Well, that escalated quickly. Friday was one of those days where the market checks you into a group therapy session and has chain-smoking in the corner. The S&P 500 took a 2% nosedive—its fifth red week out of the last six—and the Dow dropped 715 points like it had a brick in its pocket. The Nasdaq? A full-on 2.7% faceplant.

(Source: Giphy)

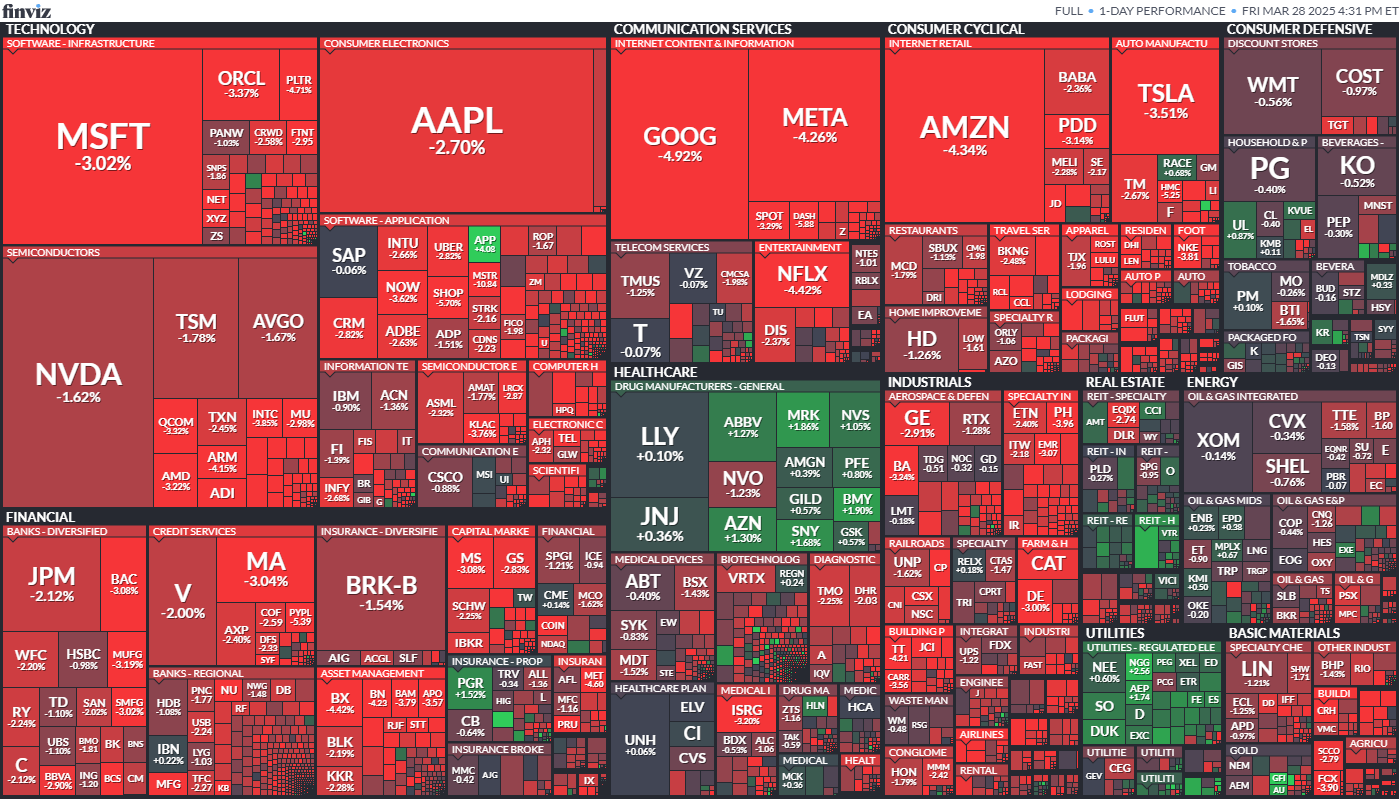

Spoiler: There was no profit-taking to be seen today. Just a market-wide “everything sucks, sell it all, ask questions later” bloodbath like we’ve been getting accustomed to. But what sparked the mass exodus this time? Well, look no further than deteriorating consumer sentiment, inflation that refuses to die, and a slowing economy that definitely isn’t “landing soft”.

Oh, and of course tariffs–which we already know. But the one who took the brunt of the force this Friday? Lululemon. Simply put, the place where rich kids go to learn about “hard work”, got absolutely slaughtered, down 14.2%, even after beating earnings. The problem? CEO Calvin McDonald warned that shoppers are spending less because people don’t want to drop $128 on leggings when they’re wondering if they can still afford eggs.

(Source: Giphy)

Additionally, Oxford Industries (aka Tommy Bahama and Lilly Pulitzer’s parent company) also beat expectations and still got punched in the face—down 5.7%. CEO Tom Chubb actually said the quiet part out loud: consumer demand started tanking in January and got worse in February. Buuut, it wasn’t just retail here. Delta Airlines plunged -5%, while Caesars Entertainment also melted -4%. Dominos Pizza burned the oven with a -5.1% loss, while Big Tech got obliterated.

Alphabet tanked 4.9%, Meta and Amazon dropped 4.3% each, and the AI trade that’s been propping up the market like it’s on performance-enhancing drugs finally blinked. All those stocks that ran way hotter than their actual revenue growth? They’re now realizing gravity still exists.

(Source: Giphy)

Oh and just to twist the knife a little deeper, U.S. markets are now officially underperforming most of the world. According to Oppenheimer, the S&P 500 ETF (SPY) is down 3% YTD, while the average country ETF is up more than 8%. Let that sink in. America’s not just losing—it’s getting dunked on by Latvia.

Meanwhile, the handful of winners were the boring-a$$, recession-proof names. Utilities like American Water Works actually went up (+2.2%), which tells you everything you need to know. When investors start piling into water companies, it means they’ve stopped believing in hope and started prepping for the economic apocalypse.

(Source: Giphy)

So yeah, Friday sucked. And unless Jerome Powell drops from the sky with a rate cut and a parachute full of cash, this might just be the new normal for a bit. Meaning, if you’re still bullish, go touch some grass. If you’re short, congrats—you’re finally the main character. And if you’re just watching from the sidelines? Well, you’re probably smarter than all of us. Until next time, friends…

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

P.S. Just when you thought our beloved congressmen couldn’t get any greasier, one Republican lawmaker decided to YOLO $175k into a stock… right before a major FDIC announcement hit. Lucky timing? Insider edge? You be the judge. We broke it all down inside our recent Stocks.News premium article… click here to check it out ASAP.

Stocks.News holds positions in Alphabet (Google), Meta, and Amazon as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer