Thank Gawd. If you woke up this morning fully expecting the market to continue bleeding out—well, you just got a gift from heaven. The Dow ripped higher by 619 points to close at 40,212, while the S&P 500 popped 1.8%. Meanwhile, the Nasdaq sprinted 2% into the weekend as all traders around collectively un-clenched after what may go down as one of the most violently bipolar weeks in market history.

(Source: Giphy)

And that’s not being dramatic. The VIX spike above 50 earlier this week, which is full-send “where’s my Xanax” levels, and yet, by Friday afternoon, the world decided everything was fine. Or at least, not an active dumpster fire. The VIX cooled to 37, which is still high enough to induce some heat flashes, but not quite “2008 remix” levels.

So what happened on this beautiful Masters Friday? Well, contrary to the celebrity death match between Xi Jinping and Trump earlier in the week, the White House mumbled something about Trump being “optimistic” that China wants a deal. Naturally, the market took that as gospel, as it should.

(Source: Giphy)

Meanwhile, corporate earnings kept rolling in, and the reactions were all over the place. Morgan Stanley crushed earnings (EPS of $2.60 on $17.74B revenue) but the stock barely budged. Wells Fargo missed revenue expectations and dropped nearly 2%, proving once again that no one gives a sh*t about “16% earnings growth” if you can’t hit the top line.

On the other hand, BlackRock posted a beat although their Commander and Chief, Larry Fink, mentioned we might already be in a recession. Shares went up 2% anyway, because of course. Gold stocks though? Well, they had one hell of a day. Newmont and Barrick both went full-on rocket mode, up 7–8%, presumably due to the fact that when tariffs cause havoc all over the globe, people start buying rocks (or they just really like listening to Jim Rickards).

(Source: Giphy)

Adding to the optimism, Apple clawed back 4% after getting slapped around all month. But still, traders are on the edge of their seats for when this pause ends. If that 145% tariff sticks and Apple is forced to make products in Arkansas, we are all going to feel it in our wallets. Fun.

In the end, this week was pure market whiplash. Volatility was on a whole other level as investors panic-sold, then panic-bought all within 72 hours. But still, even though everyone acted like all was well in the land of the free money and irrational exuberance today, we’re still in uncharted territory. So with that, let’s all enjoy the bounce over the weekend. For all we know, it may not last come Monday morning. Until next time, friends…

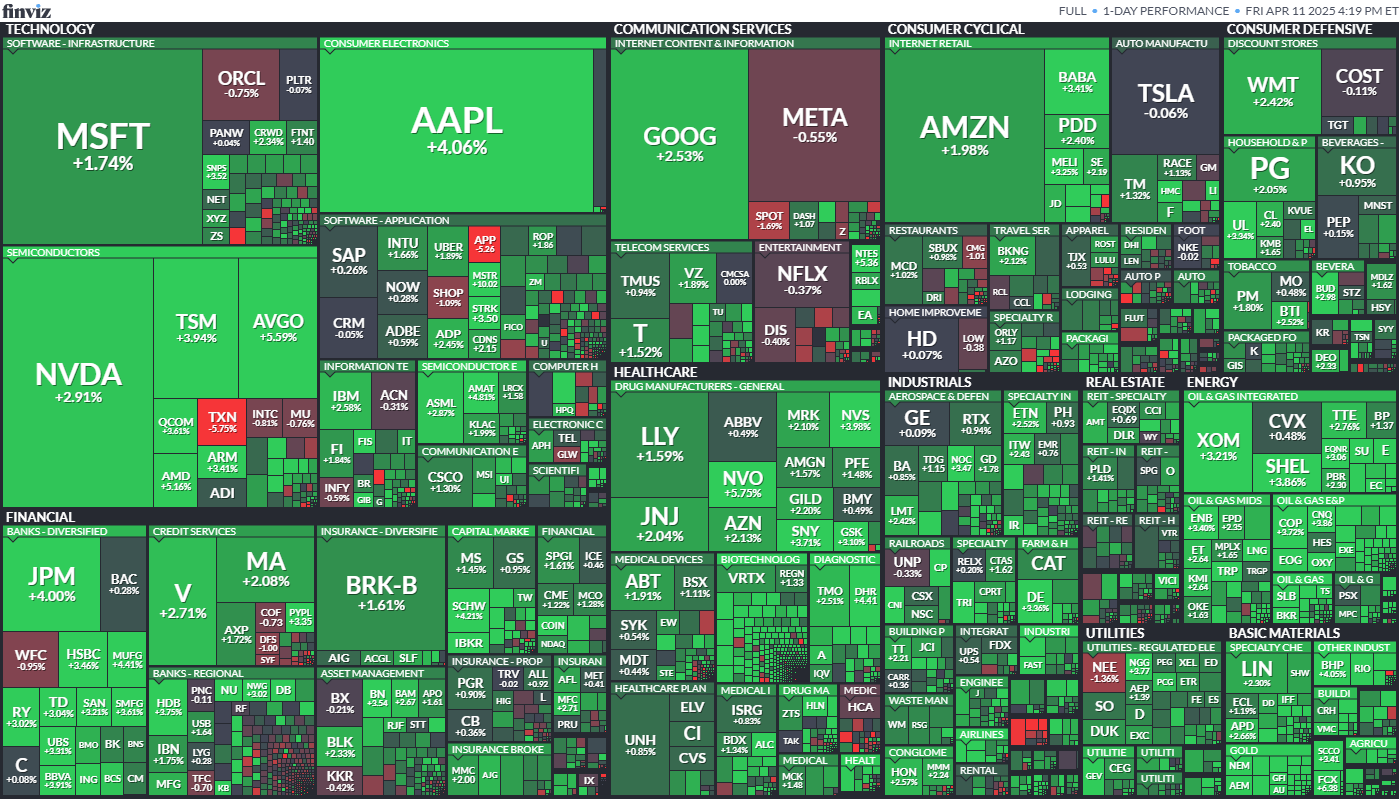

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

PS: Don’t fall for the narrative that nothing’s going up in this Trump tariff firestorm… that’s just noise. While the headlines scream doom and gloom, our Stocks.News Premium members are getting early alerts on stocks that explode 50%... even 100%+ in a single day. Every. Single. Week.

If you're sick of watching these moves from the sidelines, it might be time to get off the bench. With Premium, you’ll get two trade alerts a week, plus access to our Insider Trading Tool that tracks everyone from overpaid CEOs to your favorite Congress members magically buying before the news breaks.

Oh, and unlike Bloomberg, we don’t charge a small fortune to deliver actionable info. Their terminals might look fancy, but do they catch real-time squeeze setups and insider buys before they rip? Yeah… didn’t think so. Click here to become a Stocks.News premium member now.

Stocks.News holds positions in Apple as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer