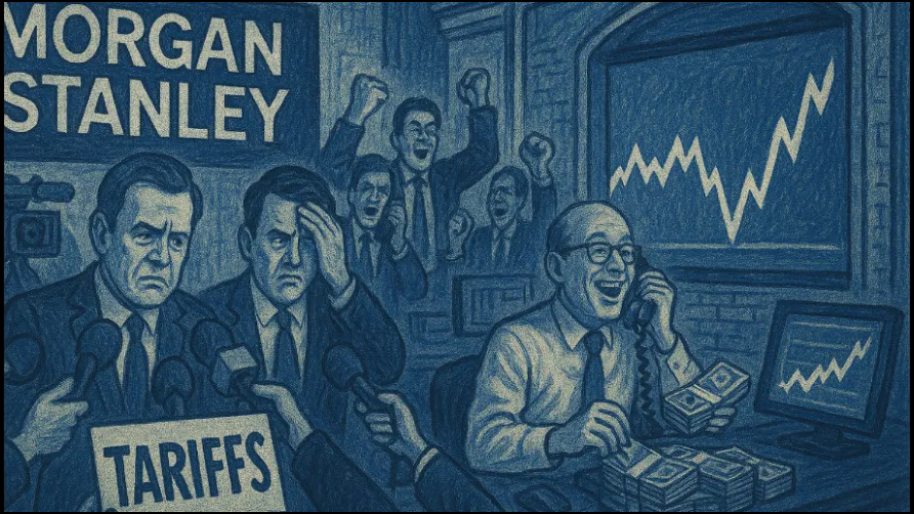

If you’ve tuned into financial news lately, you’ve probably seen a familiar scene… Wall Street analysts from New York’s finest institutions showing up on TV with their best concerned faces (the “this is serious” look they practiced in the mirror at Wharton), warning us about the impending doom of Trump’s latest tariffs. Inflation! Frozen deals! Economic instability! They say it like they’re sounding the alarm… while secretly sliding another zero onto their bonus projections.

Because here’s what they’re not saying on air… deep down, they’re loving this mess. Case in point, Morgan Stanley just posted its best quarter ever (in it’s entire 88 year history) for equities trading… pulling in $4.13 billion, a 45% jump from last year. Total revenue hit $17.74 billion, blowing past Wall Street’s $16.58 billion estimate. Net income jumped 26% to $4.32 billion, and earnings per share came in at $2.60 vs. the predicted $2.20.

And what powered the surge you ask? A trader’s best friend… Volatility. Plain and simple. The same chaos these analysts publicly curse is the market conditions Morgan Stanley’s traders dream about. Trump’s second-term tariffs and shocking policy changes have created the perfect environment for equities desks to feast. Every sudden tweet, policy switch, or trade threat sends the market spinning… and the firm’s traders are right there catching falling knives (and flipping them for a profit).

This wasn’t a one-hit wonder from the equities team, either. Wealth management brought in $94 billion in new assets. Investment banking climbed 8% to $1.56 billion. Even fixed income trading (the financial equivalent of watching paint dry) rose 5% to $2.6 billion. They also laid off 2,000 people in March in a cost saving move.

CEO Ted Pick, who recently took the reins from longtime boss James Gorman, said the success was due to “consistent execution” and a focus on “durable growth.” His team even called out strong activity in Asia and hedge fund clients… two groups that don’t exactly wake up for slow markets.

That said, not everything is on fire (in the good way). M&A activity and IPOs have cooled off, with co-president Dan Simkowitz admitting that deals are “on pause” while clients wait to see where Trump’s policies land. But, as he quickly pointed out, “paused” doesn’t mean “canceled.” If Trump decides to go easy on the tariffs in the future, we could see the IPO market get red hot fast.

PS: Don’t fall for the narrative that nothing’s going up in this Trump tariff firestorm… that’s just noise. While the headlines scream doom and gloom, our Stocks.News Premium members are getting early alerts on stocks that explode 50%... even 100%+ in a single day. Every. Single. Week.

If you're sick of watching these moves from the sidelines, it might be time to get off the bench. With Premium, you’ll get two trade alerts a week, plus access to our Insider Trading Tool that tracks everyone from overpaid CEOs to your favorite Congress members magically buying before the news breaks.

Oh, and unlike Bloomberg, we don’t charge a small fortune to deliver actionable info. Their terminals might look fancy, but do they catch real-time squeeze setups and insider buys before they rip? Yeah… didn’t think so. Go here to become a Stocks.News premium member now.

Stock.News does not have positions in companies mentioned.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer