Remember when Elon Musk used to build rockets, sell cars, and tweet chaos without needing a trillion-dollar allowance just to show up? Bring me back…

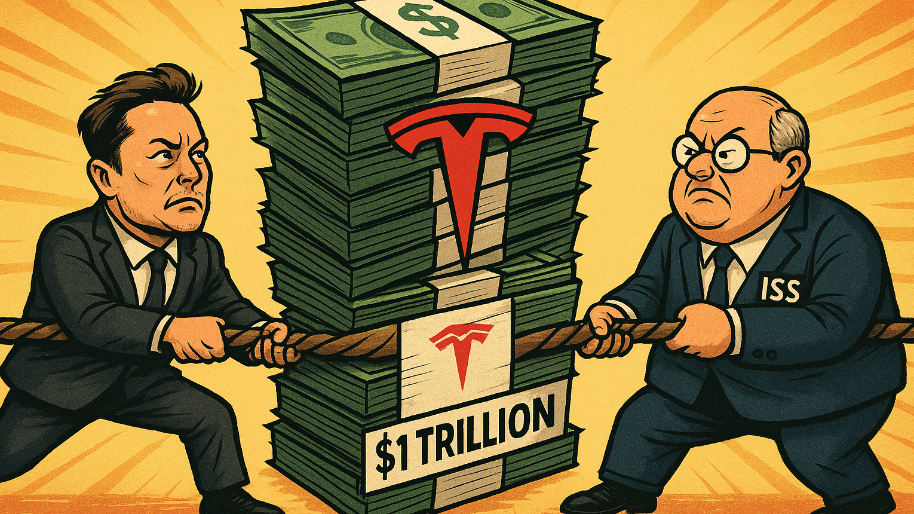

The world’s favorite chaos engineer is trying to add a one in front of his billionaire status… but the fun police over at Institutional Shareholder Services (ISS) are rolling in with the sirens blaring.

The influential proxy advisor just recommended that Tesla shareholders vote against a nearly $1 trillion pay package that would make Elon the first trillionaire in history (and the only guy to name both his kid and his company something you’d find in an algebra problem).

ISS called the proposal an “astronomical grant value,” aka: “you’ve got to be f***ing kidding me.” The firm said the 10-year plan could “reduce the board’s ability to meaningfully adjust future pay levels,” which (if you take off your Elon fanboy cape for two seconds) is actually a fair point. What’s next, a $10 trillion package to get him to show up to earning calls?

(Source: Financial Times)

The anticipation won’t last long considering Tesla’s 2025 annual shareholder meeting is set for Nov. 5, where investors will vote on whether to hand Elon this cosmic-sized compensation plan. If approved, Musk could secure up to an additional 12% stake in Tesla… but only if the company hits a market cap of $8.5 trillion and clears a few other lightweight performance goals. (For context, that’s about 3.5x Apple’s valuation and roughly equal to the GDP of Germany and Japan combined.) Totally doable, right?

The plan is essentially:

“Hey Elon, make Tesla the most valuable company on Earth (and Mars), and we’ll pay you a trillion.”

Elon: “Bet.”

After ISS tried to screw him out of a fat check, Tesla immediately went in self defense mode. In a post on X (which Elon also owns, obviously), the company accused ISS of missing the “fundamental points of investing and governance.” Translation: “You nerds just don’t get it.”

Tesla Elon argued that Musk doesn’t get paid unless shareholders win big, and reminded everyone that ISS has a history of raining on their compensation parades… including the now-infamous 2018 $56 billion pay package that Delaware courts later shredded. And yes, that’s the one a judge ruled was approved under “Elon’s Jedi mind tricks.” Musk is still appealing that ruling, because… of course he is.

If you’ve followed Musk for more than five minutes, you know he’s allergic to rules and criticism. He’s previously called ISS and its proxy pal Glass Lewis “corporate terrorists” (he actually compared them to ISIS in 2023) for influencing institutional shareholders. Which, to me, is a little dramatic… but that’s Elon for you.

Here’s the thing… the guy currently owns about 13.5% of Tesla’s voting power, which means he might not even need everyone else’s blessing to greenlight his own trillion-dollar payday. He also bought another $1 billion worth of Tesla shares in September, just in case his control wasn’t clear enough.

At this point, it’s not just about the money (though… come on, it’s kind of about the money). It’s about keeping Musk chained to the Tesla mothership. The board knows if they don’t, he’ll vanish into one of his other toys… SpaceX, xAI, or that half-joking, half-terrifying catgirl cybernetics startup he keeps teasing.

But ISS says this plan could hurt Tesla shareholders by diluting ownership and setting a dangerous precedent for future CEO pay. Because if $1 trillion is the new benchmark, Tim Cook’s next paycheck might come bundled with 100 electoral votes and a seat in the Situation Room.

On Nov. 5, shareholders get to decide: Do they want to cement Elon Musk as the world’s first trillionaire, or give him a hall pass to inevitably leave them for the next hot idea? Either way, the ripple effects from this vote are going to echo through boardrooms for decades.

At the time of publishing this article, Stocks.News holds positions in Tesla and Apple as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer