“The price is right… b*tch” - Andrew Jassey after seeing Piper’s upgrade…

Amazon does it again… makes analysts feel clever for being late. Piper Sandler lifted its target to $300 after AWS growth came in at 20%... a.k.a., the first real acceleration in almost three years.

(Source: Giphy)

For instance, over the past year, AWS looked somewhat human. Now it’s back to functioning like an absolute juggernaut of infrastructure… quiet, predatory, inevitable. $33 billion in quarterly revenue, margins widening, power capacity set to double by 2027. You don’t double the capacity when you’re guessing. You do it when you already know how this story ends.

(Source: Yahoo Finance)

With that said, the AI narrative is just a rebrand. Amazon’s product cycle doesn’t mean much when it is the “product cycle”. Every new model, every GPU shortage, every startup training its digital ego eventually rents space from the same landlord. And that my friends, is simply AWS. Additionally, we have Trainium2, Inferentia, Project Rainier… all new chips, all new clusters that prove that Amazon would rather build its own physics than buy someone else’s. Meanwhile, Jassey is juicing up his Anthropic marriage while giving them half a million Trainium2 chips for their cluster.

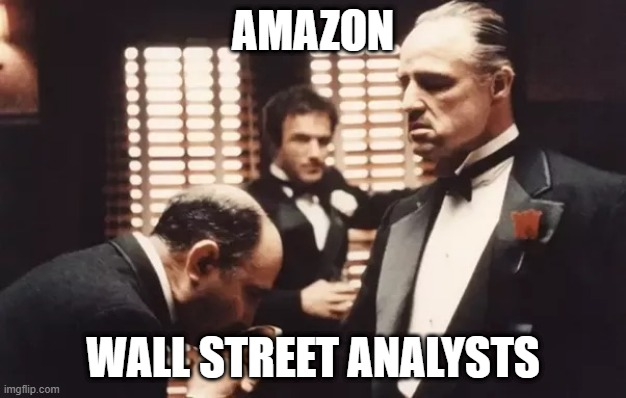

But what has really gotten Pipers Sandler's pipe going, is that operating income came in above the high end of guidance even after $4 billion in one-time charges. The company keeps cutting costs because it’s realized there’s nothing left to optimize except people (read: Pour one out for our homeis). Whereas now, Piper Sandler, Cowen, KeyBanc, Morgan Stanley… are all pushing Piper Sandler, Cowen, KeyBanc, Morgan Stanley. Some call this bullishness… but me being me, calls this obedience. Obedience to the fact that Amazon is the silent GOAT of this AI boom.

(Source: Imgflip)

Meaning, keep your eyes on Amazon. Because at this point, it’s not really about the numbers… it’s about the fact that Amazon has already rebuilt the economy in its image. And savvy investors are 100% here for it. So yeah… place your bets accordingly, friends. Until next time…

At the time of publishing, Stocks.News holds positions in Amazon as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer