Since 2017, when SoftBank launched the Vision Fund (aka “The $100 Billion Bet”) it’s been clear… Masayoshi Son doesn’t swing for singles or doubles… he shows up to the plate trying to hit Mars. With $100B in backing from the likes of Saudi Arabia’s Public Investment Fund and Abu Dhabi’s Mubadala, the Vision Fund quickly became the biggest pile of tech gambling money the world had ever seen. And Son, well he threw money at everything (I’m not kidding).

Uber. WeWork. DoorDash. ByteDance. Even Nvidia… way before Jensen Huang became Wall Street’s AI messiah. SoftBank pumped billions into anything that looked futuristic, scalable, or vaguely capable of replacing human labor. Some bets paid off… Alibaba (which he invested $20 million in after a 20 minute meeting), NVIDIA, Coupang. Others? Well… let’s just say SoftBank is now the proud owner of a $10B WeWork tattoo it can’t laser off.

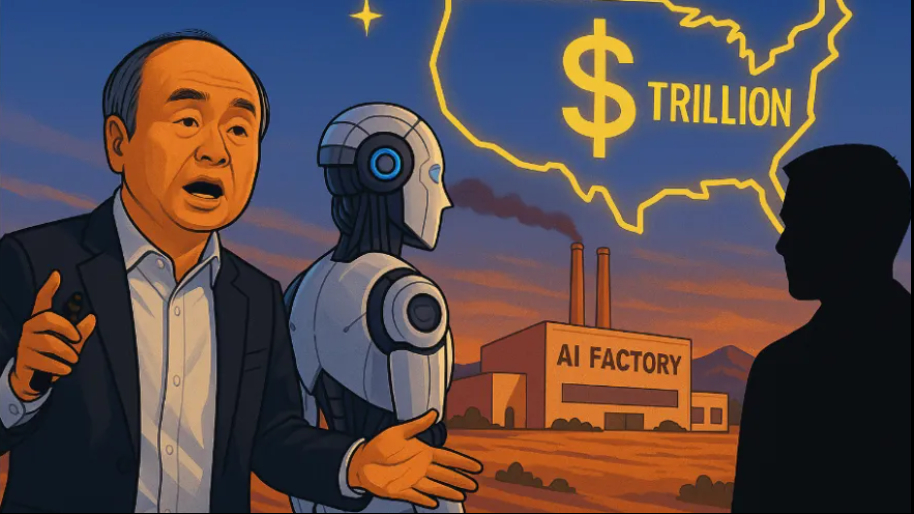

But now, Son’s chasing the ultimate comeback. He wants to build a $1 trillion AI and robotics manufacturing hub in the Arizona desert. Let that number sink in. A billion dollar deal feels huge… but a trillion is just crazy. That’s more than the GDP of 150+ countries. It’s 50x the size of Meta’s Reality Labs losses (I had to). It’s… an insane number. They’re calling it Project Crystal Land, and it’s meant to be America’s answer to Shenzhen… a gigantic, hyper-techy industrial park pumping out AI-powered robots, chips, and who knows what else that will end up ruling all of us one day.

Of course, you know this is all about wooing Trump and his idea is to bring back high-tech manufacturing to U.S. soil. Son wants companies building AI chips, humanoid robots, and automation hardware right here in the states. And he’s trying to get TSMC (the Taiwanese chipmaker that manufactures NVIDIA’s H100s and Apple’s A-series chips) to get in on the action.

While all that sounds great… there’s just one problem. TSMC already has a $165 billion expansion underway in Arizona. They’ve just begun mass production at Fab 21 in Phoenix and are still dealing with construction costs 4–5x higher than in Taiwan. On top of that they’re facing cultural friction between Taiwanese and U.S. engineers and a global chip demand cycle that’s softer than a pillow.

In other words… they’re busy. And according to insiders, SoftBank’s $1T pitch doesn’t currently factor into TSMC’s roadmap (they ghosted.) Still, Masa being Masa, he’s not giving up. He’s reportedly talking to Samsung execs, federal and state officials, and even Trump’s team… just in case he feels like putting his name on a trillion-dollar robot park. (Trump Robot Plaza does have a ring to it.)

SoftBank’s also trying to rope in its own Vision Fund portfolio companies like Agile Robots SE, a German startup working on next-gen industrial robots. If enough of these players commit to setting up shop in Crystal Land, it might start to feel real.

But again, $1 trillion is the estimated cost to bring Crystal Land to life. And SoftBank is nowhere near that number. As of March, SoftBank had about $23 billion in cash on the books. They've since raised another $4.8 billion by offloading a chunk of their T-Mobile stake. Not bad, but they’re still about $972 billion short and their most prized possession (Arm Holdings) still gives them decent leverage (they own around 90% of it post-IPO). But unless they plan to sell off their founder’s hair gel, they’re going to need outside capital.

That’s where project financing comes in. Instead of funding everything up front, SoftBank is floating the idea of raising money on a project-by-project basis… a model typically used in oil pipelines and energy infrastructure. This “Stargate” approach (yes, it’s actually called Stargate) is already being used to bankroll SoftBank’s other big investment: a $500B data center network in partnership with OpenAI, Oracle, and Abu Dhabi’s MGX.

(Source: Reuters)

Still, financing is one thing. Building trillion-dollar robot farms is cool, but it might be more cost-efficient to just support smaller partnerships between AI startups and manufacturing experts (unless you’re Son and have legacy FOMO.)

And that’s the heart of this… legacy. Masa Son has openly said he’s disappointed in his career. Despite turning a $20M Alibaba bet into $100B, he still feels like he’s got one more big swing left… one that will define SoftBank for the next century. Crystal Land is that swing (he hopes). He’s gonna need the stars to literally align for this one to work. But if he’s right, the next Silicon Valley might not be in California. It might be in the f***ing desert.

At the time of publishing this article, Stocks.News holds positions in Uber, Apple, and Meta as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer