The S&P 500 just officially entered correction territory, and you can single handedly thank the tariff wars for that. On Thursday, the S&P 500 dropped 1.39% to 5,521.52, now sitting 10.1% below its all-time high. The Dow Jones Industrial Average tanked 537 points (-1.3%), marking its fourth straight day of losses, and the Nasdaq got absolutely smoked (-1.96%) as Tesla and Apple sank deeper into a hole.

(Source: Giphy)

In short, Trump took to Truth Social to declare a 200% tariff on all alcohol imports from the EU, because, apparently, if Europe wants to tax our whiskey, he’s going to go full scorched-earth on their wine and champagne (a.k.a. Undefeated since 1776, baby). Wall Street took one look at this and collectively yeeted everything.

The receipts are as follows: The S&P 500 is down 4.3%, meanwhile the Nasdaq and Dow have cratered 4.9% and 4.7%, respectively (worst week since June 2022). The Russell 2000 on the other hand, has no bull in sight as it has plummeted 19% from its highs.

(Source: Giphy)

In the corporate world, Apple is getting absolutely wrecked—down 12% this week alone, making this its worst week since March 2020—somebody give Cook boy some milk! For more context, the stock has fallen 11 of the last 13 trading days losing nearly $776 billion in market cap since December. Bigly.

Meanwhile AI stocks are getting terminated with Palantir losing -4.8% and Super Micro down -8%, while Nvidia stays flat. Tesla, on the other hand, is continuing its brutal descent with a -3% slip, down 40% in 2025 already. Additionally, American Eagle Outfitters dropped 4.1% after admitting that “less robust demand and colder weather” are crushing sales. Translation: Consumers are broke, and no one’s in the mood to buy overpriced denim jackets.

(Source: Giphy)

However, While everything else burned to the ground, Intel popped 14.6% after naming Lip-Bu Tan (not affiliated with the Wu-Tang-Clan) as its new CEO. Love to see it. Bottom line to the day is that until there’s some clarity on trade policy (or a Fed rate cut to calm things down), expect this sell-off to keep getting worse. Until next time…

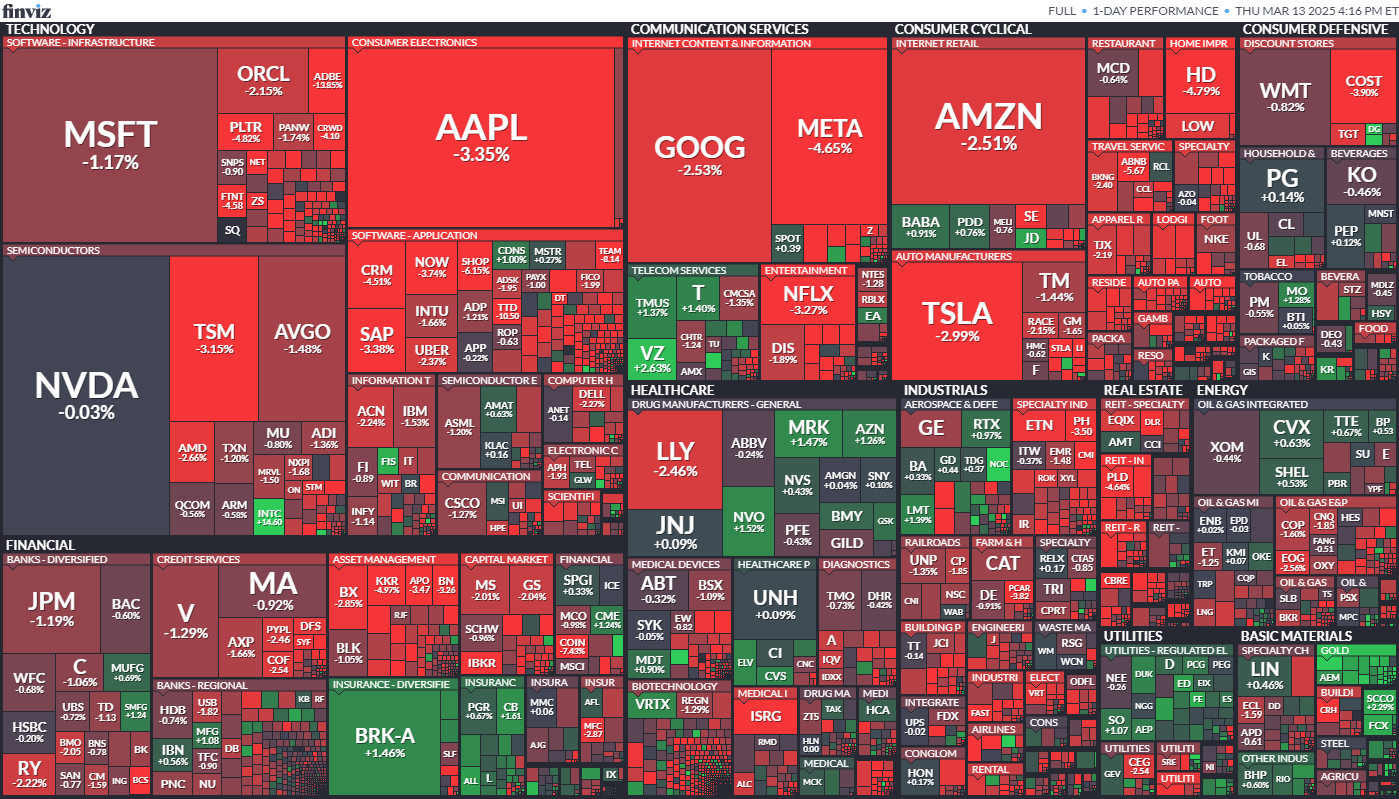

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

P.S. Robert Smalls, a big swingin’ Managing Director for StockBridge dumped $27 million in a little known aerospace company on March 10th. In less than 24 hours, we dropped a deep-dive analysis exclusively for Stocks.News premium members, breaking down the why, what it means, and how to play the aerospace sector moving forward—all while retail investors were still wiping their tears from last week's losses. Meaning, if you aren’t in the Stocks.News premium club, well, it goes without saying that you’re missing out. Don’t miss out. Click here to join ASAP…

Stocks.News holds positions in Tesla, Intel, and Apple as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer