Yesterday we talked about how the next round of economic data could either steer this market forward or send it skidding into a ditch… especially with the bears already foaming at the mouth over Trump and Xi’s awkward trade-war situationship. But surprise, surprise… the April JOLTS report came in swinging. Job openings jumped to 7.39 million… right as tariffs were ramping up. So either businesses didn’t notice, or everyone’s just ignoring it and pretending everything’s fine (I think you know the answer).

The S&P 500 rose 0.6%, the Dow added 247 points, and the Nasdaq tacked on nearly 1%... helped by another breakout day for Nvidia, which gained over 3% and leapfrogged Microsoft again in market cap (congrats, Jensen, you’ve earned it). Broadcom and Micron chipped in too, both jumping over 2%. That said, not everyone’s so rosy. The OECD cut its U.S. growth forecast to 1.6% for 2025, down from 2.2%, blaming (you guessed it) tariffs and trade chaos. So pretty much just Trump. China’s factory activity also hit a post-2022 low. After their government accused the U.S. of violating the trade truce after Trump ramped up tariffs on steel to 50%.

Still, traders seemed more focused on the possibility of a Trump–Xi phone call this week, which Dan Ives called “bullish for relations.” But just remember, this is the same guy who was pounding the table on Zoom at $400, so take it with enough salt to rim a margarita glass. Over in Washington, the White House is demanding every country cough up their “best offers” on trade by tomorrow. It’s a worldwide version of Deal or No Deal… but the banker is yelling in all caps and threatening 100% tariffs if he doesn’t like your suitcase.

Earnings season might be limping toward the finish line, but a few names decided to go out with fireworks. Dollar General soared 15% after smashing expectations and hiking its forecast (the biggest single-day jump in its history). Bumble, unexpectedly, got dumped… hard. The stock slid 4% after JPMorgan downgraded it, citing slowing growth. And Meta’s deal to buy 1.1 gigawatts of nuclear energy sent Constellation up 9%.

Speaking of legacy empires, UBS just trimmed its price target on Berkshire Hathaway to $591, citing lower expected investment income and fewer buybacks post-Buffett… though they’re still keeping it rated a Buy. ($147 billion in cash and a utility empire still go a long way, even without Warren at the wheel.)

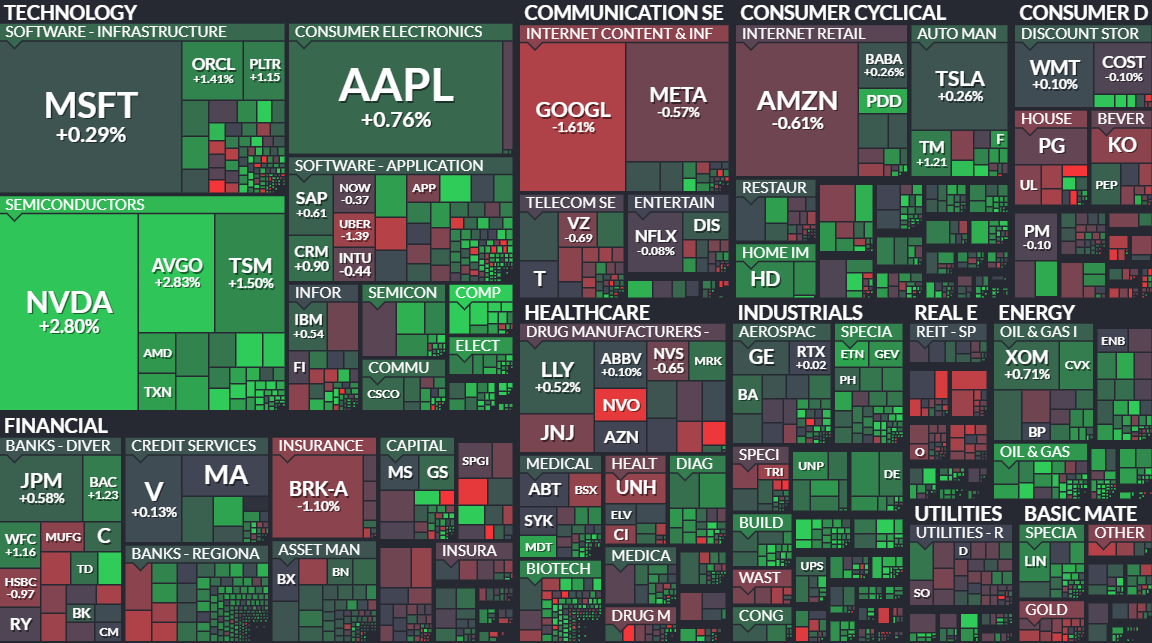

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer