Alright, I swore we wouldn’t make today all about Trump’s tariffs… but here we are, stuck in what feels like Groundhog Day: Trade War Edition. So, before we relive the same tariff drama for the hundredth time, let’s switch things up… Big Pharma’s got a fresh new scheme cooked up, and trust me, it’s a doozy.

Novo Nordisk just took a long, hard look at Hims & Hers and decided, “Yeah, we’ll have some of that.” They’re launching a direct-to-consumer pharmacy for Wegovy, their weight-loss blockbuster that’s basically the Michael Jordan of appetite suppression. No more pleading with insurance companies or risking your life with some back-alley compounding pharmacy. Novo’s going straight to the people… lowering retail prices by 50% and cutting out the middleman. (How generous… considering they were price-gouging to begin with.) Wall Street, of course, loved the move, giving Novo a nice 3% shot in the arm.

Over in “Indexland”... the stock market caught a break after Trump decided to delay auto tariffs on Mexico and Canada. (A rare case of "I'll deal with it later" actually helping someone.) The Dow climbed 1.2%, the Nasdaq rose 1.3%, and the S&P 500 added 1.1%, all bouncing off multi-month lows. Ford, GM, and Stellantis all partied like they’d just dodged a firing squad (because they kinda did. Stellantis led the charge, shooting up 8%, but let’s not kid ourselves) once the 30 days are up, they’ll be back to crying in da club.

Of course, before investors could get too comfortable, the labor market decided to play the role of Johnny Raincloud. ADP reported that private-sector job growth came in at a pathetic 77,000 for February, a steep drop from January’s 107,000. If Friday’s jobs report flops, Jerome Powell might have to channel his inner Harry Potter and pull out his magic rate-cut wand sooner than expected.

Oil prices also fell, with WTI crude dropping 3% to $65 and Brent slipping below $70. OPEC is feeling generous and decided to crank up production while demand remains, well… questionable. (Gotta love a supply-and-demand mismatch.) Energy stocks, predictably, went down with it.

Over in semiconductors, things got pretty chippy if you ask me (ok, I’ll stop). Trump called the CHIPS Act a “horrible, horrible thing,” presumably because semiconductor companies aren’t spending their government handouts fast enough (The irony of a politician complaining about slow government spending is… exquisite.) Intel, which recently pocketed $7.9 billion in federal funds, saw its stock drop 4% on the news, as investors started wondering whether future funding could be at risk.

Speaking of things imploding, CrowdStrike got humiliated (down 10%) after issuing a disappointing revenue forecast. The cybersecurity firm is still trying to wash out the lingering stench from last summer’s software meltdown that grounded flights, wrecked IT systems, and racked up $73 million in damages. Hard to convince new clients you’ll “protect their data” when your last big headline was, well… setting everything on fire.

But hey, not everyone had a terrible day. Royal Caribbean managed to moonwalk through Trump’s tariff tantrums, thanks to an upgrade from Loop Capital. The analysts gave a $250 price target on the stock, confident that people will continue to overpay for watered-down cocktails on a floating shopping mall.

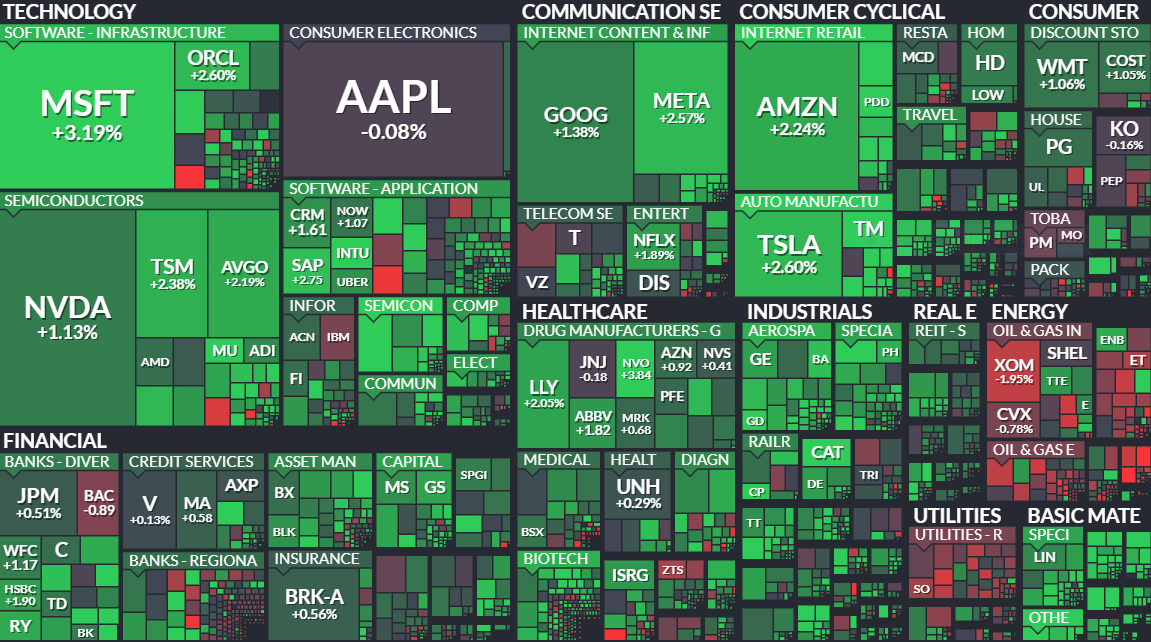

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer