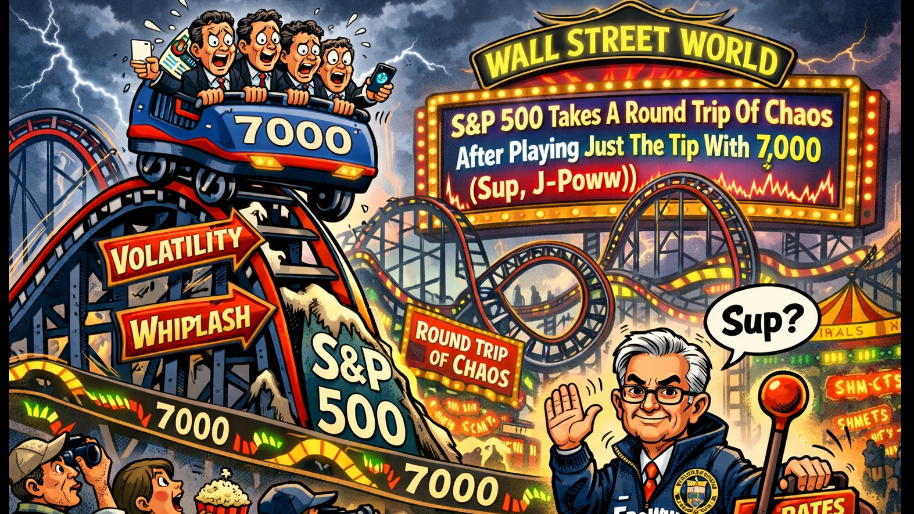

“Felt cute. Might delete later” - The S&P after briefly hitting 7,000 today.

Spoiler: It was deleted.

The S&P 500 briefly hit 7,000 today… took a screenshot… and then acted like it didn’t want to talk about it anymore. Classic. The markets opened hot, Big Tech did its thing, and for one shining moment the line went up to a number that felt fake. Then the Fed showed up, did absolutely nothing, and the vibe shifted from “new era” to “don’t make eye contact.”

(Source: Giphy)

In short, Jerry Interest Rates kept rates exactly where they are and basically said the economy is… fine. Not cooked. Not booming. Just out here jogging at a responsible pace. Jobs are stabilizing, growth is solid, and no one’s in a rush to hand out rate cuts. Because of this, treasury yields popped, stocks stopped “stonking”, and the S&P gave up the ghost. The Nasdaq, however, managed to hang onto a small gain worth +0.17%, while the Dow wasn’t too far behind with a limp bizkit +0.25% gain.

Elsewhere, Seagate ripped 20% because AI needs infinite storage and Dave Mosley looked like a genius for owning hard drives in 2026. ASML (-2.18%) dropped record orders and talked up the future, then immediately round-tripped because nothing good is allowed to last all day anymore… apparently.

(Source: Giphy)

Over in a land not too far, far, away Obi-Huang Kenobi had Nvidia (+1.59%) floating higher after reports claimed China approved sales of its H200 chips. Translation: Dario Armodei is presumably punching air. Oh, and Amazon (-0.68%) slaughtered 16,000 jobs. #rekt. Outside of the Magnificent Seven orgy, things got even weirder.

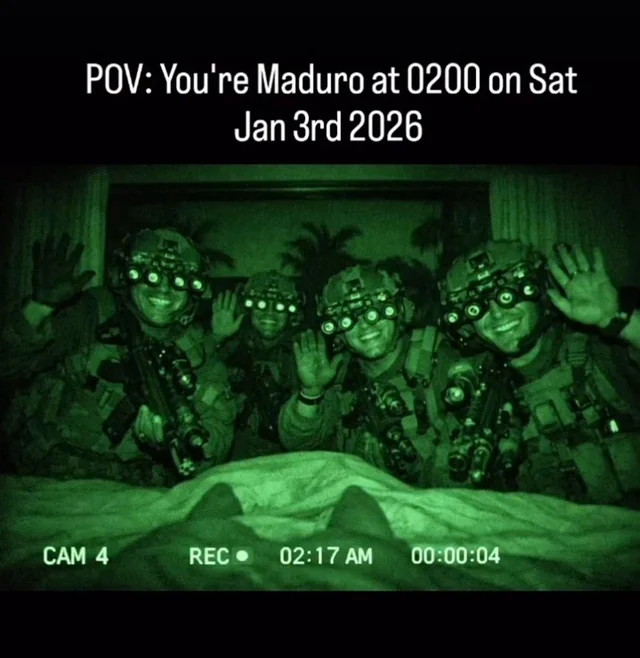

Starbucks (-0.59%) posted traffic growth for the first time in two years, which qualifies as a miracle. However, earnings missed and the stock shrugged because of it. Meanwhile, 32 stocks hit new 52-week highs, including Johnson & Johnson (+1.46%) who is trading at levels not seen since… checks notes …1944. Tyson Foods (-1.75%) briefly touched fresh highs, and Chevron (+0.52%) doing Chevron things (thanks, Seal Team 6).

(Source: Reddit)

Over in healthcare though, things stayed feral. UnitedHealth (+4%)bounced while Humana (-6.7%) kept bleeding. Yesterday’s CMS payment proposal is still haunting insurers like a ghost. Aaaaand, that’s about it. The S&P 500 played just the tip with 7,000, rates are unchanged, and Microsoft, Meta, and Tesla earnings are after the bell. Lord help us. Until next time, friends…

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

☕ Market Gossip

> JPMorgan Chase and Bank of America to match $1,000 U.S. contributions to employee ‘Trump accounts’ (CNBC): Trump Checks has a nice ring to it… (Sup, Zachary Scheidt)

> Powell Says Fed Can Afford to Wait for New Data Before Making Next Move (Bloomberg): Tell that to the Kalshi degenerates…

> Crypto PAC Fairshake touts $193 million war chest as regulatory bill faces first vote (CNBC): Crypto twitter is about to be even more insufferable…

> The Financier Giving Olympians a Nest Egg (Wall Street Journal): Not all heroes wear capes…

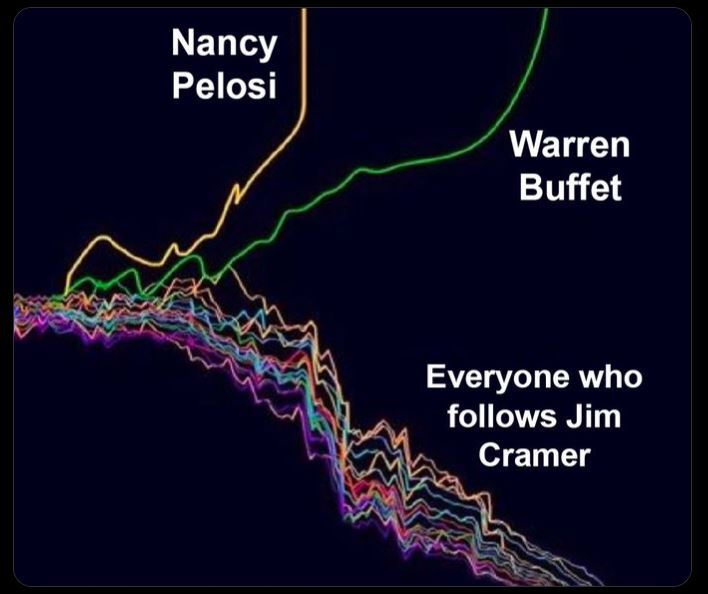

“WTF” Meme of the Day

The greatest trader of all time… a guy named Warren Buffett.

At the time of publishing, Stocks.News holds positions in Microsoft, Starbucks, Amazon, Meta, and Tesla as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer