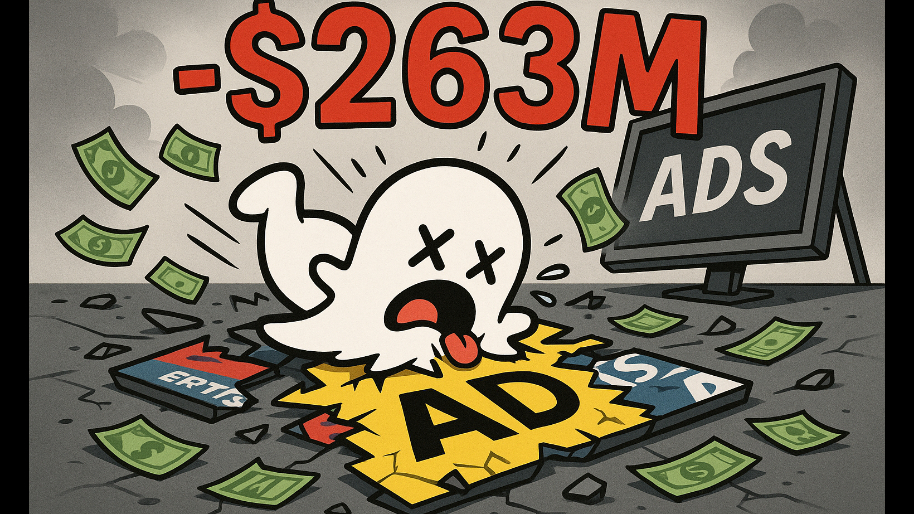

TBH, Snapchat’s ghost logo is starting to feel a little too on the nose…

It’s earnings season, which means it’s time for Snap to remind investors why trust is a liability. The social media company dropped a fresh turd onto Wall Street Tuesday night, missing revenue expectations, flubbing ARPU, and blaming… among other things… the “timing of Ramadan”. Yes, really.

(Source: Giphy)

For starters, here are the receipts: Revenue clocked in at $1.34B vs. $1.35B expected. Not a huge miss, but in Snap land, expectations are already curled up in the fetal position. ARPU came in at $2.87 vs. $2.90 expected, and down 9 cents from Q1. Sure, users are growing, but each one is now worth less than a McChicken. Especially when you factor in that Snap’s net loss was $262.6M. Which is up from $248.6M last year. Translation: “Tell me blowing up your own monetization engine has consequences without telling me.”

(Source: CNBC)

As for Adjusted EBITDA… well it was $41M vs. $53M expected. Now I’m not to good at numbers, but that’s a 25% year-over-year drop. Of course, management called it “softness”. I call it a full on dumpster fire. And yet, Evan Spiegel, always the innovator, blamed the weak quarter on a laundry list of issues ranging from a botched platform update to Trump-era import tax tweaks. If you’re keeping score at home: bad code, geopolitics, religious holidays, and the lunar cycle. But don’t worry… Snap is “allegedly” reverting the changes.

(Source: Giphy)

For instance, the company is re-orging its engineering teams in a move that feels less like a strategy and more like an HR cover story. The CIO and CISO now report directly to Spiegel. Monetization engineering is getting parked under the business chief. And Snap’s head of engineering… who joined in 2023, is officially bailing. On the bright side, Snapchat+ is almost at 16 million subscribers, up 42% year-over-year. That’s… something. It now drives $171M in revenue, which is compared to a lemonade stand next to Amazon’s 23% YoY ad growth.

Speaking of which, while Snap was out here spilling its ad revenue all over the pavement, Meta, Reddit, and Alphabet were printing money like it was pre-Volcker. Meaning, you can blame all the irrelevant astrology stuff you want, but this isn’t an industry problem. It’s a friggin’ Snap problem. And Wall Street knows it. The stock is down nearly 33% YTD, and this latest quarter reads like the kind of performance review that gets your accountants doing the Super Micro dance.

(Source: Giphy)

Meaning, if you’re holding Snap, the real question is this: do you believe this is a temporary glitch in the home of the vanishing d*ck pic matrix… or is it the final season of a show that ran out of the plot back in 2018? Only time will tell of course, but the only good news I’m seeing here is a “BTFD” for degenerates (who presumably use Snap solely for the reason above). Until next time, friends…

At the time of publishing, Stocks.News holds positions in Snap, Meta, Reddit, Amazon, and Alphabet as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer