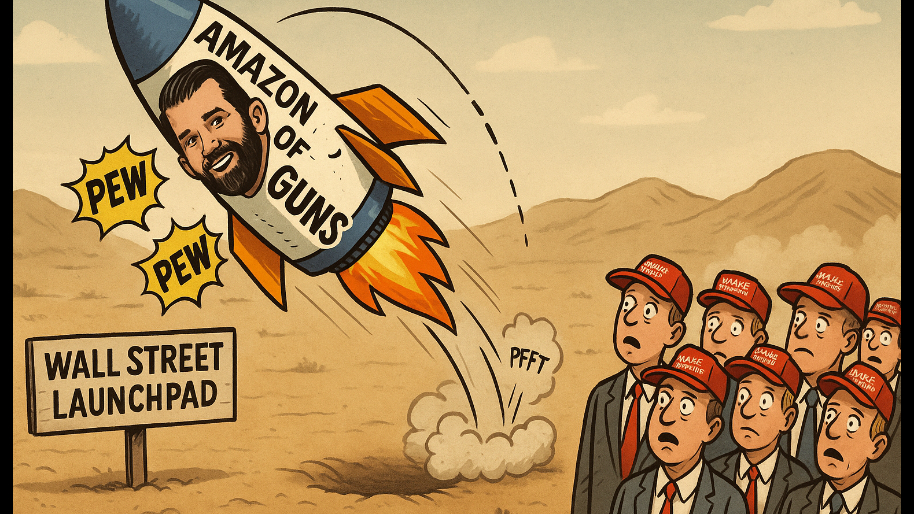

Well, apparently, Grabagun is neither a grower nor a shower. The company with the most legendary ticker symbol ever (read: $PEW)... a.k.a. Donald Trump Jr.’s answer to Amazon, but with more ammo and fewer shipping delays… made its Wall Street debut this week to chants of “USA” and the smell of gunpowder pride. Then promptly face-planted.

(Source: Giphy)

On day one, the gun e-tailer dropped over 24%, then dribbled another 1.1% lower by Friday’s close. So much for shooting the moon. By the end of the week, it wasn’t a patriotic IPO so much as a slow-motion correction wrapped in red, white, and regret. The company went public via a SPAC merger with Colombier Acquisition Corp. II, a blank-check vehicle helmed by Republican megadonor Omeed Malik. Additionally, Trump Jr., a board member and proud owner of 300,000 shares, rang the opening bell himself on Wednesday. There was cheering. There were flags. There were Fox Business soundbites about “woke corporate tyranny” and “vindication.” But by market close, the only thing getting vindicated was the algorithm’s right to sell into volume.

(Source: Newsweek)

“It’s an ultimate triumphant return,” Trump Jr. said of listing a gun company on the New York Stock Exchange. Less triumphant: watching PEW’s market cap get body-checked by retail investors in real time. To be fair, SPACs aren’t exactly hot right now. The glory days of 2021’s blank-check sugar rush are over, buried under the ruins of BuzzFeed, Virgin Galactic, and other market Darwin Award winners. Meaning, investors have learned the hard way that splashy tickers and politically loaded brand equity don’t guarantee anything but volatility.

Still, GrabAGun insists it’s here to disrupt. CEO Marc Nemati called the moment “a major milestone for the 2A community,” promising a “technology-first approach” to guns, ammo, and freedom-fueled commerce. The company pitches itself as the “Amazon of guns,” banking on a slick user experience and conservative culture-war branding to win over younger, degenerate firearm buyers who presumably mutter “Murica!” every time they crack open a cold one.

(Source: Giphy)

However, there’s just one problem: the market doesn’t buy aura alone anymore. As IPOX analyst Lukas Muehlbauer put it: “Investors are looking past the political branding, focusing on whether the company can find a sustainable path to increase market share.” Translation: chants don’t count as revenue… even if the chants fully embrace the great country that is America. That said, the Trump brand does carry weight… especially in the “parallel economy” world of MAGA-flavored capitalism. GrabAGun joins the ranks of Trump Media, Rumble, and other right-aligned plays that substitute traditional growth narratives for culture war momentum. It’s a sector fueled more by loyalty than logic, and occasionally, that’s enough to move the needle. For a day.

With that said, the company did raise $179 million in gross proceeds from the merger. That’s not nothing. And Colombier claimed “near-zero” shareholder redemptions pre-merger, a sign that some investors were genuinely bought in. But with shares already falling and scrutiny mounting, GrabAGun’s leadership now faces the tougher question: how do you turn a meme into a friggin’ margin?

(Source: Giphy)

As our homeboy Trump Jr. put it on X, “What we’re doing with GrabAGun would have been unthinkable four years ago.”He’s not wrong. In 2020, this would’ve been cancelled straight to hell. In 2025, it’s a reality, and it’s what the people want… just not what investors want. Meaning, for now, PEW is trading like a novelty ticker with political baggage and a lot to prove. Whether it becomes a growth story or just another failed example in the SPAC Burn Book fully depends on how fast it can scale, execute, and deliver more than just red-meat marketing.

So with that, keep your eyes on $PEW as we get the party started today, and place your bets accordingly. Until next time, friends…

At the time of publishing, Stocks.News holds positions in Amazon as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer