Thank gawd Bezos nonchalantly sold $5.7B of his Amazon shares precisely one week before earnings, amrite? LOL

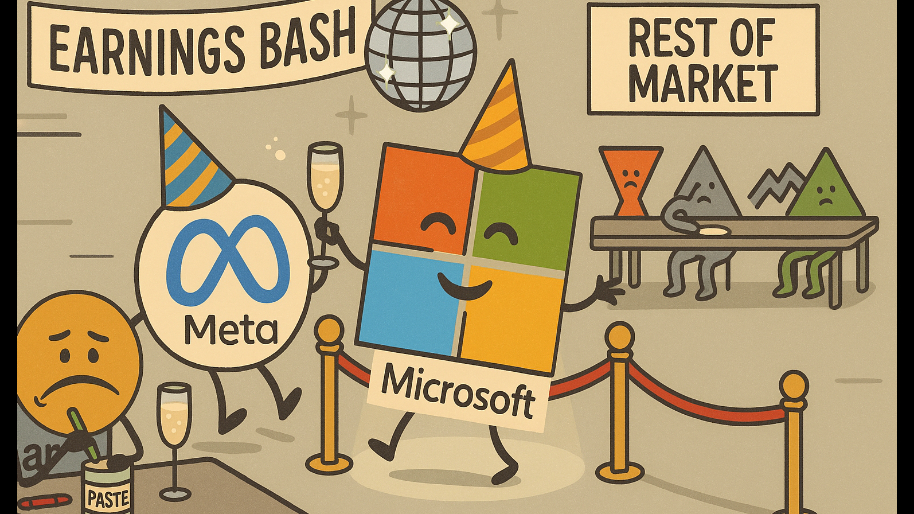

On paper, it was supposed to be a moonshot day. Microsoft and Meta both dropped earnings like a double-stack haymaker last night… blowout quarters, guidance up, shareholders foaming at the mouth. Meta surged +11%. Microsoft popped +4%. And yet, the S&P 500 coughed up its third straight loss, down -0.37% on the day. The Dow got kneecapped… down 330 points… and the Nasdaq limped across the finish line flat.

(Source: Giphy)

Why? Because the rest of the market is acting like it got hit in the head with a rake. Nine out of eleven S&P sectors finished red. UnitedHealth and Merck cratered -6% and -4%, respectively, dragging the Dow down like Russell Wilson drags down any team he’s a part of. Pharma stocks took a swan dive after Trump sent a “I would like to have a word…” letter to 17 drugmakers demanding price cuts in 60 days. It’s unclear if those letters came with a bigly dose of ALL CAPS, but regardless, Wall Street took the hint.

Elsewhere, Baxter missed earnings and cut guidance (-22.%). Broadcom and Tesla shed -3%. Alphabet gave up -2%. Nvidia, the golden pony of AI, drifted down almost -1%. As for other chip stocks, ARM plunged -13%. Qualcomm followed with an -8% drop. Talk about a bloodbath. Oh, and if you were banking on Figma’s debut to liven things up, you got about five minutes of glory before trading halted. It opened at $85, doubled its IPO price, kissed $100, then froze. Which is a pretty good metaphor for the entire market: a brief euphoric pop, then a spontaneous time-out. However, trading eventually resumed and Figma is now topping $130 in after-hours. Have a day, Figma, have a day.

(Source: Giphy)

Over in the land of counterfeit Rolexes, eBay surged +18% after proving it’s still not dead. Carvana pulled a Lazarus and jumped 17%. And Comcast found a +2% gain hiding under a few cable cords that magically haven’t been cut yet. This, mind you, all happened while Treasury Secretary Scott Bessent hinted at a deal with China, offering zero detail, zero timeline, and zero clarity. Additionally, Trump who is horned up over the recent GDP numbers, extended 25% tariffs on Mexican imports for another 90 days.

As for the big earnings results of this afternoon, Amazon absolutely crushed estimates… but then killed the rest of the evening. Even with solid numbers like $1.68 EPS on $167.7B in revenue, it was the company’s limp bizkit Q3 profit guidance that gave shares the “close, but no cigar” treatment during extended trading. At the time of publishing, shares have plummeted -6.7%.

Live look at daddy Jeff when asked if he knew something we all didn’t:

(Source: Giphy)

Oh, and Bitcoin hovered around $116,800. down from $119,000 overnight. Noice. In the end, if you strip out big tech, and big pharma, this market looks like it's being held together with nicotine patches and whatever sketchy appliances eBay is grifting. Of course, tomorrow may be a different story… but with Amazon shatting the bed, it doesn’t seem likely. Until next time, friends…

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

At the time of publishing, Stocks.News holds positions in Amazon, Microsoft, Tesla, Meta, Alphabet and Merck & Co. as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer