And for that reason, I’m out.

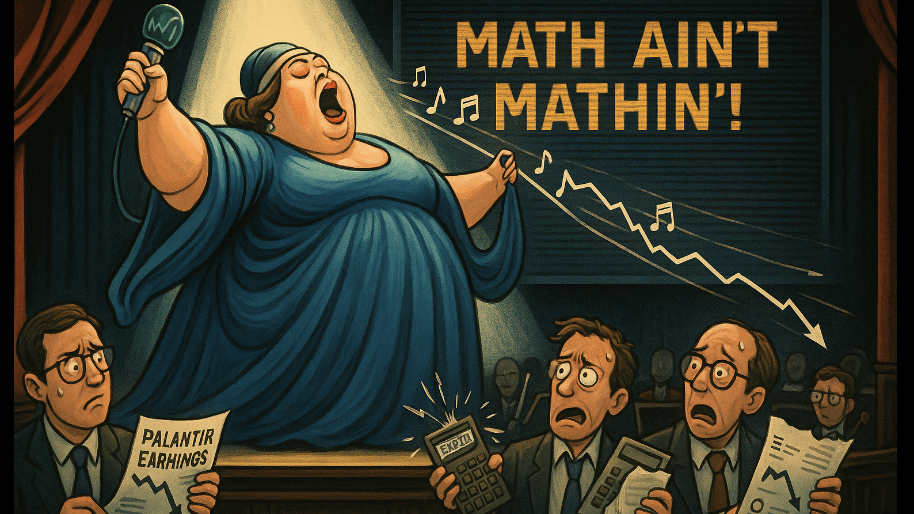

Palantir has now fallen for six straight sessions… its longest losing streak since April 2024… sliding 20% off the highs it set just weeks ago. For a company that finally cracked $1 billion in quarterly revenue and strutted into the S&P 500 last year, the timing couldn’t be more brutal. What felt like a coronation in August now looks like a market remembering the difference between hype and math.

(Source: Giphy)

However, the selloff didn’t happen in a vacuum. The broader tech trade is wobbling, and short-seller Andrew Left of Citron Research just poured gasoline on Palantir’s chart. And honestly, his argument is not only blunt, but understandable: Palantir is “detached from fundamentals and analysis,” a company priced like it already solved artificial intelligence itself. He compared it directly to OpenAI’s $500 billion valuation and concluded that even at $40 a share… nearly 70% below where it was trading… Palantir would still be expensive. Ooof.

(Source: CNBC)

Whereas, for once, the market has listened with a yeeting of shares this week. But, but, but… the truth is Palantir’s story has always been a Rorschach test. Bulls see a company embedded in the Pentagon, riding AI with sticky government contracts. Bears see a stock priced like it already won the entire AI sweepstakes… despite selling software so opaque that even loyal shareholders can’t explain what it actually does beyond “data + AI + war.”

And yet, this is exactly the problem with cult stocks. Once the narrative breaks, valuation math comes back like gravity. And gravity doesn’t care that you just joined the S&P 500 or cracked the top 10 tech firms.

(Source: Giphy)

So the question remains, is this just a correction or a mind-melting reckoning? Well, down 20% in a week doesn’t erase the fact that Palantir shares have still doubled this year. But this slide feels different. It’s not a single earnings miss or a bad contract cycle; it’s the broader realization that the company is carrying a price-to-earnings ratio that looks like a typo, propped up by an AI bubble that’s finally catching its breath.

Meaning, investors are now left with the same nausea that Viking Therapeutic patients are feeling. More specifically, “if OpenAI at half a trillion is the benchmark, then what exactly are you paying for here?” Because right now, Palantir looks less like a defense contractor of the future and more like Wall Street’s favorite trading sardine… far too hyped up and rotting fast once the frenzy cools.

(Source: Giphy)

So what, to do, what to do then? Well, for now, don’t decide to YOLO into a stock trading at science-fiction multiples. But don’t abandon it either. Palantir can easily recharge its rally with something of value that makes sense for a valuation justification… but for now, the math just ain’t mathin’. And for that reason I’m out. Until next time, friends…

At the time of publishing, Stocks.News does not hold positions in companies mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer