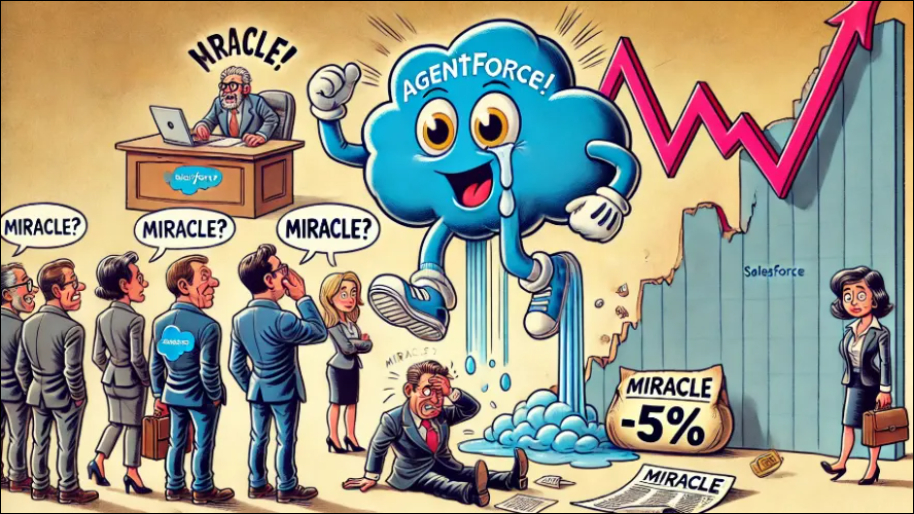

Remember when Agentforce was supposed to be the miracle drug for slowing sales growth? Yeah, Marc Benioff does too, and he’d really like you to ignore the fact that Salesforce just whiffed on revenue expectations and is now serving up a lukewarm 2025 outlook that has investors side-eyeing its AI ambitions.

(Source: Giphy)

In short, the numbers are as follows: Q4 EPS beat ($2.78 vs. $2.61 expected), but revenue ($9.99B) came in light. More importantly, Salesforce’s full-year revenue guidance of $40.5B-$40.9B missed the Street’s $41.5B target. Investors weren’t amused as the company posted single-digit growth for the third straight quarter—shares were yeeted -5% after hours.

Live look at Salesforce investors after watching Nvidia earnings…

(Source: Giphy)

Regardless of the earnings though, Benioff is still pounding the table on Agentforce, Salesforce’s AI-powered customer service agent that’s supposed to automate tasks and make the company’s CRM software stickier than ever. And sure, 5,000 deals have been closed since its October launch, with Pfizer, Equinox, and Singapore Air on board. But here’s the issue: AI should be moving the needle faster. If Agentforce was a real game-changer, Salesforce wouldn’t be guiding for another year of mid-single-digit revenue growth.

Plus, the AI revenue impact is minimal… for now. Outgoing CFO Amy Weaver admitted Agentforce won’t meaningfully contribute until 2027, meaning Salesforce is still stuck grinding out traditional software sales in the meantime. However, when competition is as ruthless as it is right now (read: Microsoft and ServiceNow), time is more of an essence than ever.

(Source: CNBC)

For example, Microsoft doesn’t just compete in AI, it owns the infrastructure everyone else rents. Thanks to Azure and OpenAI, it’s got a vertically integrated AI stack that Salesforce can’t touch.

On the other hand, ServiceNow has quietly built one of the most effective enterprise AI automation platforms out there. More specifically, they now dominate IT service management—which, let’s be honest, is where AI automation shines. Companies want AI that fixes IT issues, manages workflows, and reduces human intervention—not just another chatbot.

(Source: Giphy)

So naturally, even with the promises of Agentforce, investors' patience is officially wearing thin. Especially when you take in the fact that Salesforce shares have been underperforming its software peers, up just 2.3% in the past 12 months while other big tech names have been mooning to new highs. And with longtime CFO Amy Weaver and COO Brian Millham both exiting, there’s concern about whether Salesforce can execute on its AI vision without more turbulence.

Adding to the issues are the fact that the company is cutting jobs (again) and diversifying its cloud infrastructure ($2.5B Google Cloud deal), but even that alone doesn’t change the core problem—Salesforce isn’t growing like a high-flying AI stock, and the market is noticing.

(Source: Bloomberg)

So in the end, Benioff can name-drop big customers all he wants, but until Salesforce proves AI can drive real, hockey-stick revenue growth, investors aren’t willing to shove money in his face. Even worse, is if Agentforce doesn’t start pulling its weight soon? Well, it’ll just prove that maybe, just maybe… AI can’t save everything.

For now, keep an eye on Salesforce and place your bets accordingly, friends. And as always, stay safe and stay frosty! Until next time…

P.S. My buddy Jared is sharp as hell—probably one of the smartest guys I know. But when it comes to investing? An absolute clown. Why? Because he doesn’t grasp the one thing that separates winners from losers in the market: information. And not just any information—I’m talking about the kind of intel that Wall Street hoards like the FBI hoards Hunter Biden's laptop—because the second retail traders get their hands on it, their edge starts to disappear.

Moral of the story here? Don’t be a Jared. Get access to the real market-moving data, the stuff hidden behind paywalls and institutional gatekeeping by joining Stocks.News premium. At the end of the day, the market isn’t playing fair—so why should you?

Stocks.News holds positions in Microsoft and Google as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer