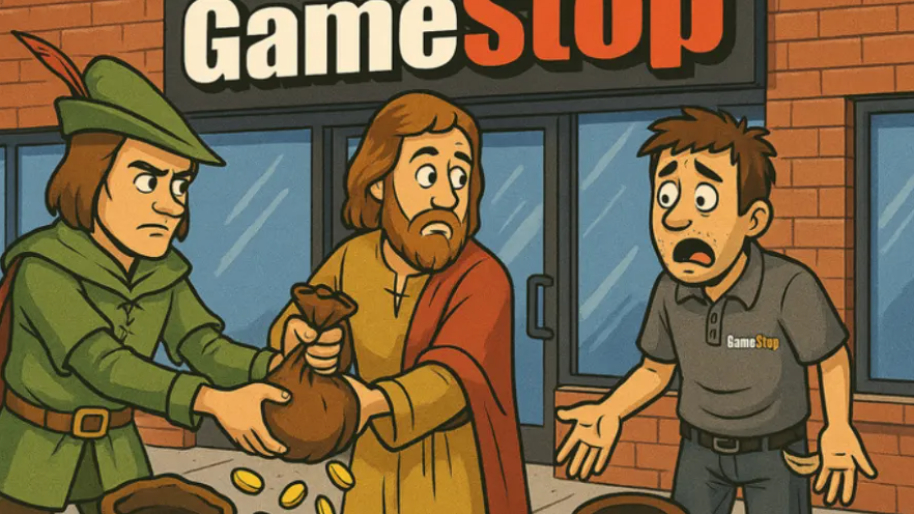

I’ve gotta hand it to them… GameStop’s first move this week actually made a lot of sense (for the position they were in). On Tuesday, they basically said, “Let’s stop pretending we sell video games and just become Michael Saylor,” hinting that Bitcoin was now the company’s true north star. The whole “digital transformation” thing took a backseat to let’s just make buying Bitcoin our entire business model.

Honestly, I don’t blame Ryan Cohen… if I were backed into a corner by a dying retail model and a bunch of Reddit memes, I might’ve done the same. That cryptic photo he posted with Saylor months ago? Turns out, it was a perfectly timed breadcrumb for the big reveal. And when the announcement dropped, shares jumped 16%. It was meme magic.

Then today came in like a wrecking ball. GameStop followed up with part two of the plan: raise $1.3 billion through convertible senior notes… and use THAT money to buy Bitcoin (in their defense, where else were they gonna get the money?). That’s when things went off the rails. Wall Street and reddit diamond hands clearly didn’t like the idea considering the stock tanked over 24%, erasing nearly all of the prior day’s gains, and then some.

That chaos spilled into “Indexland,” where things weren’t much better. The Dow dropped 114 points, the S&P 500 barely tripped 0.1%, and the Nasdaq bounced like a pinball before closing down 0.2%. Trump’s announcement yesterday of 25% tariffs on all foreign-made cars didn’t help… especially with a coming April 2 deadline and threats of even “much larger” penalties for the EU and Canada.

Over at the Fed, Jerome Powell is still clinging to the narrative that inflation driven by Trump’s new tariffs will be “transitory.” (Yes, the same word he used back in 2021… right before inflation hit 9.1%.) But not everyone on the team is buying it. St. Louis Fed President Alberto Musalem said this week that while Powell’s optimism is noted, the “scope and unpredictability” of the tariffs could create lasting price pressures… especially if trade partners retaliate.

That makes Friday’s PCE report (a.k.a. Powell’s favorite inflation metric) a potential landmine. Last month’s 2.4% reading already sat above the Fed’s 2% target, and if this month comes in hotter, kiss any springtime rate cut dreams goodbye. A cooler print might keep the soft-landing narrative alive (for another week, at least).

If you're hoping to buy a house anytime soon, don’t get your hopes up. Mortgage rates are still glued to 6.7% for the third straight week. (So unless you're paying cash, you might want to ask BlackRock for a discount before signing your new lease with the 10% rent hike.) Good luck with that.

Auto stocks were among the hardest hit. General Motors tumbled 7%, Ford lost 3%, and Stellantis slipped 1% as investors started pricing in supply chain chaos and higher sticker prices. Tesla, on the other hand, rose 2%, since all its U.S.-sold vehicles are made in Fremont and Austin.

And while everyone was yelling about tariffs and Bitcoin, gold kept quietly doing its thing… climbing to another all-time high at $3,060 per ounce. It’s now up 17% this year. Bank of America thinks it could go as high as $3,500 within 18 months if geopolitical tension, central bank hoarding, and economic weirdness keep piling up. (Which, based on current events, feels like a safe bet.)

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer