The Dow came, it saw, and it friggin’ won as the Granddaddy index steamrolled 443 points higher on this fine Friday. Apparently, all it took was a jobs report that didn’t look like a crime scene… US payrolls were supposed to climb by 125,000, but clocked in at 139,000. Not exactly Michael Jordan numbers, but enough to make Wall Street forget about Elon’s foul mouth and Trump’s anger management faults.

(Source: Giphy)

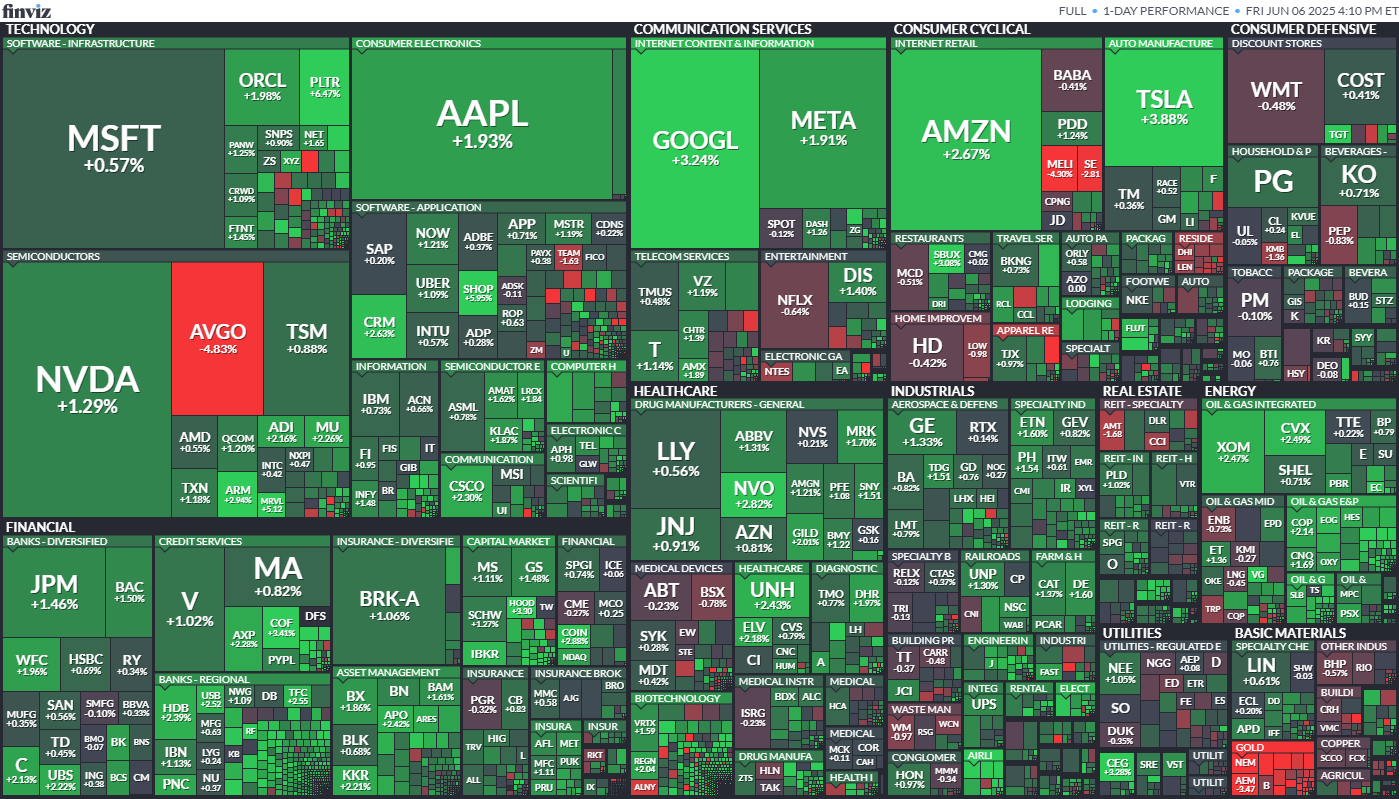

Additionally, the S&P 500 smashed through 6,000 for the first time since February, and the Nasdaq rose 1.2%, mostly because Tesla finally stopped bleeding long enough for people to remember it’s really just a meme stock that trades off its CEO’s word salads. As for Nvidia, Meta, and Alphabet, shares rose 1.2%, 1.91%, and 3.25%, respectively. Amazon and Microsoft also played wingmen with both stocks hitting 2% gains on the day.

Meanwhile, Broadcom managed to fumble the bag even after beating earnings. Revenue came in at $15 billion, slightly above the $14.99B consensus, while EPS hit $1.58 for another beat. And yet, did that matter? Nada. Wall Street wanted a guidance raise high enough to make Snoop Dogg buzzed and instead got a face-plant. Cue the 5% sell-off on the day.

(Source: Giphy)

Elsewhere, Palantir rose 6%, leading the S&P 500 as Marvell and Arm also posted 5% and 3% gains. On the other hand, Lululemon got absolutely decapitated after trimming its full-year outlook. Spoiler: there’s a limit to how many $128 leggings people will impulse-buy, even in this market. LULU’s quarterly numbers beat, but guidance missed, and now shares have gotten smoked with a -20% plunge.

For the macro diehards, the 10-year Treasury yield spiked to 4.51% (from 4.39%), meaning everyone aged 22 and up are making “forever renting” their entire personalities. Oh, and the dollar index jumped 0.4%. Bigly. In the end, despite the few bad apples (Broadcom, Lululemon, among others), today was pure market FOMO.

(Source: Giphy)

One decent jobs report, and suddenly everyone thinks Jerry interest rates is going to hand out free rate cuts and happy endings backrubs. Under the surface though, the market’s still on edge, but for now, as long as the economy’s not actively catching fire, it’s risk-on and logic-deficient. Of course, it’s 50-50 whether Monday will give us a masterclass on bi-polar disorder or not, but in the meantime, enjoy the gains this Friday and have a fantastic weekend. Until next time, friends…

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

Stocks.News holds positions in Tesla, Microsoft, Meta, Amazon, and Alphabet (Google) as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer