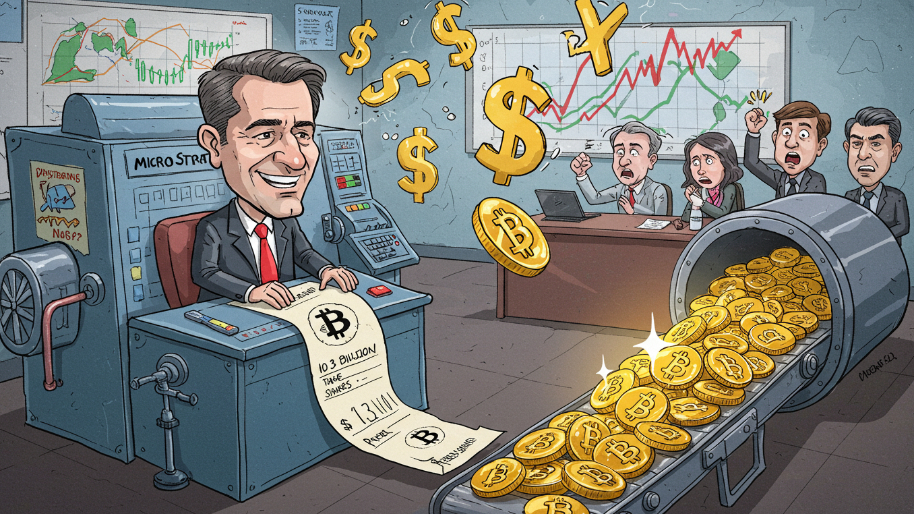

Michael Saylor is at it again, friends. The executive chairman of MicroStrategy managed to get shareholders to sign off on increasing the company’s authorized Class A shares from a modest 330 million to a mind-melting 10.3 billion. That’s right—10.3 billion shares, meaning they’ve officially gone full send on their crypto love affair (more on that in a moment).

(Source: Bloomberg)

For more perspective, MicroStrategy is on track to have more outstanding shares than all but four of the biggest players in the Nasdaq 100—Nvidia, Apple, Amazon, and Alphabet. Not exactly the company you’d expect to see in the same conversation as trillion-dollar behemoths, unless you’re counting Saylor’s ability to hoard Bitcoin like it’s canned food during the apocalypse.

Yet the vote wasn’t exactly a nail-biter either. Saylor controls 47% of the voting power, so this was less of a shareholder democracy and more of a formality. The proposals passed with 56% of the vote, which is basically just the shareholders saying, “Yeah, sure, whatever. Just do your thing.” Alongside the Class A share increase, MicroStrategy also approved a 201x increase in its preferred stock count, bumping it from 5 million to 1 billion. Because why stop at common shares when you can “Salt Bae” some preferred stock for good measure?

Now for the endgame to all of this. If you guessed buying more Bitcoin you’d be right. This is simply about funding more Bitcoin, and always more Bitcoin. Simply put, MicroStrategy’s so-called “21/21 plan” aims to raise $42 billion in capital—half from equity, half from fixed-income offerings—to buy even more of the digital gold. And they’re well on their way, sitting on 461,000 Bitcoin as of this week, worth a cool $47 billion. That’s more than 2% of all Bitcoin that will ever exist. Meaning, if Bitcoin were a country, Saylor would basically be running the treasury.

What’s more is the timing is a bit interesting as well. MicroStrategy shares dropped 7.25% on Tuesday (settling at -3%) as the crypto hype machine hit pause after Trump’s first day back in office. While the former president didn’t roll out any crypto-friendly executive orders on Day One, Saylor and the Bitcoin faithful are betting the Trump administration will usher in a more lenient regulatory backdrop for the industry. Keep in mind, Saylor was spotted rubbing elbows at the Crypto Ball in D.C. over the weekend, mingling with Trump’s crypto czar and other insiders. Wadda suckup.

(Source: Giphy)

But, but, but… still, this isn’t even the craziest part of MicroStrategy’s Bitcoin strategy. The company just announced they’ve been on an 11-week buying spree, snapping up $1.1 billion worth of tokens to bring their total stash to levels that would make even the stoic Winklevoss twins horned up. All of this while the company’s stock is still up an impressive 28% year-to-date, riding Bitcoin’s modest 11.09% gains this year.

So given this, and like I’ve said in the past, MicroStrategy isn’t a software company anymore. It’s a Bitcoin ETF in a suit. Saylor’s strategy has transformed the company from a mild-mannered enterprise software outfit into a high-stakes crypto proxy, where the stock price lives and dies by Bitcoin’s every move. And now, with 10.3 billion shares authorized, they’ve essentially printed themselves a blank check to keep the Bitcoin binge going.

(Source: Giphy)

In the end, love him or hate him, you’ve got to admit Saylor’s commitment to the cause is nothing short of psychotic genius. While most CEOs are out here trying to diversify and hedge, he’s doubling down so hard it’s practically a triple down. Whether this pays off or ends in tears is anyone’s guess. But one thing’s for sure: MicroStrategy has officially gone all in—and by “all in,” we mean they just ordered a second mortgage on the house to fund their next trip to the friggin’ casino.

P.S. Trump is officially back in the White House, meaning we could see fireworks at any moment. Make sure you are prepared and deciphering the market for the most explosive opportunities with Stocks.News premium. Don’t say I didn’t warn ya!

Stocks.News holds positions in Apple, Amazon, and Alphabet (Google) as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer