Who pissed in Michael Burry’s coffee? Asking for a friend…

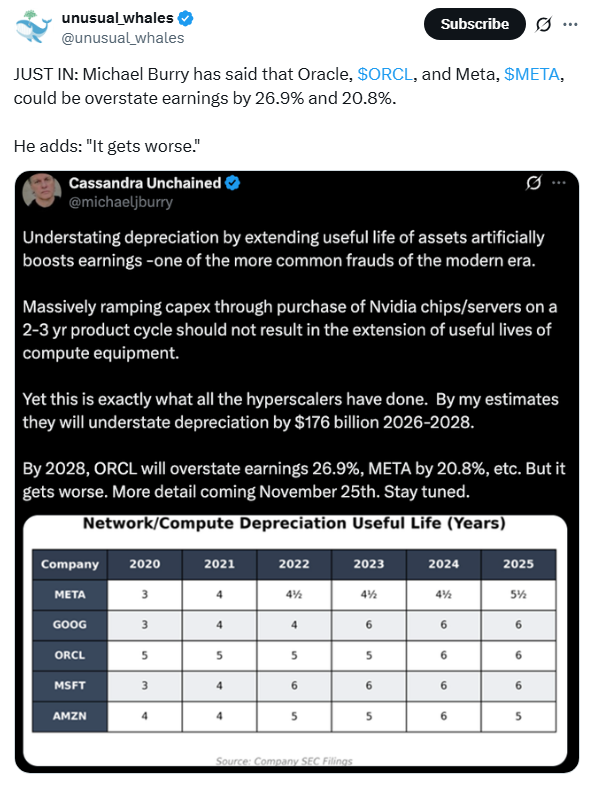

Michael Burry has chosen violence again… this time accusing Big Tech of inflating earnings through what he calls “one of the more common frauds of the modern era.” The man behind The Big Short claims companies like Meta, Oracle, Microsoft, and Amazon are overstating profits by pretending their servers last longer than they actually do. Translation: You can basically smell the faint scent of a bloodbath heading into today’s opening bell (read: Meta and Oracle both down over -1% in pre-market).

(Source: Giphy)

In short, in his most recent diss track on X, Burry pointed out that the so-called “hyperscalers”... are depreciating their members over five or six years, even though Nvidia keeps releasing new GPUs every 18 months like it’s an iPhone. Meaning, they’re spreading the cost of their hardware too slowly, which makes profits look better than they are. And when you’re buying billions of dollars in silicon that’s obsolete before your interns finish onboarding… that’s a big deal.

(Source: X)

For instance, Burry estimates the accounting trick will inflate total earnings by $176 billion between 2026 and 2028… with Oracle overstating by nearly 27% and Meta by about 21%. He called it “massively ramping capex through purchase of Nvidia chips/servers on a 2-3 year product cycle,” adding that this accounting “boosts earnings artificially.” Now of course, Burry hasn’t released the full breakdown yet… that’s coming November 25th… so the good news is that we still have time to collect our food stamps before impending doom.

With that said, not everyone agrees with him. CoreWeave’s CEO said demand for older chips like the A100 and H100 “remains robust,” and that one customer even re-upped a 2022 chip contract at almost the same price. In other words, the hardware may age fast, but in a world where everyone’s still chasing compute capacity, the junk drawer of old GPUs is still paying rent. Still though, the G.O.A.T.’s point cuts deeper than accounting policy… and more about the illusion of permanence in an industry built on obsolescence.

(Source:Imgflip)

Translation: If he’s right, Big Tech isn’t just overvalued… It's overcooked. And the next “AI earnings beat” might just be depreciation lag wearing lipstick. Which means… which means… the question now isn’t if Burry is early (he always is)... it’s whether everyone else will notice before the GPUs get recycled into friggin’ keychains. Oh, and need I remind you that the last time Burry went full-scorthed Earth on X, Nvidia plummeted over 6% (read: literally 7 days ago). Until next time, friends…

At the time of publishing, Stocks.News holds positions in Meta, Amazon, and Microsoft as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer