It wasn’t that long ago that Albert Bourla was probably refreshing his LinkedIn profile, crafting something along the lines of “Experienced CEO seeking new opportunities. Open to all industries, except ones that require a global pandemic to stay profitable.” Because, let’s be real, things at Pfizer were looking rough. Back in 2020 through 2022, the company was practically growing money on trees, taking advantage of the COVID vaccine cash. But then the world stopped panic-buying booster shots, and suddenly, Pfizer’s stock resembled a deflated balloon from a work Christmas party.

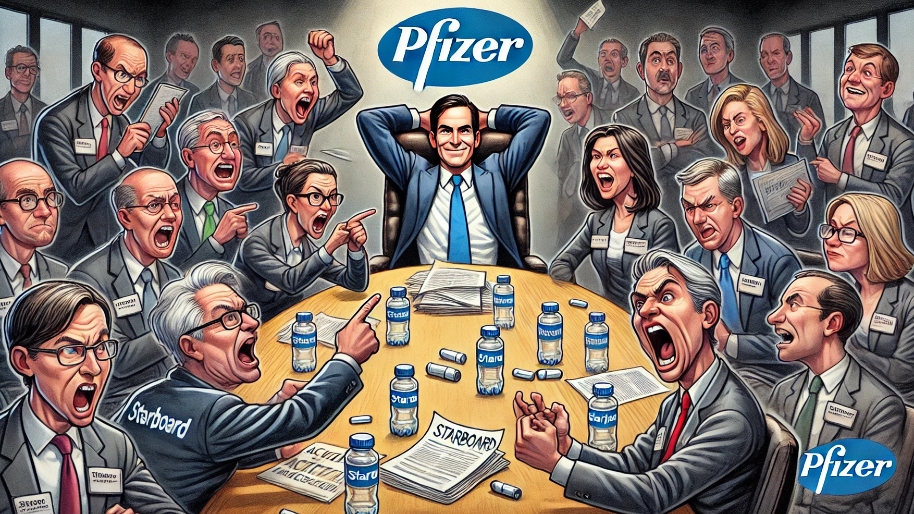

Then came Starboard Value, a hedge fund that decided Pfizer was just too cheap to ignore and threw down $1 billion on its stock. And if there’s one thing activist investors don’t do, it’s sit quietly and trust management to “figure things out.” Reports surfaced that Starboard wanted “unspecified changes”... which really means “either start making us money again, or start packing your desk.” Naturally, all eyes turned to CEO Albert Bourla, whose job security was starting to look about as sturdy as Pfizer’s stock price.

At the time, Pfizer was in hot water. The pandemic-era money that once masked all its problems vanished faster than a crypto influencer after a rug pull. This was a company that had once hauled in $60 billion in COVID revenue, but by 2024, that number had shriveled to just $3 billion.

With COVID revenue circling the drain, investors finally started noticing the cracks in Pfizer’s long-term strategy. Bourla, desperate to prove the company wasn’t a one-hit wonder, embarked on a $43 billion buying spree. His biggest buy was Seagen, a cancer-drug maker that was supposed to carry Pfizer into a more sustainable future. But Starboard clearly wasn’t buying it (figuratively speaking… they had literally just bought $1 billion worth of stock). Pfizer’s shares kept sinking, and Bourla’s seat at the head of the table started feeling very wobbly.

Pfizer tried to regain control by rolling out aggressive cost-cutting measures, promising $5 billion in savings by 2027… which Wall Street largely laughed at as another desperate move (“Great, but how about making money the normal way?”). The company had been fighting to convince investors it still had some life left, but the market was about as interested as a teenager being forced to listen to their dad’s “back in my day” stories.

And then, earnings happened. Against all odds, Pfizer actually delivered a monster earnings report. Revenue came in at $17.76 billion, beating expectations. Earnings per share soared to 63 cents, absolutely obliterating the 46-cent estimate. After months of getting pummeled, the stock even managed to jump 2% in premarket trading… which, after the beating it had taken, felt like a full-fledged rally. Suddenly, Pfizer had something it hadn’t seen in a while: momentum.

The turnaround really is shocking. Sure, the stock is still down nearly 50% from its pandemic highs, but for the first time in a long time, investors have a real reason to believe Pfizer might actually claw its way back.

For Bourla, this means he still has keys to the office (and doesn’t have to “accidentally” leave his personal belongings in a box by the door just yet). The existential crisis has been postponed (at least until next quarter), and for now, he still has a job. But the fight isn’t over. The earnings beat bought him time, but unless Pfizer can keep the wins coming, Starboard will be back with pitchforks in the office lobby.

PS: Want a front-row seat to the stock market puppet show? Our Insider Trading Tool lets you see exactly where CEOs and Congress members are quietly investing their millions. Plus, you'll get exclusive stock write-ups and reports. Click here to see all the benefits of becoming a premium member.

Stock.News does not have positions in companies mentioned.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer