Thank God. The Dow ripped over 1,000 points on Tuesday, snapping a four-day losing streak and reminding everyone just how stupidly reactive this market can be when it hears the right words whispered in the right rooms. The spart this time? Treasury Secretary Scott Bessent told a bunch of suits behind closed doors that the U.S.-China trade war might cool off. That’s it. That’s the catalyst. Not an actual deal. Not a rollback of tariffs. Just a vague suggestion that maybe, possibly, someday, things won’t suck as much.

(Source: Giphy)

Naturally, Wall Street, the desperate addict it is, mainlined that hopium straight into its bloodstream. The Dow closed up 1,016 points. The S&P followed, up 2.5%, while the Nasdaq finished +2.7%. In all seriousness, today was a full-blown melt-up. A.k.a. The kind of day that makes CNBC anchors say “Hallelujer” and hedge fund managers suddenly love their wives again.

At one point, the Dow was up more than 1,100 points before pulling back slightly (not because anything meaningful changed, but because the market realized it might be getting ahead of itself… again). But alas, Bessent’s quote, which just so happened to occur in some backroom JPMorgan investor lunch orgy, was that “no one thinks the current status quo is sustainable.” Additionally, the guy said that if the U.S. signs something “in two or three years” that looks half-decent, he’d call that a win. Two or three years. Meanwhile, the market heard “de-escalation” and went full Pavlov’s dog.

(Source: Giphy)

Meanwhile, Tesla short sellers are having the time of their lives. They're up $11.5 billion this year. Tesla stock is down 44% in 2025 alone, and short interest is up 15%, with another 10 million shares sold short. If you’re wondering how Elon’s doing, he’s probably challenging someone to a Diablo slap fight to blow off some steam. Elsewhere, Danaher and 3M both posted earnings beats, which is great if you're into watching legacy industrials quietly outperform while everyone else burns. Danaher beat on both revenue and EPS, sending shares up 5%. 3M jumped 8% after also topping expectations.

Not to be out done, CoreWeave also jumped 7% after analysts started slapping buy ratings all over it. Good stuff. Now with that said, was this really a rally? Especially since it was built off the backs of someone rubbing shoulders with other powerful men just to make the afternoon less depressing?

(Source: Giphy)

I mean the same sh*t that was tanking the market last week (read: tariffs, inflation, geopolitical chaos, and the ever-present threat that the Fed might actually do its job), is still very much here. Nothing got solved today. All we got was a vague promise of “maybe” someday,” and Wall Street took that as gospel. And guess what? Tomorrow, we are one bad headline away from the market's projectile vomiting chaos all over us again. So yeah, keep your head on the swivel friends and place your bets accordingly. Until next time…

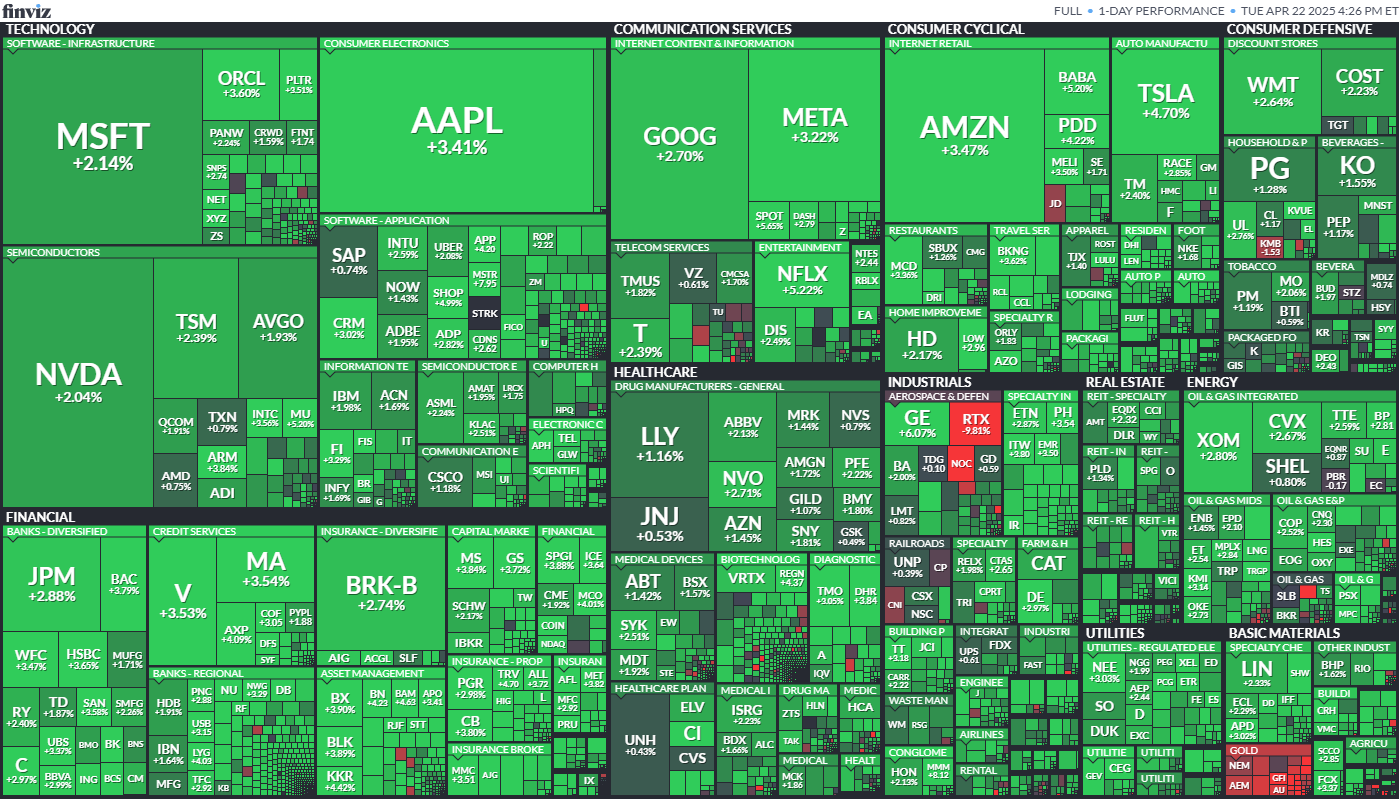

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

P.S. Oh, I’m sorry, I didn’t know you liked getting rekt. Let’s face it, retail investors get the short end of the stick all day everyday. It’s the smart money’s world, and we are just living in it–only useful when it comes to liquidity purposes in the market. Meaning, if you’re as pissed off as I was when I found out Milli Vanilli was lip syncing the whole time, then it’s time to go from investing blind, to investing smart. Luckily for you, the key is right here as a Stocks.News premium member. Click here to see exactly how our premium members are printing while others quake in the face of today’s market chaos.

Stocks.News holds positions in Tesla as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer