Somebody call the ambulance, because Tesla just got put in a friggin’ body bag. Shares dropped more than 8% yesterday, officially plunging below the oh-so-sacred $1 trillion market cap line. The havoc now puts Tesla down -20% YTD, giving Elon a massive -$100 billion net worth hit. Ooof.

(Source: Giphy)

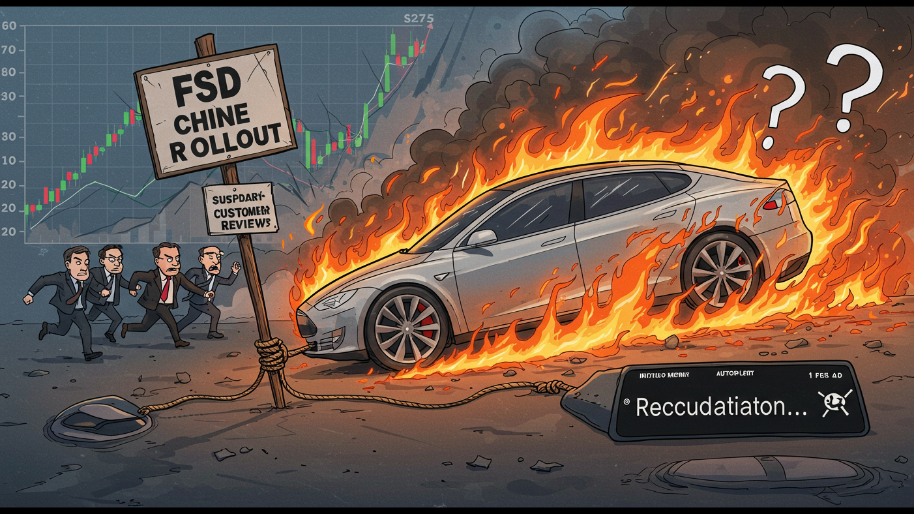

The reason for the bloodbath, you ask? Well, Chinese EV buyers just called Musk’s bluff, and investors didn’t like what they saw. In short, Tesla finally rolled out its long-awaited Autopilot update in China, and guess what? It sucks. Owners who shelled out $7,700 for the so-called “Full Self-Driving” package were expecting something revolutionary. Instead, they got a glorified lane-keeping assist that still needs a babysitter.

Meanwhile, homegrown Chinese EV makers like BYD, Xiaomi, and Huawei are out here basically slingin’ better tech for free.99 like a Costco sample. Xiaomi’s new SU7 sedan—already outselling the Model 3 in China—comes with a smarter navigation system at zero extra cost. And BYD is slapping free autonomous driving features on models that cost as little as $9,500. Meaning, buying Tesla’s “self-driving” technology in China is like paying extra for WiFi when it’s already free.

(Source: Reuters)

Now of course, the Tesla fiasco isn’t just about fumbling the bag in China, investors are already losing patience because Elon is spending more time in Washington than in a Tesla factory. As I’m sure you know, Musk has been LARPing as a government official with DOGE–which has unmatched access to government data and a free pass to purge regulators who oversee Tesla.

Which to be fair, is necessary due to the massive bloat of government waste our country has shot itself in the foot with over the years—-but investors aren’t keen on the fact that instead of fixing Tesla’s collapsing demand, he’s cosplaying as a Trump czar while still getting his a$$ handed to him by Chinese EV makers.

(Source: CNBC)

Adding insult to injury here, Tesla’s European sales are in freefall, U.S. demand is stagnating, and the company is still pumping out the same stale Model 3s and Model Ys like it’s 2019. Plus, considering Tesla’s stock was already propped up by insane expectations, it’s officially come to light that those expectations are now colliding with brutal reality checks.

Meaning, If you still think Tesla is a growth stock, you probably also believe that Elon is going to colonize Mars next week. The stock is already down 35% from its December peak, and with the problems in China, and the overarching story of the DOGE distraction while sales are plummeting left, right, and twice on Sunday—there’s a pretty good chance this thing keeps sliding in the days to come. So with that, beware.

(Source: Giphy)

Of course, do what you will with this information, but don’t let love blind you here. Elon is the renaissance man of the century, and whether you love him or hate him—the man is skilled and efficient in what he does. But still, there’s no denying the fact that Tesla has been taken behind the barn and shot recently, and the market is beginning to realize how bad it actually is. Which means, place your bets accordingly and do your due diligence. As always, stay safe and stay frosty, friends! Until next time…

P.S. My buddy Jared is sharp as hell—probably one of the smartest guys I know. But when it comes to investing? An absolute clown. Why? Because he doesn’t grasp the one thing that separates winners from losers in the market: information. And not just any information—I’m talking about the kind of intel that Wall Street hoards like the FBI hoards Hunter Biden's laptop—because the second retail traders get their hands on it, their edge starts to disappear.

Moral of the story here? Don’t be a Jared. Get access to the real market-moving data, the stuff hidden behind paywalls and institutional gatekeeping by joining Stocks.News premium. At the end of the day, the market isn’t playing fair—so why should you?

Stocks.News holds positions in Tesla as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer