“I wish Stevie Nicks would show up in her birthday suit with a jar of pickles and a bottle of baby oil massive gallon of oil” - J.K. Simmons Mark Lashier, probably…

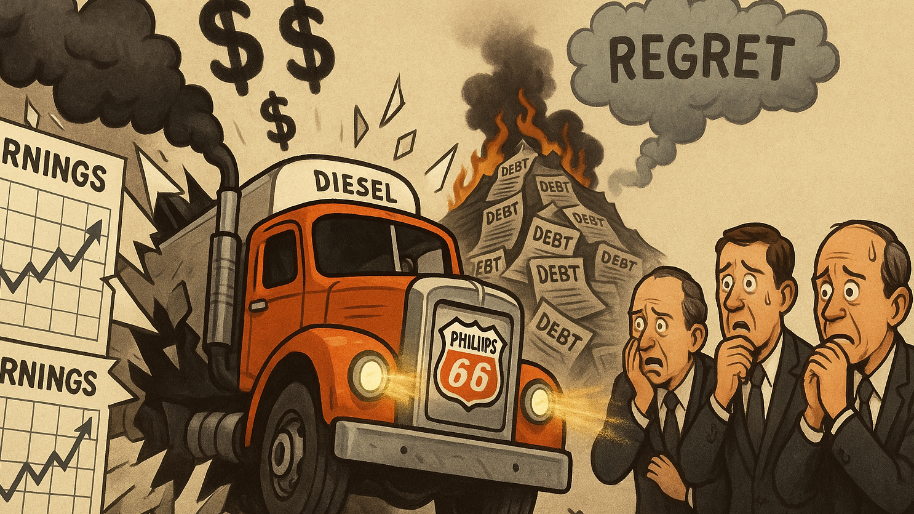

Phillips 66 just did what every blue-haired Karen in America hates: make diesel margins sexy again. The refiner reported second-quarter earnings that blew past Wall Street estimates Friday, thanks to surging refining margins, falling turnaround costs, and a nationwide thirst for fuel strong enough to make Daniel Plainview want some of that milkshake.

(Source: Giphy)

Naturally, the stock barely budged… up less than 1% by mid-afternoon… but the headline was loud and clear: $2.38 in adjusted earnings per share, crushing the $1.71 consensus. Translation: While other sectors hallucinate about AI futures, Phillips 66 is making old-school money the old-school way… ranking out refined products like it’s 2006. The company ran at 98% crude utilization, dragged in $392 million from its refining unit (up 30% YoY), and flexed an average realized margin of $11.25 per barrel, a 12.4% gain from last year. Bigly.

(Source: Yahoo Finance)

Of course, diesel was the belle of the earnings ball. Low inventories and strong demand gave Phillips a license to print profits. CFO Kevin Mitchell was most definitely horned up as he preached about maximizing diesel output and eyeing future projects to boost switching flexibility between gasoline and diesel. Spoiler: If you like fossil fuels that sound industrial and angry, they’ve got you covered. Mitchell said the company was “relatively bullish on refining in the near to medium term”... a phrase that keeps every old oil head pressing the buy button on repeat.

(Source: Giphy)

However… the debt is still the side character who might kill the hero here. For instance, net debt-to-capital hit 41%, compared to Valero’s 12%, and analysts weren’t shy about flagging it. Midstream investments and asset expansions have left Phillips 66 with a financial gut that needs trimming. Activist investor Elliott Management already body-checked them earlier this year during a proxy fight… grabbing board seats and suggesting a spin-off of the midstream business. So far, Phillips is noncommittal, which is what happens when your cash cow is also your heaviest liability.

Speaking of the midstream segment, it alone was down 3%. But when your debt-to-cap ratio starts looking like a student loan statement, suddenly flat isn’t good enough. So with that, what now? Well, Phillips 66 is a refinery. It refines. It makes money. It beats earnings. And the market shrugged because it's not whispering sweet nothings about generative AI or quantum-powered SaaS integrations. It’s just a boring old company hauling in cash… with a tad bit of baggage.

(Source: Giphy)

But in a market that’s high on its own supply, maybe the real play is the grizzled guy still shoveling diesel in the corner. Regardless, Phillips 66 is getting dirty and making money while doing it… and this quarter was about as back-to-basics bullish as it gets. Meaning, if you like reliability then keep your eyes on this stock. Even though we didn’t see massive price action on Friday, doesn’t mean we won’t see something worth writing home about on Monday. So yeah, keep your head on the swivel and place your bets accordingly. Until next time, friends…

At the time of publishing, Stocks.News does not hold positions in companies mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer