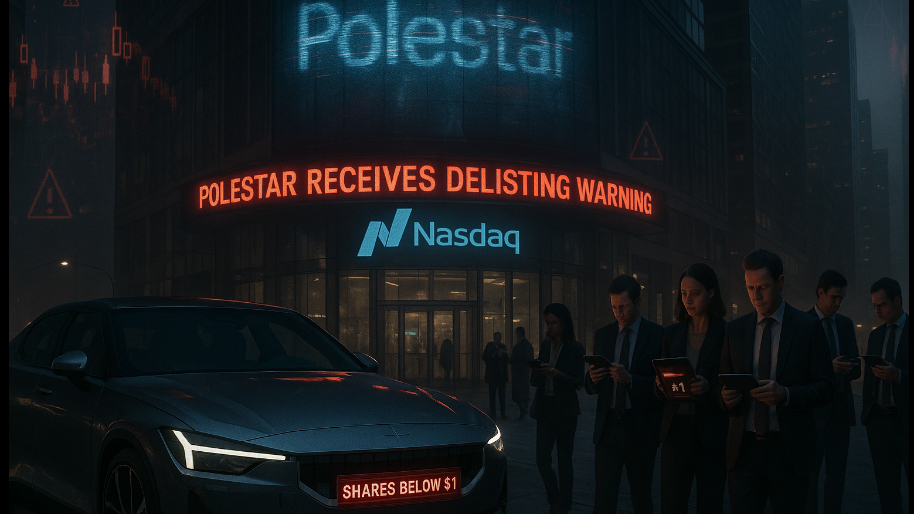

Polestar Automotive Holding UK PLC (NASDAQ: PSNY) said Friday it has received a formal notice from the Nasdaq Stock Market after its share price fell below the exchange’s minimum $1 bid price requirement, adding to the mounting challenges facing the struggling electric vehicle maker.

Nasdaq informed Polestar that the company’s shares have traded below the $1 threshold for 30 consecutive business days, triggering non-compliance under Nasdaq Listing Rule 5450(a)(1). The Swedish EV maker has 180 days… until April 29, 2026… to regain compliance by maintaining a closing bid price of at least $1 for ten consecutive trading sessions.If Polestar fails to meet the requirement within that window, it may be eligible for an additional 180-day extension or face delisting from the exchange. The company said it intends to monitor the stock closely and “consider all available options” to restore compliance.

Polestar shares closed Friday at $0.8449, down 2.95%, hovering near their 52-week low of $0.8210. The stock has fallen more than 10% over the past month and 94% from its all-time high following its 2022 SPAC merger, which initially valued the company at nearly $20 billion. With a current market capitalization of roughly $1.8 billion, the company now trades at a fraction of that level.

The delisting threat follows a turbulent stretch for Polestar, which has been retreating from key markets and restructuring operations amid persistent losses and intensifying competition from Tesla and Chinese automakers such as BYD. The company shuttered its remaining retail store in China earlier this month and closed two UK R&D facilities in Nuneaton and Coventry, eliminating around 130 jobs as part of a cost-cutting drive.Leadership turnover has compounded the instability. Founder and former CEO Thomas Ingenlath was ousted last year by majority shareholder Geely Holding Group and replaced by Michael Lohscheller, who has since grappled with production delays, soft demand, and operational losses. Polestar reported a $1.03 billion net loss in the second quarter, its fifth consecutive quarterly deficit.

Despite unveiling its new Polestar 5 sedan at September’s Munich IAA auto show, analysts remain skeptical that new products will reverse the company’s decline amid slowing EV demand and price competition. To regain Nasdaq compliance, Polestar could pursue measures such as a reverse stock split, which would mechanically lift the share price above the $1 threshold. The company emphasized that the notice has no immediate impact on its Nasdaq listing, and shares will continue trading under the ticker PSNY, pending further developments.

About Polestar

Polestar Automotive Holding UK PLC (NASDAQ: PSNY) is a Swedish electric performance car manufacturer headquartered in Gothenburg, Sweden. Founded by Volvo Cars and Geely Holding, Polestar designs and develops premium electric vehicles combining Scandinavian design, performance, and sustainability. The company’s growing lineup includes the Polestar 2, Polestar 3 SUV, and Polestar 5 performance sedan, reflecting its mission to accelerate the shift toward sustainable electric mobility across global markets.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer