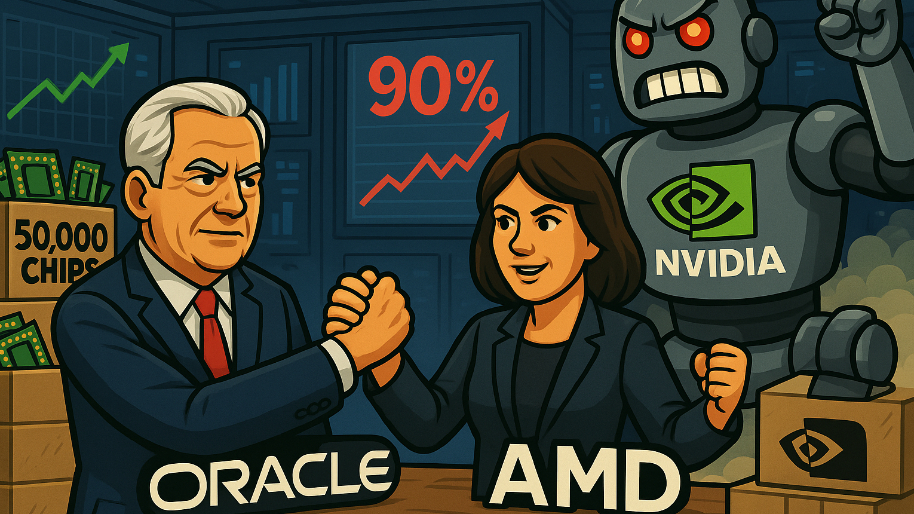

Larry Ellison’s software company said Tuesday it plans to roll out 50,000 AMD graphics chips across its global data centers starting in the second half of 2026. The move highlights Oracle’s growing focus on artificial intelligence infrastructure… and a push to compete in a market long led by Nvidia.

The chips come from AMD’s new Instinct MI450 line, introduced earlier this year. They’re designed for heavy-duty AI tasks, including training and running complex models, and can be linked together in large racks where 72 GPUs operate as a single unit. Meaning: Oracle will be able to handle larger workloads at faster speeds across its Oracle Cloud Infrastructure (OCI) platform.

“We believe customers will adopt AMD’s technology very well, especially for inferencing workloads,” said Karan Batta, senior vice president at Oracle Cloud Infrastructure. Inference (the process of using trained AI models to make real-time predictions) is one of the biggest sources of cloud demand today.

The deal marks one of Oracle’s largest hardware investments yet and shows how quickly big cloud providers are moving to diversify their chip supply. For years, Nvidia’s GPUs have been the industry standard, powering more than 90% of data centers running AI workloads. But with Nvidia’s chips often in short supply and priced at a premium, Oracle’s partnership with AMD gives its customers another option… one that could be more cost-effective and easier to scale.

This comes after Oracle’s recent efforts to strengthen its AI partnerships. Earlier this year, the company announced a five-year cloud deal with OpenAI, reportedly valued at up to $300 billion, to support the training of next-generation AI models. OpenAI also reached a separate agreement with AMD to provide processors requiring up to 6 gigawatts of power over several years, with a 1-gigawatt rollout expected in 2026.

The market reaction was mixed. AMD shares rose about 3.3%, as investors grew more confident in the company’s growing data center business. Oracle’s stock slipped 2%, while Nvidia fell roughly 3%, reflecting the market’s read on an increasingly competitive AI hardware landscape.

The announcement also reinforces AMD CEO Lisa Su’s broader strategy to expand her company’s footprint in the AI and cloud sectors. AMD has been steadily gaining traction with major providers like Microsoft and Oracle as both seek to balance Nvidia’s dominance with new supply sources.

“Oracle has already shown it’s willing to make major investments to meet AI demand,” said Daniel Newman, CEO of The Futurum Group. “The next step is proving that the company can turn that capacity into real enterprise value.”

Oracle plans to begin the rollout in the third quarter of 2026, phasing in deployments across its global data centers. More details on performance benchmarks and customer adoption are expected later this year.

AI spending across the tech industry continues to surge, and demand for computing power shows no sign of slowing. So clearly, the race between Nvidia, AMD, and other chipmakers like Broadcom and Intel is only going to get more intense.

At the time of publishing this article, Stocks.News holds positions in Microsoft and Intel as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer