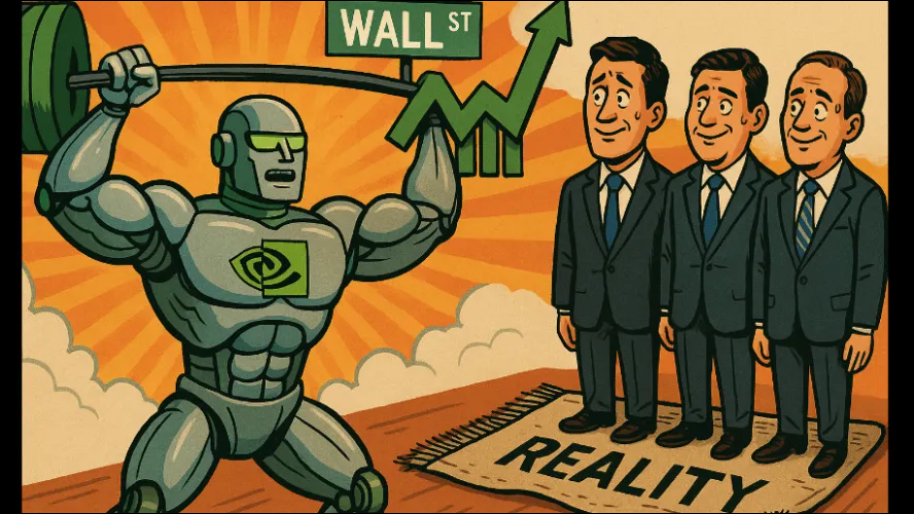

If Nvidia is the G.O.A.T. (Greatest of All Time) of the AI revolution, then their recent earnings were absolutely biblical. And naturally, the market reflected it in today’s price action (kind of). Both the Nasdaq and the S&P 500 clocked in an easy 0.4% gain while the Dow reported a gain of 0.3%.

As for Nvidia though, it mooned 3%, and basically set the tone for the entire AI market. Miss earnings? The Nasdaq gets thrown out of a moving car. Beat by a country mile, like yesterday? The market buys every chip-adjacent stock in sight and prays Jensen doesn’t announce “he’s retiring”. Meaning, Obi Huang Kenobi, once again cemented the fact that AI is less of a trend and more a full-blown cult on Wall Street, with every hedge fund manager and a pension fund stepping over themselves as soon as those green bars print.

But, that’s Nvidia. On the other side of the aisle of GPU-fueled FOMO, HP did its best impression of a dying moden noise, tanking -8% after slashing its outlook thanks to… *checks notes*... tariffs. Shocker. Best Buy followed suit with a -7% plunge, proving that selling $2k TVs nobody wants during a trade war isn’t exactly a license to print money.

(Source: Giphy)

Meanwhile, the tariff plot thickened courtesy of the U.S. Court of International Trade, which straight up told Trump he overstepped with his “reciprocal” tariffs. The court vacated the orders, giving Wall Street lawyers a reason to expense another round of martinis. The market loved it for about five minutes, then realized the entire tariff situation is still dumb and unpredictable, especially when the courts are basically saying foreign countries can shaft us… but Trump can’t shaft them. Sounds legit.

But, but, but… hold up! To everyone’s ungodly surprise, Boeing finally posted a green candle, thanks to CEO Kelly Ortberg announcing that China’s letting U.S. jets land again. Boeing shot up 3%, even hitting a 52-week high, while promising to ramp up Max production to 47 per month. Bigly.

(Source: Giphy)

Over at Salesforce, investors yeeted shares south after a supposedly “good” quarter. As it turns out, beating estimates isn’t enough if you keep buying companies like they are collectibles… (read: Informatica buyout), and Wall Street hates nothing more than an exec on an M&A bender. Case in point: RBC downgraded them for “execution risk”, and shares got paddled accordingly. Oh, and C3.ai had its own little meme spike after a smaller-than-expected quarterly loss and a revenue win. Shares melted up 23%, because… yes.

As for the 10-year Treasury… it slid 4.43% (down from 4.48% yesterday but still hovering in “mortgage rates will destroy your soul” territory). So yeah, there’s that. In the end, Nvidia is still king and tariffs are still clown shoes. Meaning, nobody in their right mind knows what’s going to happen tomorrow. It could be great, it could be ugly. So place your bets accordingly, and stay safe out there, friends. Until next time…

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

Stocks.News does not hold positions in companies mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer