Goodmorning and Happy Saturday friends!

If you’re like me, and have watched the Big Short as many times as I have (it’s my favorite movie), guys like Michael Burry and Steve Eisman are like the Taylor’s to my Swifties. Translation: They are the GOATs in my eyes, simply because they saw that everyone was asleep at the wheel of a doomsday machine.

(Source: Giphy)

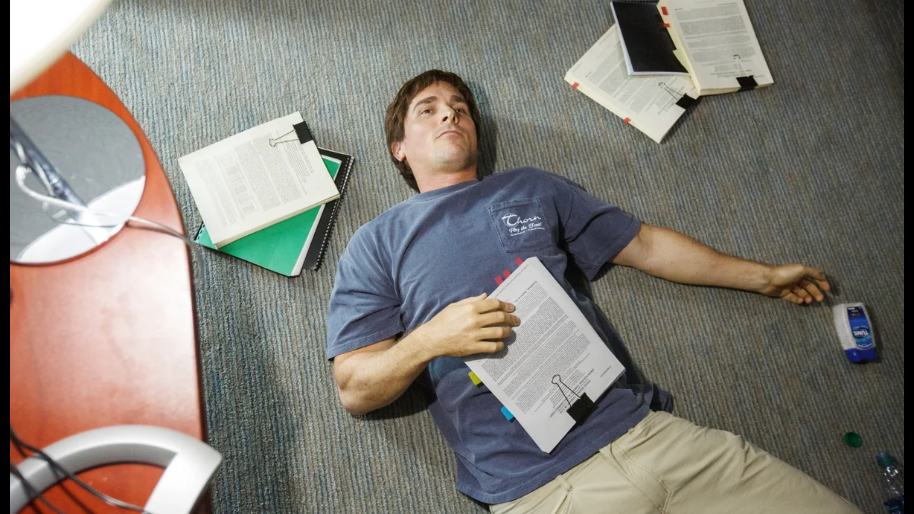

However, after Baidu's earnings results yesterday, I can only imagine Michael Burry going down into his basement, slamming on his drums, and screaming “F*********k” as loud as he did in my favorite movie of all time.

(Source: The Independent)

As we all know, according to recent SEC filings, Burry went balls deep on Baidu in the second quarter. But as of now, that investment is basically running the same path as his four year drawdown on credit default swaps from 2004-2008.

In short, despite Baidu flexing it’s AI muscles with some impressive earnings, the stock has been on a downhill slide this year with the stock taking a steep -25.70% nosedive YTD and a -35.33% plunge over the past 12 months.

(Source: Simply Wall Street)

Which is why, understandably, all hopes were on Baidu’s big earnings report on Thursday. But with that said, if you’ve been keeping track of Google's Chinese step-twin, you’d know that Baidu’s earnings are about as unpredictable as Oklahoma weather.

For instance, September 2023, they missed EPS estimates by a staggering -85.03% but somehow managed to squeak by with a +0.34% beat on revenue. December rolled around, and they flipped the script, beating EPS by +21.31% but missing revenue by -0.38%.

(Source: IBD)

Fast forward to March 2024 - Baidu had yet again, another EPS miss at -84.25%, while barely eking out a tiny revenue win. And finally, their latest report? Well, the “every other” pattern continued as Baidu beat EPS estimates by +12.45%, as revenue fell short by -0.33%. So clearly, Baidu’s earnings are basically the stock market’s version of a seesaw.

With that said though, not all is wishy washy for the company. For example, despite the earnings roller coaster, Baidu’s AI game is on fire. Their AI Cloud business is stepping up to cover for sluggish online marketing sales, and the Ernie Bot—Baidu’s response to ChatGPT—is handling over 600 million requests daily.

(Source: Yahoo Finance)

Compare that to ChatGPT’s 500 million API requests per day, and it’s obvious that Baidu is getting a massive amount of traffic. See: More eyeballs to shove ads to = good for business.

This new traction clearly shows in Baidu’s trailing 12 month numbers as revenue has nudged up +1.18%, with operating income and cash flow soaring by +10.12% and +119.37%, respectively. However, on the other hand, again, not all is sunshine and rainbows - Baidu’s net income and EPS has taken a hit, with net profit margins leading the losses at -7.54%. Translation: Baidu has gotten a raise, but it’s legit still having trouble making ends meet.

(Source: Seeking Alpha)

So given all of this, it’s clear that Baidu is somewhat on the right track, because even though some analysts have trimmed their price targets, Baidu’s consensus target still suggests a jaw-dropping +123.19% upside. So yeah that’s encouraging for Burry…

But when you look at the technical aspects on Baidu, well buddy, it’s a whole ‘nother story. For instance, all 17 of our Stocks.News daily chart indicators are practically screaming “Strong Sell,” while all 15 daily moving averages signal for down trend continuation.

Yet, apparently in light of its current rocky road, Baidu’s management still remains bullish as recent reports have told us that they’re basically serenading investors with “Don’t Stop Believin’” while they plow $301 million into their stock buyback program.

So with everything on the table, what’s the takeaway for investors?

Well simply put, while Burry may be onto a massive opportunity in the making, it’s clear he has a stomach for massive drawdown. Most investors witnessing a -25% nosedive, would’ve cashed out with a “sayonara” (that’s Japanese, but close enough).

(Source: Giphy)

Plus, with all eyes on the Chinese government’s economic stimulus measures up in the air, the anticipation is high, but the outcome is anyone’s guess. So as the company tries desperately to sync it’s EPS numbers with its dang revenue numbers in the future, all investors can really hang their hats on right now is the seismic AI potential that Baidu possesses in the Chinese search game.

(Source: Giphy)

Now of course, do what you will with that information, but for now… it’s really anyone’s guess that Burry is actually onto something or not. Because even though I consider him one of my heroes - this investment has yet to prove the legend of Michael Burry is still alive and in its prime.

In the end, keep an eye on this company moving forward, but in the meantime, I’d pass for now. As always, do your own due diligence to see if it’s right for you, and please don’t be dumb. Just because someone else is willing to jump off a bridge doesn’t mean you should too.

As always, stay safe and stay frosty, friends! Until next time…

Stocks.News holds positions in Google as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer