“Don’t worry, it’s just a phase” - Silver heads sounding a lot like crypto mouth breathers today…

Well friends, the market woke up today and chose violence. Specifically: violence against tech, vibes, and anyone who thought December was going to be a straight line up and to the right.

(Source: Giphy)

In short, after flirting with record highs last week, the S&P 500 decided it was done pretending and slipped 0.35%, while the Nasdaq did its usual thing and fell harder (-0.50%) because that’s where all the hope lives. The Dow tagged along, down about 250 points, mostly out of solidarity. The good news is, nothing broke or imploded.

Instead, today was a classic year-end behavior where the Belfort’s of Wall Street start cleaning up their colossal f*ck ups before performance reviews, trimming winners, and pretending all the risk was in the name of fiduciary “risk management.” That said, tech took the brunt of it, because of course. Nvidia (-1.21%) gave back a chunk of last week’s gain, Palantir (-2.40%) cooled off, Meta slipped (-0.69%), Oracle (-1.32%) got hit… a.k.a. The usual suspects.

(Source: CNBC)

Meanwhile, silver drank a fat cup of concrete today (read: faceplanted). After ripping to $80 an ounce overnight… a sentence that would’ve sounded fake 18 months ago… silver reversed hard, down more than 6% on the day. The iShares Silver Trust dropped around 7%, reminding everyone that parabolic charts don’t come with seatbelts. But don’t you worry silver bag holders, the currency John Wick built is still up something like 150% this year, which means this wasn’t a collapse. It was a “congratulations to anyone who bought before Twitter discovered it” moment.

Elsewhere, the market did that thing where it quietly tells you where money is rotating to. For instance, Chubb (+.036%) casually hit all-time highs, because boring insurance stocks don’t need narratives or AI copilots. Capital One (-1.42%) also tagged a fresh high earlier in the session before giving some back… a reminder that credit card companies thrive when everyone else is in America is following the Dave Ramsey diet (see: beans and rice). And then there was DigitalBridge Group, which jumped nearly 10% after SoftBank decided it wanted more data center exposure and just… bought the whole thing for $4 billion. Masayoshi Son saw “AI infrastructure” and said “yeah, I’ll take that.”

(Source: Giphy)

So yeah, today twas the day of “rotation". Not a crash or a top… but a tradition after a market ran hot, hit records, and needed to exhale (with a side dose of ear-end books closing and nobody wanting to explain why they chased Nvidia at the highs again LOL). Until next time, friends…

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

Market Gossip

> Trump threatens to “knock the hell” out of Iran if they build weapons (CNBC): “Catch me outside, how bout that?” - Donnie Politics

> The 11 Big Trades of 2025: Bubbles, Cockroaches and a 367% Jump (Bloomberg): Extreme FOMO loading…

> Copper Rally Boosts Zambia’s Kwacha as Africa Gains from Commodities (Bloomberg): Hey silver heads, too soon?

> You’ve been targeted by government spyware. Now what? (TechCrunch): Sh*t…

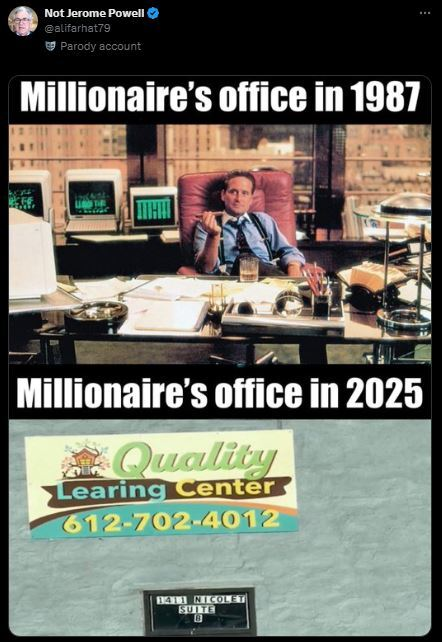

Meme of the Day

At the time of publishing, Stocks.News holds positions in Meta as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer