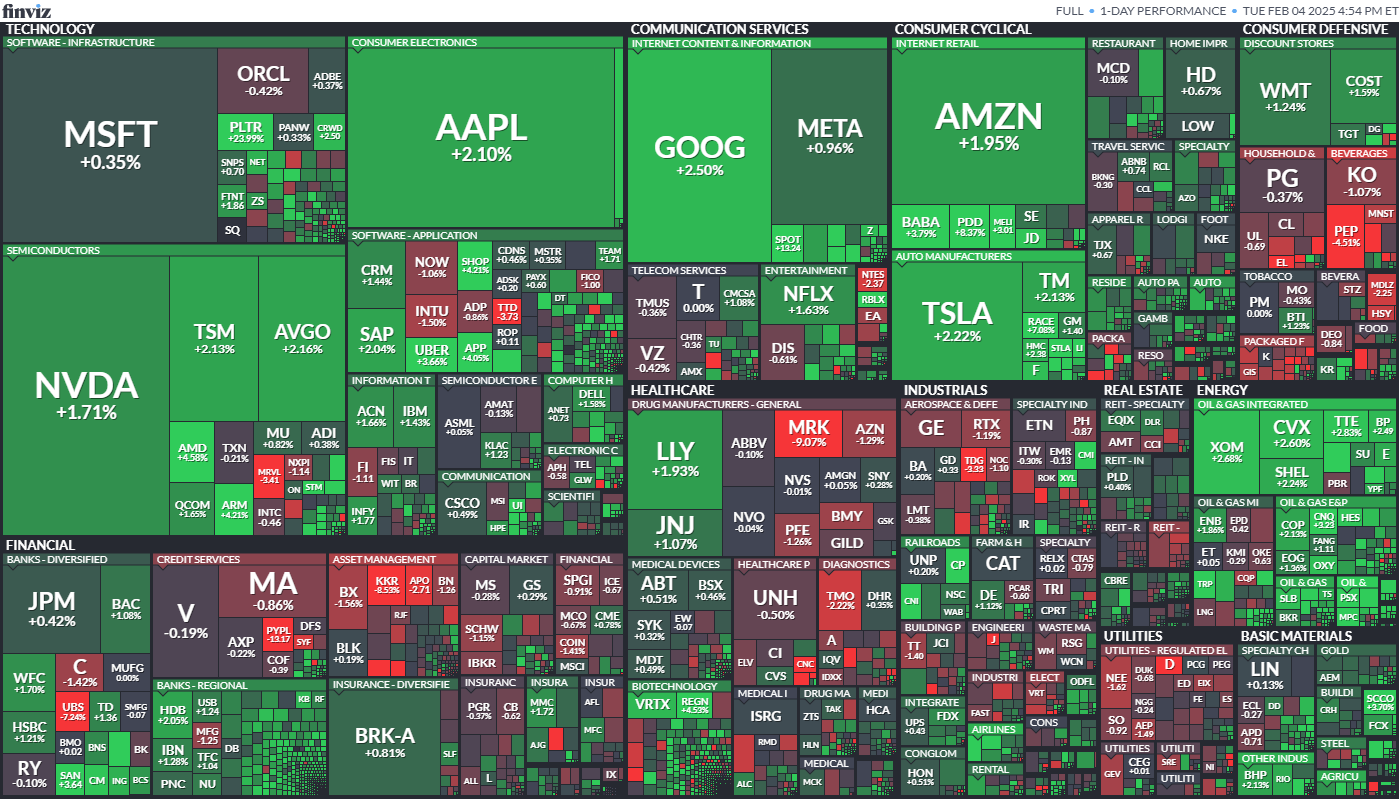

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

Stocks.News holds positions in Tesla as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer